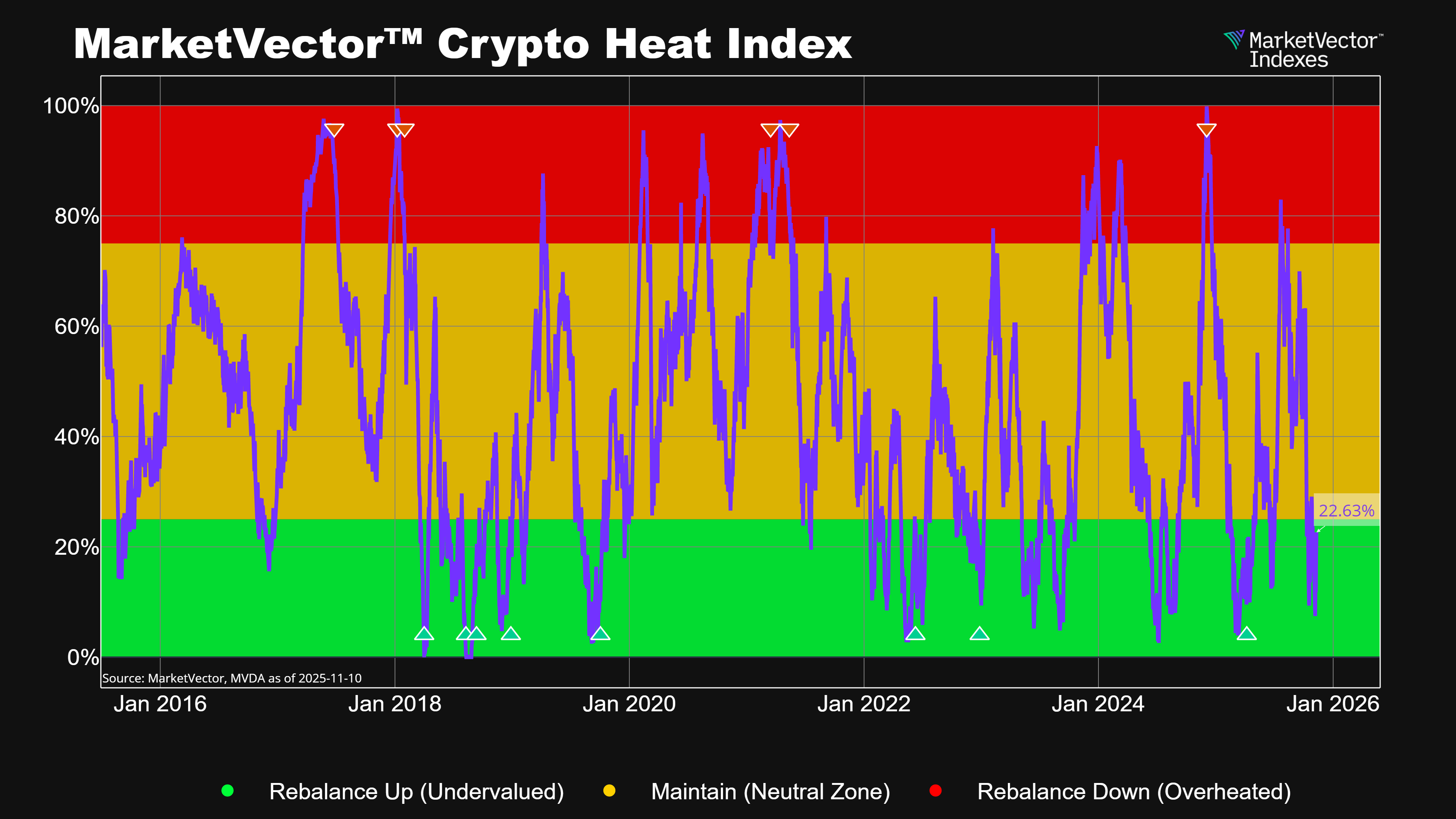

Crypto Market Rebound and Bullish Sentiment

The crypto market surged in Q3 2025, with Bitcoin breaking above $120,000 and Ether surging past $4,200 amid a broad upswing. The total digital asset market capitalization surpassed $4 trillion in July, and Ethereum even notched new all-time highs as strengthening on-chain activity and regulatory clarity fueled optimism. Investor sentiment turned bullish alongside these gains, as a global survey found roughly 66% of crypto users plan to increase their exposure despite lingering macro risks. [1][2]

Macro Tailwinds from Monetary Policy Shifts

The macroeconomic climate provided tailwinds for crypto in Q3 as inflation in the United States continued to moderate from post-pandemic highs and policymakers signaled a move away from strict monetary tightening. In September the Federal Reserve enacted its first interest rate cut of 2025, citing diminished inflation risks and growing concern over employment, which bolstered investor confidence in risk assets. Anticipation of easing financial conditions helped improve sentiment toward riskier investments, adding momentum to cryptocurrency markets despite some persistent economic uncertainties. [3]

Landmark U.S. Crypto Legislation

In a historic step, the United States enacted its first federal crypto law in Q3 2025 as the GENIUS Act was signed in July, creating a comprehensive regulatory framework for payment stablecoins and placing their issuance under bank supervision. The law mandates full reserve backing in cash or Treasurys and rigorous audits for stablecoin issuers, effectively ending the previous “gray zone” and prompting some banks to start planning their own regulated digital dollar tokens. The U.S. House of Representatives also advanced the Digital Asset Market Clarity Act to delineate SEC and CFTC oversight of crypto, indicating bipartisan momentum toward clearer rules for exchanges and investors. [2]

Regulatory Shift and Global Standards

U.S. regulators pivoted toward a more accommodative crypto stance in Q3, with the SEC’s new leadership dropping lawsuits against major exchanges and exploring rule changes to allow digital asset trading on traditional stock exchanges. SEC Chair Paul Atkins introduced a pro-innovation agenda — including potential safe harbors for token sales and clarity on broker-dealer rules — marking a sharp reversal from the previous administration’s hardline approach. Meanwhile, other jurisdictions from the EU to Asia pushed forward on digital asset regulation, from Europe’s implementation of stablecoin standards to Hong Kong and Singapore expanding crypto licensing, reflecting a worldwide drive for regulatory clarity. [4]

Major Hacks Highlight Ongoing Risks

Despite overall growth, the crypto sector faced major security incidents in Q3 2025, with hackers stealing over $140 million in July alone through 17 separate attacks on exchanges and DeFi protocols. The largest was a $44 million breach of India’s CoinDCX exchange, while a $42 million exploit of the GMX platform saw the hacker return funds after being paid a $5 million bounty. Analysts warn that 2025 is on track for record crypto thefts — exacerbated by mega-heists like the Lazarus Group’s $1.5 billion Bybit hack — underscoring persistent vulnerabilities even as security measures tighten. [5]

Institutional Adoption and New Crypto Products

Institutional participation accelerated in Q3 2025 as regulators approved faster pathways for crypto exchange-traded funds, spurring a wave of Bitcoin, Ether and even altcoin ETF launches that attracted tens of billions of dollars in inflows. Traditional finance and tech firms also expanded crypto integration, highlighted by Chainlink’s partnership with Intercontinental Exchange to enhance blockchain market data and PayPal’s rollout of a U.S. dollar stablecoin for transactions on its platforms. These moves by established players signal growing mainstream acceptance of digital assets, as more institutions bridge into the crypto ecosystem to meet rising demand from investors and users. [1]

[1] investingnews [4] Reuters

[2] cryptorank [5] Coingeek

[3] abcnews

Get the latest news & insights from MarketVector

Get the newsletterRelated: