The Fed began a new monetary easing cycle last month by slashing the interest rate by 50 bps. The recent decline in interest rates has reshaped the financial strategies of U.S. banks. While lower rates typically reduce the profitability of loans by compressing net interest margins [NII], many banks have adopted innovative approaches to maintain and grow their earnings.

Fee-based earnings: A Stable Revenue Source

Fee-based income refers to revenue that banks earn from services rather than interest on loans, making it a more stable source in this dynamic interest rate environment. Key sources include wealth management, where banks charge fees for managing assets and providing financial advice. Morgan Stanley’s [MS] wealth management division saw revenue jump 14% YoY.

Banks also make money from account maintenance fees, credit card fees, and loan origination charges. Wells Fargo [WFC], for instance, saw an uptick of 16% in 2024 YTD in fee-based revenue, offsetting the NII income.

Revenue from Investment Banking Activities

Banks generate significant revenue through their investment banking segment, which offers services like underwriting new issues of securities, advising on mergers and acquisitions (M&A), and facilitating corporate restructuring.

These services are usually compensated by fees, which can be substantial, particularly in periods of strong capital markets and corporate activity. Bank of America [BAC] has seen a surge in M&A deal-making, with underwriting income increasing by almost 40% in Q3.

Streamlining Operational Efficiency

Cost-cutting measures have been another area of focus. By investing in digital services and automation, banks have been able to reduce operational costs, improving efficiency ratios. This has allowed many financial institutions to remain profitable, even in a low-rate environment.

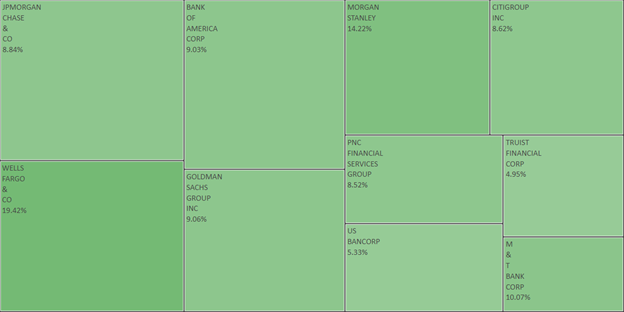

BlueStar® Top 10 US Banks Index,(BUBNK), which tracks the performance of the 10 largest U.S. banks was up 30.78% YTD 2024, with each of its components posting a positive return for the last 30 days.

The monthly returns [15 Sep to 15 Oct 2024] of the U.S. banks listed in BUBNK [5]

Source: Refinitiv Eikon.

[2] https://www.cnbc.com/2024/10/16/morgan-stanley-ms-earnings-q3-2024.html

[4] https://www.reuters.com/business/finance/bofa-profit-drops-weaker-interest-income-2024-10-15/

[5] Monthly Returns sourced from Refinitiv

For more information on our family of indexes, visit www.marketvector.com.

Get the latest news & insights from MarketVector

Get the newsletterRelated: