A New Frontier for AI Exposure

The AI revolution is reshaping everything, from productivity to infrastructure. But while equity investors chase the next model or chipmaker, a quieter story is emerging in the bond market: AI’s foundational layer is being built and financed through credit.

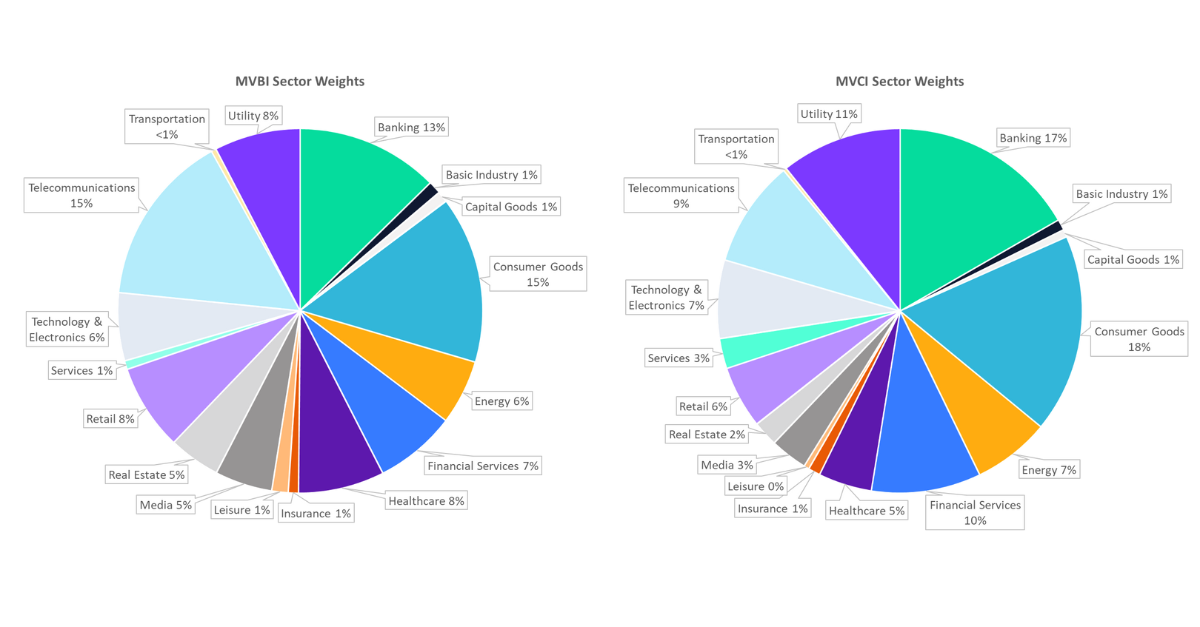

MarketVector’s MVIS Moody’s Analytics US Investment Grade Corporate Bond Index (MVCI) and the MVIS Moody's Analytics US BBB Corporate Bond Index (MVBI) offer complementary approaches to balancing value and credit quality across the investment-grade spectrum. As of the July 2025 rebalancing, both MVCI and MVI are showing growing exposure to firms powering the AI infrastructure: Oracle, VMware, Equinix, Fiserv, Mastercard, Visa, and Apple. These companies sit at the heart of cloud, software, data centers, and digital transactions that are critical components for the AI economy. Figure 1. Shows the growing tech sector distribution of MVBI and MVCI indexes as of the July 2025 rebalance.

Figure 1. Sector Composition Breakdown (MVBI and MVCI)

Source: MarketVector Indexes. Data as of July 2025.

Credit-Aware Indexing Meets AI Infrastructure

Unlike marketcap weighted equity strategies that may lean into volatility and momentum for growth, MVBI and MVCI use a rules-based credit selection framework grounded in:

1. Excess spread over fair value, based on Moody’s Analytics valuation models

2. Probability of downgrade, using forward-looking credit risk metrics

MVBI focuses on the BBB segment, where downgrade risk is typically higher. It selects the top 10% of bonds within each sector-duration group, emphasizing undervalued issuers with relatively stable credit profiles.

MVCI applies the same framework across the full investment-grade spectrum (AAA to BBB), but with stricter inclusion criteria, selecting only the top 5% of bonds, while also enforcing tighter downgrade risk and issuer exposure limits. Its broader scope increases the likelihood of capturing rising stars, issuers improving in credit quality.

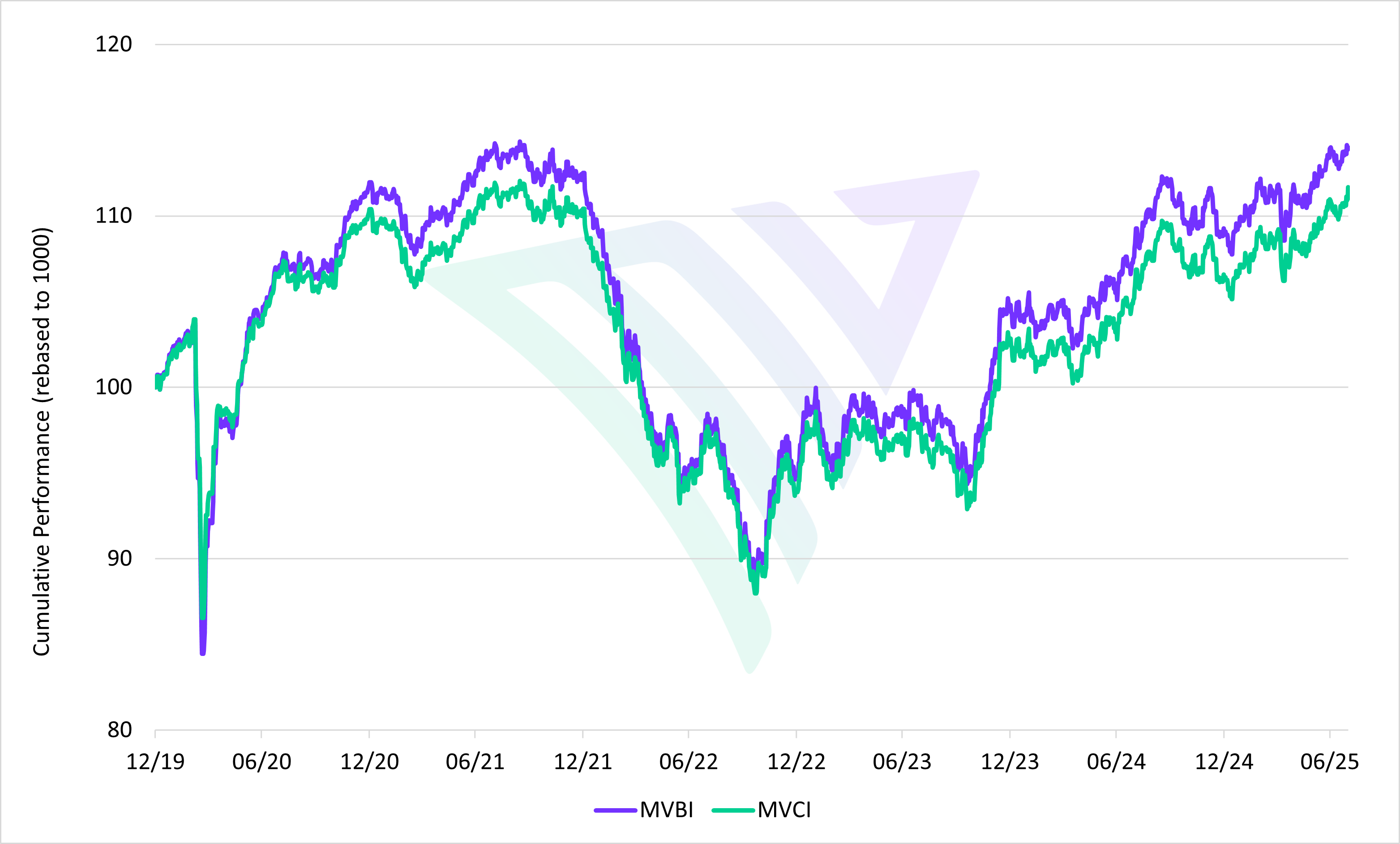

The result is two distinct yet complementary strategies that aim to capture value and mitigate risk through disciplined index construction. The chart below in Figure 2. compares the historical performance of the MVBI and MVCI indexes, highlighting how each strategy has responded to market cycles and credit conditions.

Figure 2: Performance Comparison – MVBI vs. MVCI

Source: MarketVector Indexes. Data as of July 2025.

Structure Meets Secular Trends

With the MarketVector approach, AI exposure surfaces organically. These bond indexes don’t target it but found it because the infrastructure layer of AI is creditworthy, scalable, and stable. The inclusion of companies like Apple and Equinix reflects the path to innovation through credit, offering investors exposure to secular growth themes without sacrificing credit quality.

AI may dominate headlines, but in the bond market, it’s disciplined frameworks, not hype, that define exposure.

For more information regarding the eligibility criteria, please refer to the index guide , MVCI).

About the Author:

Antonio Fons Palomares is an Index Specialist at MarketVector Indexes™ ("MarketVector"). He is primarily responsible for the research, development, and maintenance of MarketVector Indexes™ across all asset classes. Antonio holds a Master's Degree in Financial Engineering from the Business Administration Institute (IAE) of the University of Poitiers, France, and a Bachelor's Degree in Economics and Business Administration from the University of Paris-Saclay, France. He has cleared the CAIA Level 1 exam.

For informational and advertising purposes only. The views and opinions expressed are those of the authors but not necessarily those of MarketVector Indexes GmbH. Opinions are current as of the publication date and are subject to change with market conditions. Certain statements contained herein may constitute projections, forecasts, and other forward-looking statements, that do not reflect actual results. It is not possible to invest directly in an index. Exposure to an asset class represented by an index is available through investable instruments based on that index. MarketVector Indexes GmbH does not sponsor, endorse, sell, promote, or manage any investment fund or other investment vehicle that is offered by third parties and that seeks to provide an investment return based on the performance of any index. The inclusion of a security within an index is not a recommendation by MarketVector Indexes GmbH to buy, sell, or hold such security, nor is it considered to be investment advice.

Get the latest news & insights from MarketVector

Get the newsletterRelated: