Situated in the North Atlantic Ocean, Greenland is the world’s largest island, yet it remains one of the most sparsely populated territories on Earth, with fewer than 56,000 inhabitants. Approximately 88% of the population identifies as Greenlandic Inuit, descendants of the Thule people—an Indigenous culture historically noted for its sophisticated whaling techniques involving large boats, and its reliance on dog sleds for transportation and foraging across the Arctic terrain.

Formerly a colony and later a province of Denmark, Greenland achieved home rule in 1979. The Greenland Self-Government Act of 2009 marked a significant milestone, further expanding Greenland’s autonomy and granting its people the legal right to pursue full independence. While a majority of Greenlanders support the long-term goal of sovereignty, the island's heavy economic dependence on Danish subsidies remains a key obstacle.

Moreover, recent geopolitical developments have complicated this ambition. The current U.S. administration, under President Trump, has renewed interest in acquiring Greenland, framing it as essential to U.S. national security—raising concerns among Greenlanders about external pressure on their sovereignty aspirations.

Although Greenland is part of the Kingdom of Denmark, it exercises control over most domestic affairs, including economic development, education, labor and social policy, and cultural matters. Denmark, however, retains authority over constitutional issues, foreign policy, and defense.

Fisheries and Resources: Uncovering Greenland’s Economic Backbone and Engines of Growth

Greenland is classified as a high-income economy, with a GDP per capita of approximately USD 58,000. Its economy remains heavily reliant on the fishing industry, which in 2024 accounted for more than 90% of total exports—primarily fish and seafood products. It is also characterized by its vast reserves of untapped natural resources, with rare earth minerals emerging as a particularly strategic asset. These minerals are among the most sought-after globally, due to their essential role in powering innovation and enabling the next generation of cutting-edge technologies, including renewable energy systems, electric vehicles, and digital infrastructure.

Greenland offers a unique investment proposition grounded in its emerging comparative advantage in clean energy with melting ice unlocking vast hydroelectric potential—enough to power up to one million homes, far exceeding domestic demand. This surplus positions the country to attract energy-intensive industries suited to its cold, remote environment and abundant renewable power.

Greenland presents a compelling case for hosting data center infrastructure, thanks to its abundant hydroelectric power, naturally cold climate, and access to critical minerals—factors that significantly reduce operational and cooling costs. This makes Greenland an ideal location for sustainable, large-scale data center operations. Beyond digital infrastructure, its renewable energy surplus and raw material reserves also position Greenland as a promising hub for energy-intensive industries such as metal smelting and ammonia fertilizer production.

Arctic Cold Rush: Greenland’s Strategic Ascent and It’s Role in Geopolitics of the Melting North

With approximately 81% of its landmass covered by ice, Greenland was long considered economically and strategically peripheral, due in part to its infrastructure limitations and harsh climate. However, recent shifts in global climate patterns and global warming have altered that perception, opening a new window of opportunity. As the Arctic becomes more accessible, global powers such as the United States, Russia, and China are increasingly turning their attention to the region. Their interest is driven by Greenland’s strategic location in relation to untapped critical mineral reserves, emerging Arctic shipping routes, and broader security and defense considerations. This growing geopolitical focus underscores Greenland’s rising relevance in the global competition for resources, trade access, and influence in the High North.

Shipping routes

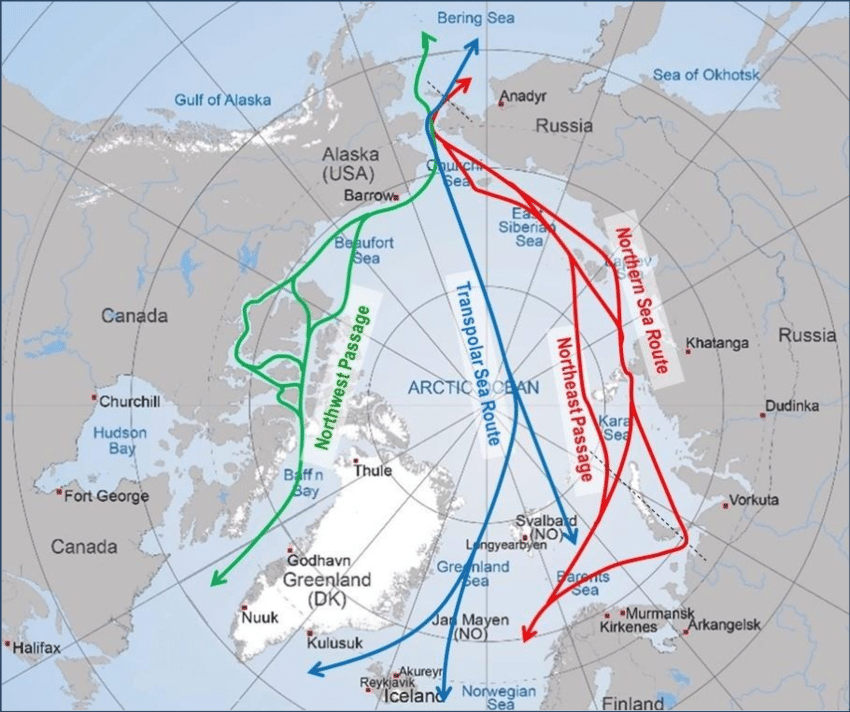

Greenland is poised to become a critical player in global maritime trade as new Arctic shipping routes emerge due to the melting polar ice.

- Northwest Passage - along Canada’s northern coast.

- Northern Sea Route - along Russia’s Arctic coast.

- Future Trans-Arctic or Transpolar Route - through the central Arctic Ocean.

These routes promise to significantly shorten transit times between major global markets, potentially complementing or even replacing traditional pathways such as the Suez Canal. Among them, the Transpolar Route holds the most transformative potential: by avoiding most territorial waters and Exclusive Economic Zones, it could become a geopolitically neutral, high-speed corridor between the Atlantic and Pacific, dramatically reshaping global trade dynamics once ice conditions allow for regular navigation.

Source: Safety of Navigation in the Arctic

Proximity along emerging Arctic shipping lanes makes Greenland an ideal site for developing support infrastructure like ports, logistics hubs, and refueling stations, alongside investments in maritime safety and traffic management systems. Additionally, its position enables monitoring and defense of key routes, while growing accessibility could boost Arctic tourism and expand the island’s broader economic potential.

Mineral resources

Greenland’s subsoil holds significant mineral wealth, including rare earth elements, graphite, lithium, uranium, and precious metals, with strong potential for further discoveries. A 2023 GEUS report found 25 of the EU’s 34 critical raw materials present on the island, while Benchmark Minerals Intelligence identified 43 of 50 U.S.-listed critical minerals. As climate change improves access and global demand rises, Greenland’s resource potential and strategic importance are drawing increased international interest.

Defense & Security

As the Arctic’s geostrategic significance increases, Greenland’s location is becoming pivotal for regional powers seeking to project influence, secure emerging trade routes, and deter strategic competitors.

Hosting the U.S.-operated Pituffik Space Base under a NATO defense agreement, Greenland supports missile defense, satellite operations, and early warning systems critical to NATO’s security. The 2022 war in Ukraine ended much of the Arctic's prior scientific cooperation, fueling renewed geopolitical tension.

The Lone Listing: Bank of Greenland and the Untapped Arctic Market

Despite its significant economic potential, Greenland remains one of the few countries without a stock exchange. Most major companies operating in Greenland are state-owned and not publicly listed, including Royal Greenland—the country’s largest employer—alongside Royal Arctic Line (shipping) and Air Greenland (aviation).

The Bank of Greenland (GRLA) is the only publicly listed company, trading on Nasdaq Copenhagen—but with average daily liquidity below USD 100,000, market activity is extremely limited. According to the MarketVector™ Total Global Equity Index methodology, any country with at least one listed company qualifies for inclusion. Based on the latest index review, Bank of Greenland (GRLA) is the only Greenland-incorporated stock represented in the index.

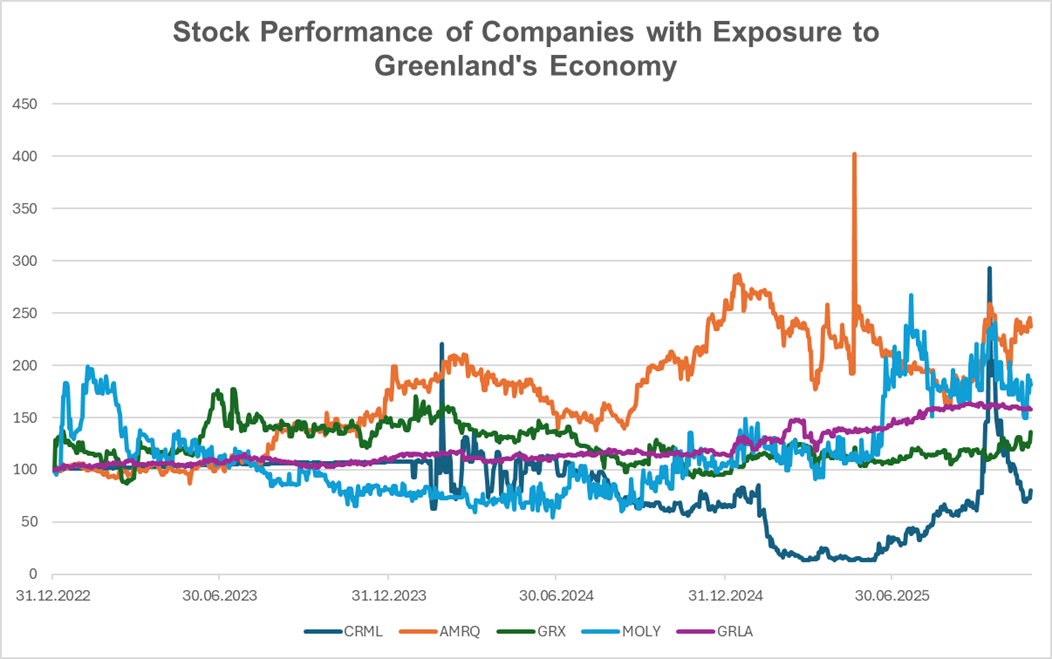

In addition to the Bank of Greenland (GRLA), other foreign publicly traded companies have significant exposure to Greenland’s economy, particularly in rare earth metals, oil and gas, and mineral development. These include:

- Critical Metals (CRML): operator of the Tanbreez Rare Earth Project in Southern Greenland, holding significant rare earth deposits. The Trump administration has reportedly explored a potential equity stake, highlighting strategic U.S. interest in the Arctic.

- Amaroq (AMRQ): active in multiple exploration projects in Southern Greenland, focusing on gold and other strategic minerals.

- Greenland Resources (MOLY): developer of the Malmbjerg project, a major Climax-type molybdenum deposit with by-product magnesium, located near tidewater in east-central Greenland.

- GreenX Metals (GRX): operator of the Arctic Rift Copper (ARC) Project, exploring high-grade copper mineralization at the northern end of Neergaard Dal in northern Greenland.

Source: MarketVector. Data as of November, 2025

References:

· https://www.europarl.europa.eu/thinktank/en/document/EPRS_BRI(2025)769527

· https://www.cfr.org/article/ground-greenland-arctic-security-and-great-power-competition

· https://www.cfr.org/report/changing-geopolitics-arctic-0

· https://www.belfercenter.org/research-analysis/explainer-geopolitical-significance-greenland

· https://www.britannica.com/place/Greenland

· https://www.brown.edu/news/2022-06-22/arctic

· https://eitrawmaterials.eu/opinions/greenland-ready-power-europes-raw-materials-future

About the Author:

Gent Pocesta is a Senior Index Specialist at MarketVector Indexes, where he conducts in-depth research, development, and ongoing maintenance of indexes spanning all asset classes. Gent holds a Master’s Degree in International Economics and Public Policy, and a Bachelor's Degree in Business Administration, where he brings a strong analytical foundation to his market insights and index strategy commentary.

For informational and advertising purposes only. The views and opinions expressed are those of the authors but not necessarily those of MarketVector Indexes GmbH. Opinions are current as of the publication date and are subject to change with market conditions. Certain statements contained herein may constitute projections, forecasts, and other forward-looking statements that do not reflect actual results. It is not possible to invest directly in an index. Exposure to an asset class represented by an index is available through investable instruments based on that index. MarketVector Indexes GmbH does not sponsor, endorse, sell, promote, or manage any investment fund or other investment vehicle that is offered by third parties and that seeks to provide an investment return based on the performance of any index. The inclusion of a security within an index is not a recommendation by MarketVector Indexes GmbH to buy, sell, or hold such security, nor is it considered to be investment advice.

Get the latest news & insights from MarketVector

Get the newsletterRelated: