This article is the first in our new "Index of the Month" series. In this series, we\ll spotlight an index that stood out prominently due to its market impact, performance swings, or noteworthy trends. Our goal is to unpack the indices shaping today's investment landscape.

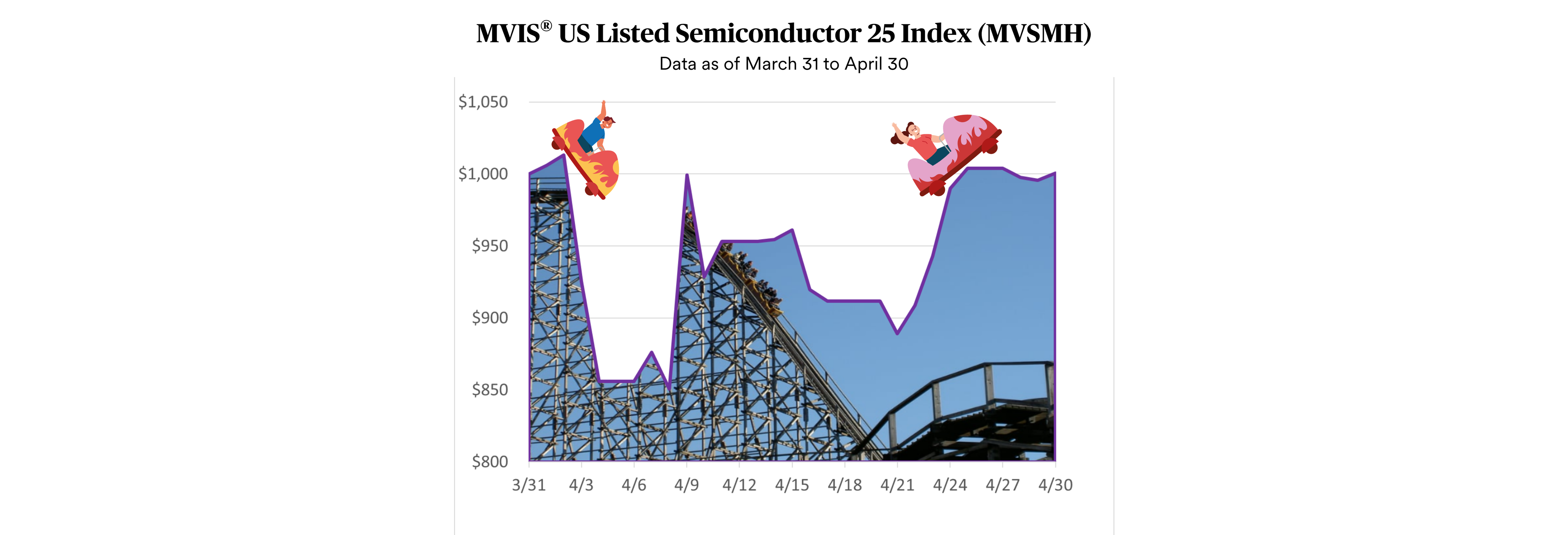

Charles Dickens begins his novel A Tale of Two Cities with "It was the best of times, it was the worst of times". I wonder if he wrote this in April? If you closed your eyes for all of April, you would have thought not much happened in the markets. And this is how the MarketVector semiconductor index, MVIS® US Listed Semiconductor 25 Index (MVSMH), looked at first glance finishing April with a return of 0%.

But if you opened your eyes at just the right moments, you might have seen the extremes: MVSMH fell as much as –15%, only to rebound nearly +18%. That’s not a quiet month; that's a white-knuckle ride. And hopefully, if you were invested in one of the ETFs tracking MVSMH, you didn’t panic-sell at the lows or chase the rebound at the highs.

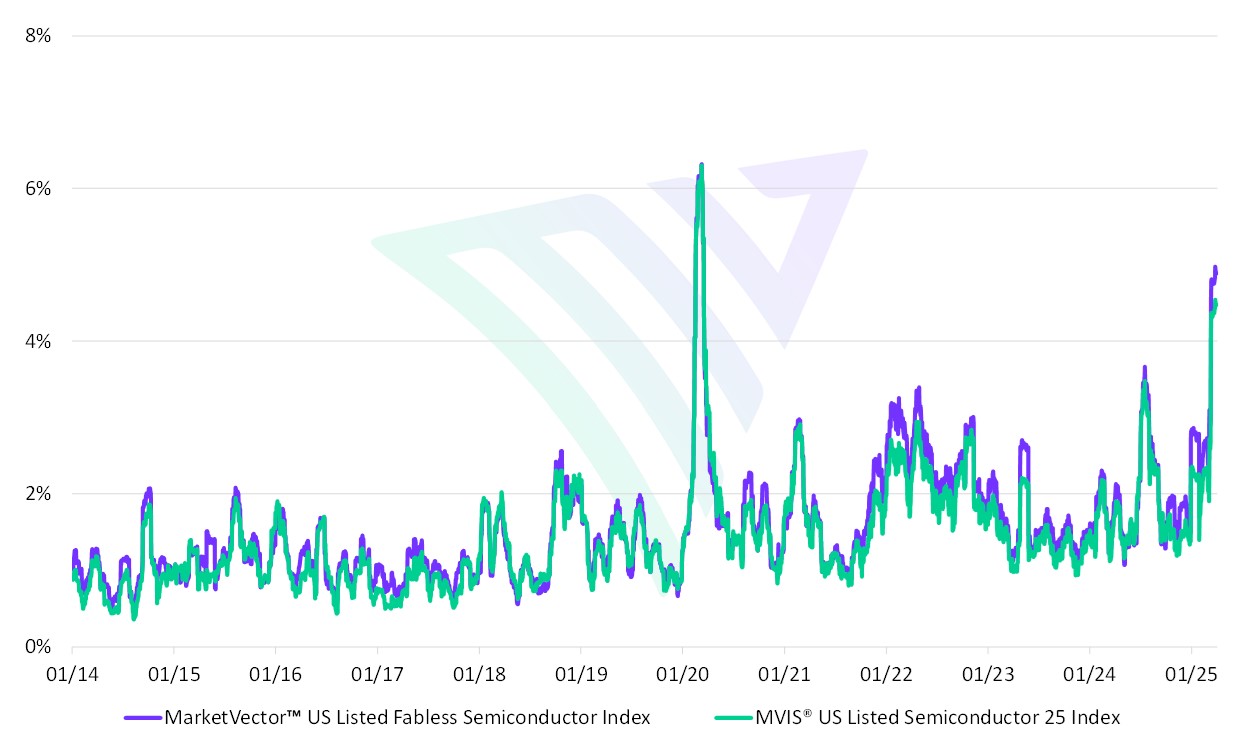

For seasoned followers of the semiconductor space, this kind of volatility won’t come as a surprise. The sector is known for its sharp movements, and MVSMH reflects that well: its daily realized volatility can easily reach 2%, even in periods without major news events.

Exhibit: Rolling 30-Day Daily Volatility of MVSMH & MVSMHX

Source: MarketVector. Data as of May 1, 2025

Semiconductor companies are fundamentally different from traditional value plays or defensive sectors. Their valuations often price in future innovations, next-gen chips, AI acceleration, and quantum breakthroughs, which are still years away from mass adoption. By nature, the future is difficult to model and even harder to value. This introduces risk well beyond quarterly earnings or macro conditions.

The semiconductor sector, as reflected by MVSMH, continues to behave like a high-speed rollercoaster, offering sharp peaks and equally steep drops, often within short timeframes. April's performance was a vivid reminder of the volatility embedded in this theme. Because in semiconductors, sometimes it is the best and worst of times—all in the same month.

For more information on MarketVector Indexes, visit www.marketvector.com.

Get the latest news & insights from MarketVector

Get the newsletterRelated: