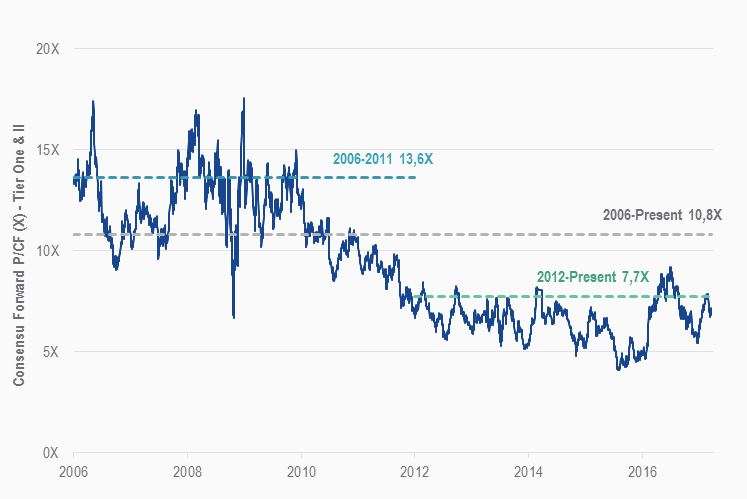

Looking at historical valuation levels (see illustration below), we see that stocks are currently trading at multiples that are below the long-term average, and well below the multiples reached during the peak of the last bull market.

Historic Price-to-Cash Flow of Gold Majors and Mid-Tiers

2006-201

Source: RBC Capital Markets. Data as of March 17, 2017

Following the bull market, the gold sector has transformed itself into a healthy, cash flow generating business, offering attractive returns. A re-rating of the entire sector to reflect this transformation is justifiable in our view. Companies need to continue to demonstrate that they are deserving of the premium valuation multiples they have historically enjoyed. The formula, although complex, is not too complicated: Increase the potential and ability to develop gold deposits into profitable and sustainable mines while reducing the risks associated with those developments, and these companies should enjoy a re-rating by the market.

Get the latest news & insights from MarketVector

Get the newsletterRelated: