A Stellar Year for Market Leaders

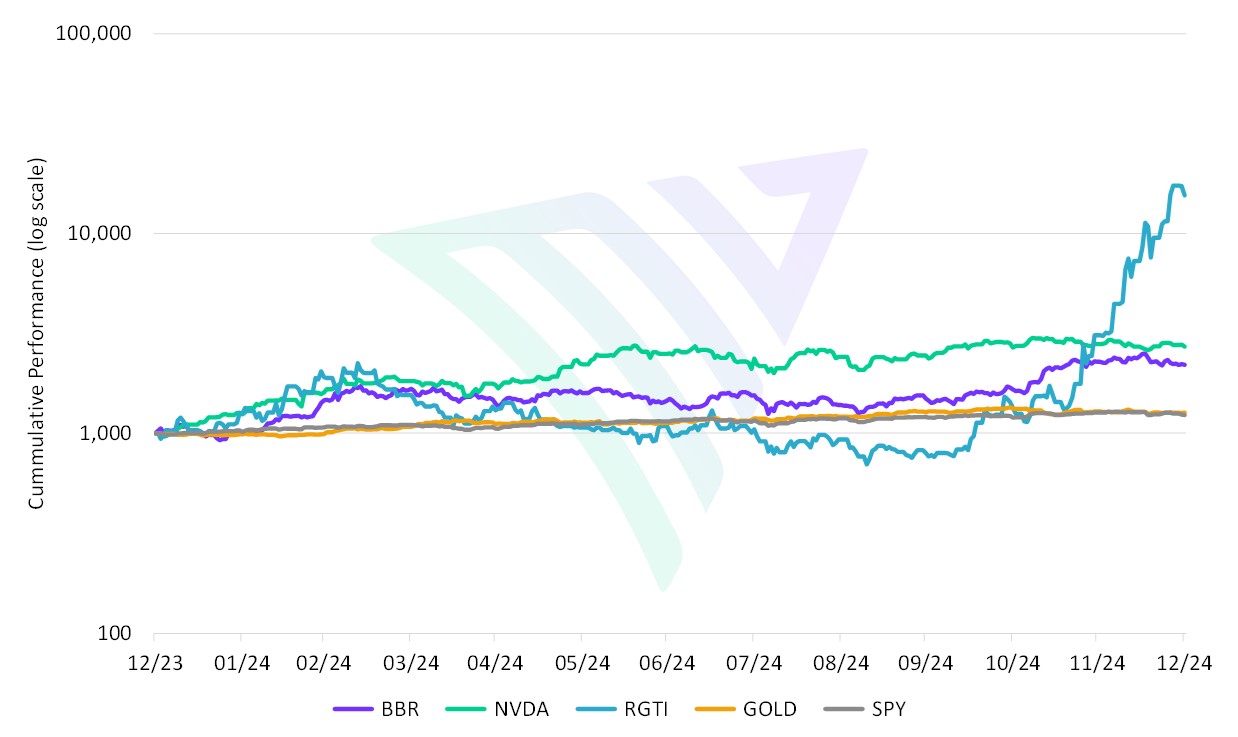

2024 brought extraordinary gains to select assets. Rigetti (RGTI: 1,449%), Nvidia (NVDA: 171%), Bitcoin (BBR: 120%), and Gold (OUNZ: 27%) all outperformed even the exceptional Large-Cap US Equities (SPY: 23%). But these outsized returns also came with equally outsized risks. Volatility, single-day drawdowns exceeding -10%, and annualized risk greater than 50% remind investors of the price of chasing high returns.

Exhibit 1: 2024 Shining Stars Performance

Source: MarketVector, Nasdaq. Data as of December 31, 2024.

Why Diversification Matters

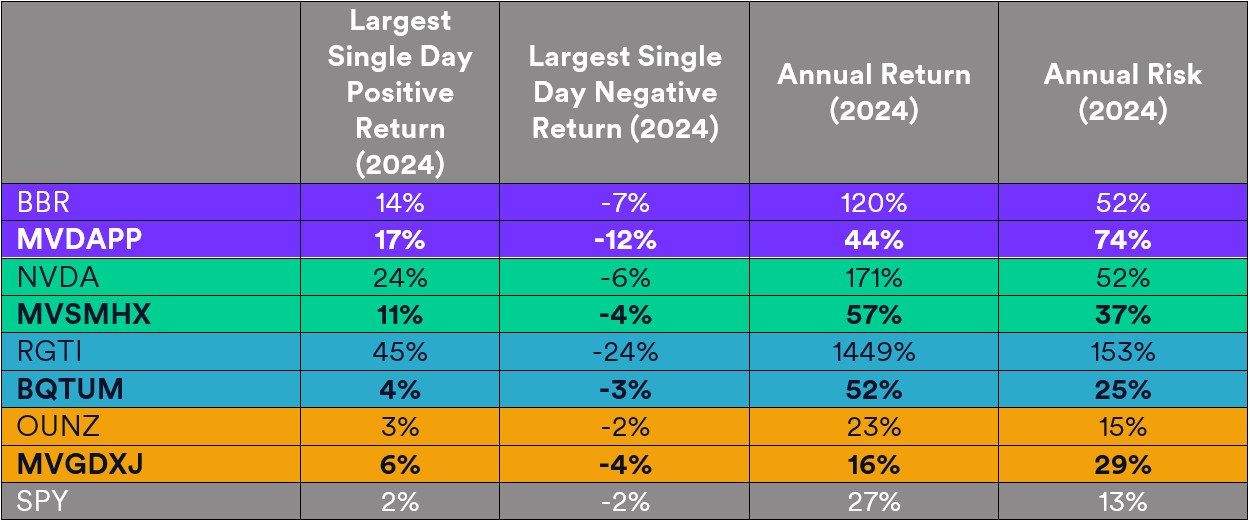

Investors aiming to replicate these stellar returns must weigh the risks of single-asset concentration. A diversified approach reduces exposure to idiosyncratic risk while allowing participation in broader growth trends. MarketVector offers thematic equity indexes that capture exposure to:

- MVIS® Global Digital Assets Equity Index (MVDAPP): tracks the performance of the largest and most liquid companies in the digital assets industry.

- MarketVectorTM US Listed Fabless Semiconductor Index (MVSMHX): tracks the performance of US-listed companies that specialize in the semiconductor industry and operate as fabless semiconductor companies.

- BlueStar® Machine Learning and Quantum Computing Index (BQTUM): tracks the performance of the largest and most liquid companies in the global quantum computing and machine learning industries.

- MVIS® Global Junior Gold Miners Index (MVGDXJ): tracks the performance of the most liquid small-cap companies in the global gold and silver mining industries.

Exhibit 2: 2024 Performance

Source: MarketVector, Nasdaq. Data as of December 31, 2024.

Capturing Opportunities with a Diversified Approach

2024 underscored the potential rewards of being in the right themes at the right time. However, the accompanying volatility highlights the value of diversified exposures. By leveraging broader themes, investors can participate in growth while mitigating the risks of single-asset concentration.

For more information on MarketVector Indexes, visit www.marketvector.com.

Get the latest news & insights from MarketVector

Get the newsletterRelated: