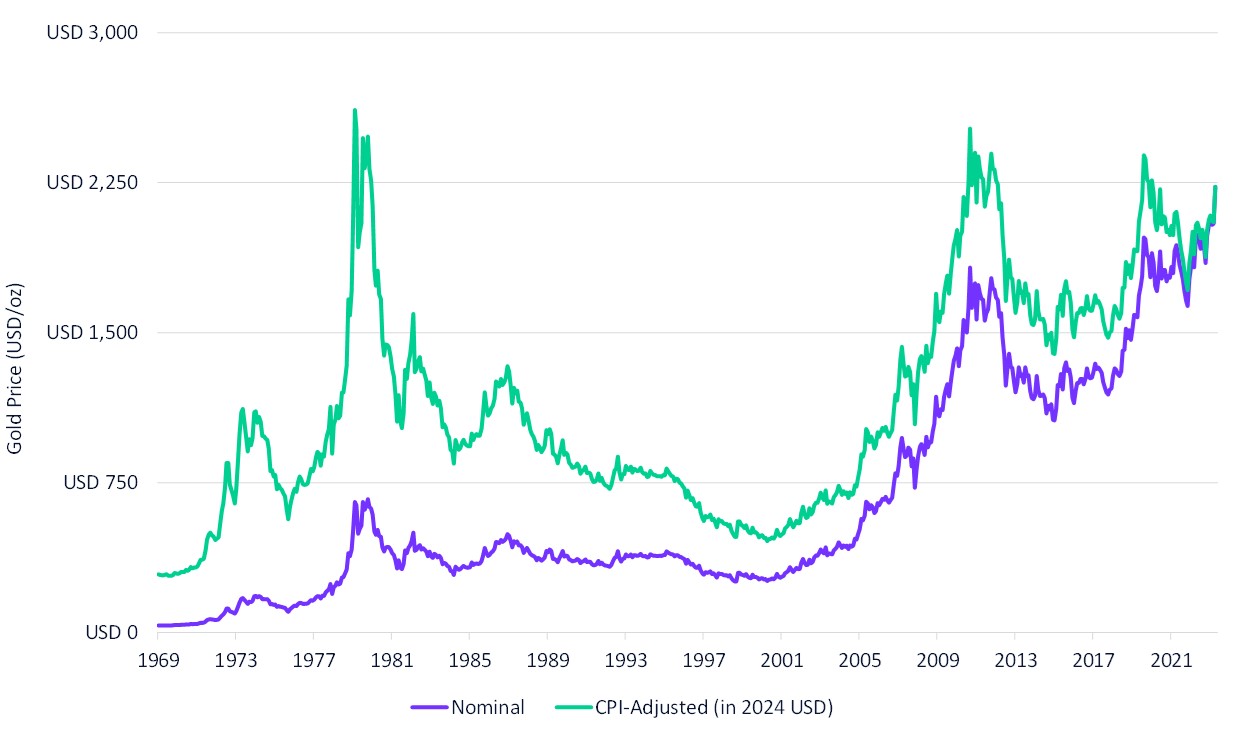

When Spandau Ballet released their song “Gold” off their third album “True” on August 5, 1983, the price of gold, the hard asset, was USD 410 per ounce. On April 12, 2024, gold reached an all-time high of USD 2,431 per ounce, returning close to 500% since the 1980s. At these levels, can gold prices maintain their strength and durability?

It’s important to note that, when adjusted for inflation, the 1980s is still the peak for gold. Although inflation is trending down, it has been stubbornly sticky, and if it stays higher for longer, there might still be room for gold to catch up.

Gold Price - Nominal vs. Inflation-Adjusted

Source: MarketVector, VanEck. Data as of March 31, 2024. Note: January 1980’s intra-month high of USD 815 (in nominal terms) would be equal to approximately USD 2,819 in today’s (2024) dollars.

Gold prices are primarily driven by supply and demand. Gold sources of demand are diversified across jewelry, technology, investors (including ETFs), and central banks, providing diverse drivers for gold prices. This diversity of demand underpins gold’s robust qualities as an investment asset with increasing demand from one source often offsetting decreasing demand from another. As US investors sell out of gold ETFs over the last few years, central bank demand from the rest of the world has increased. Since 2021, central banks around the world have increased their reserves in gold, almost doubling the average quarterly demand over the previous decade and more than offsetting the outflows in US gold ETFs. “Gold! Always believe in your soul. You\ve got the power to know. Youe indestructible!” (Spandau Ballet, Gold, 1983).

Central Bank vs ETF Gold Demand (Quarterly)

.jpg)

Source: MarketVector, World Gold Council. IMF IFS Statistics. Data through March 31, 2024.

As the rest of the world tries to reduce its dependency on the dollar, gold has benefited, with continued central bank stockpiling. This has kept gold prices up, despite the previously strengthening dollar. With interest cuts back on the radar, the dollar is weakening, this should attract US investors back into gold ETFs. Indeed, gold-related stocks, such as gold miners, which have previously delinked from gold prices, are now reclaiming their role as leveraged play on gold prices. The MVIS® Global Junior Gold Miners Index (MVGDXJ), which tracks the performance of the most liquid small-cap companies in the global gold and silver mining industries, is up 16% YTD (as of May 15, 2024). The return of interest rate cuts, and US demand, combined with the potential impact of sticky inflation and higher for longer has the potential to drive gold prices up further beyond all-time highs, inflation-adjusted.

For more information on our family of indexes, visit www.marketvector.com.

Joy Yang is the Head of Product Management and Marketing at MarketVector. She is responsible for managing MarketVector products and services to accelerate innovation in financial index design and adoption. Joy brings more than 25 years of investment experience to MarketVector, having led teams delivering index and quantitative-active investment solutions at Arabesque Asset Management, Dimensional Fund Advisors, Vanguard, Aberdeen Standard Investments, AXA Rosenberg, and Blackrock. She has an MBA from the University of Chicago Booth School of Business and a Bachelor of Science in Electrical Engineering from Cooper Union’s Albert Nerken School of Engineering.

For informational and advertising purposes only. The views and opinions expressed are those of the authors but not necessarily those of MarketVector Indexes GmbH. Opinions are current as of the publication date and are subject to change with market conditions. Certain statements contained herein may constitute projections, forecasts, and other forward-looking statements, that do not reflect actual results. It is not possible to invest directly in an index. Exposure to an asset class represented by an index is available through investable instruments based on that index. MarketVector Indexes GmbH does not sponsor, endorse, sell, promote, or manage any investment fund or other investment vehicle that is offered by third parties and that seeks to provide an investment return based on the performance of any index. The inclusion of a security within an index is not a recommendation by MarketVector Indexes GmbH to buy, sell, or hold such security, nor is it considered to be investment advice.

Get the latest news & insights from MarketVector

Get the newsletterRelated: