2015 will be a hard year for the biotech industry to beat.

Not only did it set records in financing, net income, and revenues, but M&A activity also set records for the second consecutive year. With a total value of USD100.2 billion (up 120% from 2014), the space saw some 89 M&A deals *.

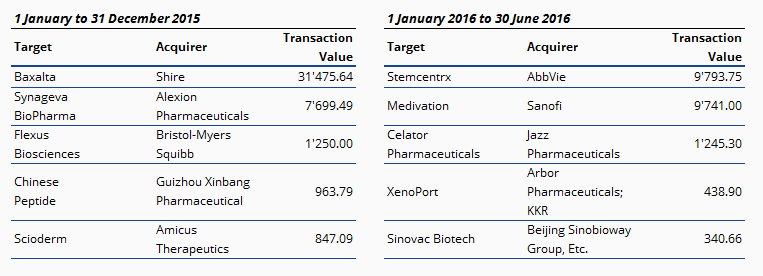

Some Significant Biotech Deals Completed or Pending

(USD Million)

Source: FactSet

On many fronts, however, growth actually slowed. These included market capitalization, year-on-year revenue, and net income.

As Glen Giovannetti, Global Life Sciences Leader at EY, so succinctly put it: “To restore investor confidence in the industry’s long-term prospects and to set the stage for future growth, biotech companies must demonstrate the value of their products to payers, physicians, patients and the public.”

We can but wait and see how the year pans out.

* EY: Beyond borders: Returning to Earth, (6 June 2016)

Get the latest news & insights from MarketVector

Get the newsletterRelated: