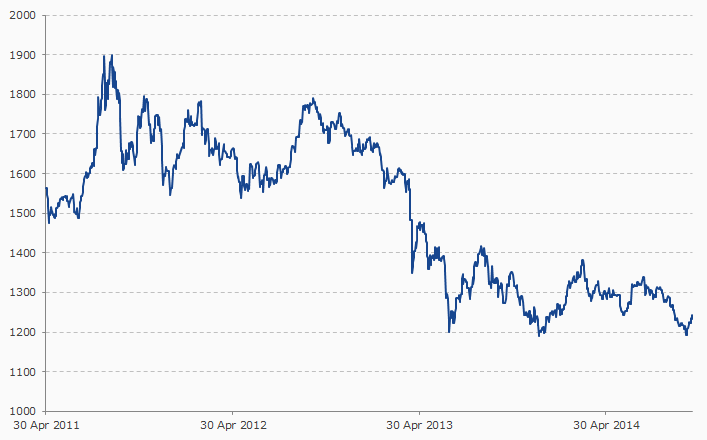

Gold has suffered a painful bear market since 2011, falling 740 USD (38%) from its peak. Now many investors are wondering if it has finally found a bottom. In October gold tested the 1,180 USD level for the third time since June 2013. Is this a bullish «triple bottom» in technical jargon, or a sign of further weakness? Nobody knows, but an abundance of geopolitical and economic risk around the world suggests the former. Gold is often used as a hedge against tail risk or stress in the financial system.

Gold Spot

Source: Bloomberg, Van Eck Research

Data as of 15 Oct 2014

Get the latest news & insights from MarketVector

Get the newsletterRelated: