Gold stocks have a strong historical correlation to the gold price. Despite experiencing a significant de-rating after the last gold bull market, gold mining stocks have outperformed gold during the current gold bull market, the beginning of which we place at the end of 2015.

This makes sense. Gold stocks are supposed to outperform the metal when the gold price is rising. Their leverage to the gold price justifies the outperformance. For any given move in the gold price, the operating cash flow generated by these companies increases (or decreases) by a much greater percentage. This year, however, although gold is up almost 9% as of the end of October, the gold stocks have posted losses.

We see gold companies at present as greatly undervalued. And, historically, the sector has never traded at lower valuation multiples. The companies’ continued focus on cost control, portfolio optimization, and disciplined capital allocation to drive growth and maximize returns, responsibly and sustainably, along with our outlook for higher gold prices, support our expectations for a re-rating of the sector. Gold stocks are outperforming in the first few days of November; perhaps the re-rating has already begun.

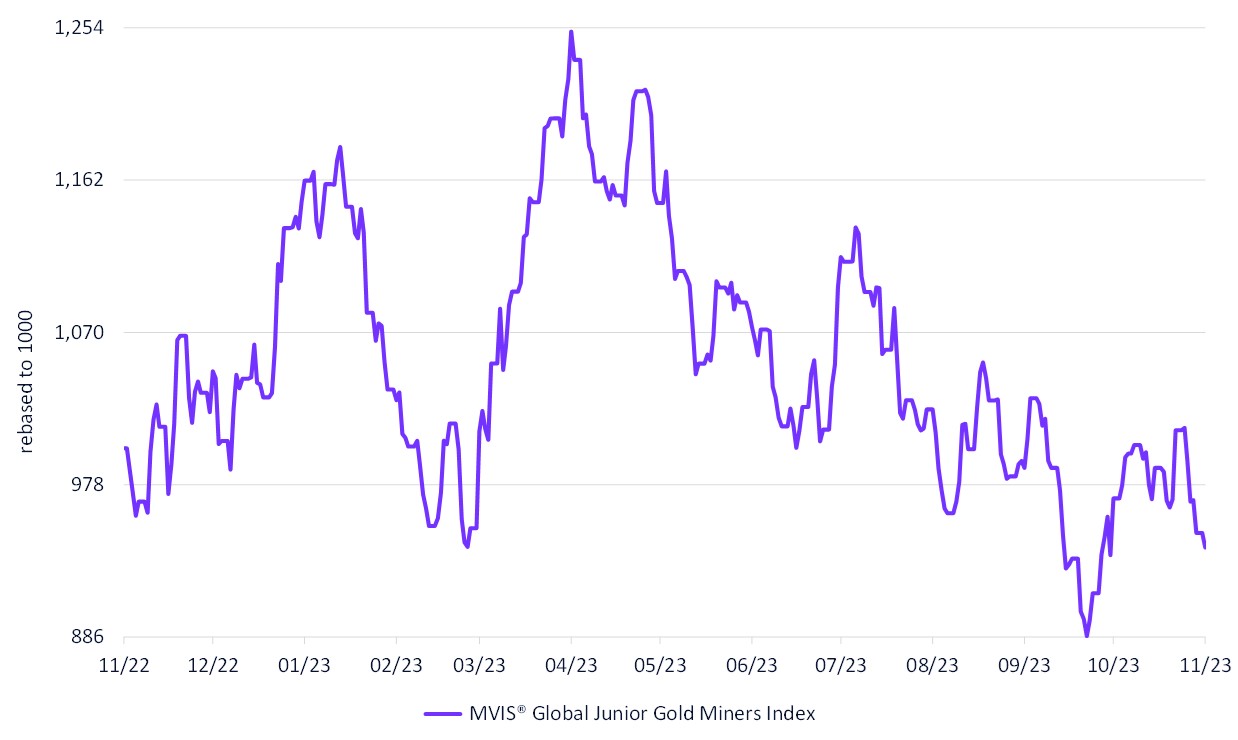

MVIS® Global Junior Gold Miners Index

11/13/2022-11/13/2023

Source: MarketVector IndexesTM. All values are rebased to 1,000. Data as of November 13, 2023.

Get the latest news & insights from MarketVector

Get the newsletterRelated: