The free fall in oil prices has triggered some tension among investors who have periodically started to underweight the Energy sector in their portfolios. Moreover, as this sector represents a significant share of the S&P 500, some have argued that the entire index would be affected by this situation, and thus, one should start looking for opportunities in other markets.

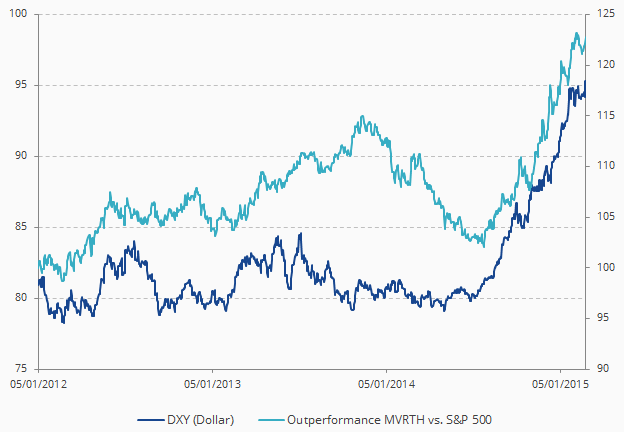

However, in our view these events provide opportunities for sector rotation, rather than risk aversion. In this case the clear winner would be the American consumer. Additionally, by the same time oil began its sky dive, the dollar started rallying. And so did the Retail Consumption sector in comparison with the rest of the S&P, as imports are becoming cheaper and exports more expensive.

Source: Bloomberg. Data as of 27 February 2015

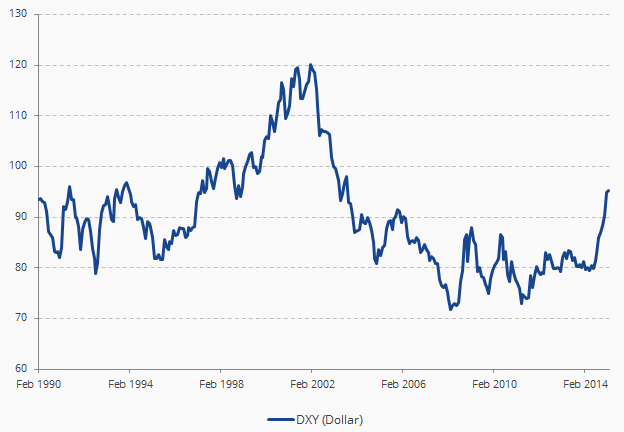

Finally, for some, the recent rise of the greenback seems overdone. But if history is any guide, the dollar has a lot of room to keep going further.

Source: Bloomberg. Data as of 27 February 2015

Get the latest news & insights from MarketVector

Get the newsletterRelated: