Since ancient times when the Babylonians and early Chinese insured shipping losses, insurance has worked as a business model because insurers’ gains from premiums generally exceed claims from losses. Insurers manage risk and profitability by constantly re-pricing premiums and diversifying their portfolios. The Market Vectors US Volatility Premium Capture Index (MVVCAP) is a simple implementation of a hedge fund strategy that sells put options on a diversified portfolio of stocks as a form of portfolio insurance to investors with a visceral need to calm their fears of market volatility. Put option premiums constantly re-price to reflect latest market volatility, and tend to climb following market corrections.

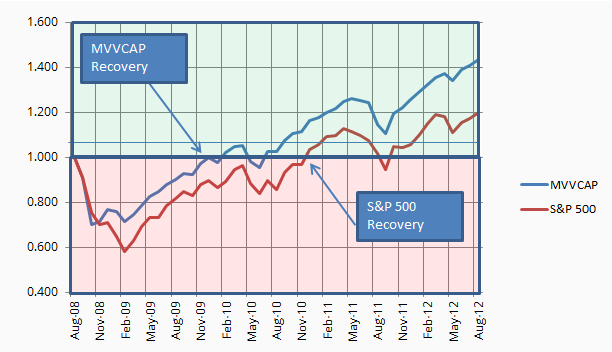

Source: Bloomberg, SPTR Index, MVVCAP Index

Stress Test: Following the 2008 Financial Crisis, hefty premiums helped MVVCAP recover in 13 months vs. more than 2 years for S&P 500.

For the past 9-year period 31 Dec 2005 - 31 Dec 2014, MVVCAP had higher annualized return and lower standard deviation than S&P 500.

Get the latest news & insights from MarketVector

Get the newsletterRelated:

About the Author:

Michael F. Mazier (MBA, Columbia Business School; MEE, Electrical Engineering, Villanova University; BSEE, Electrical Engineering, Syracuse University) serves as Chief Quantitative Strategist at VanEck and Portfolio Manager for all the Market Vectors fixed income exchange traded funds (ETFs). Mr. Mazier previously held positions at MSCI-Barra, Morgan Stanley’s fixed income research department, Merrill Lynch Global Securities Research, Citicorp Select Investments, and General Electric Aerospace Business Group.

The article above is an opinion of the author and does not necessarily reflect the opinion of MV Index Solutions or its affiliates.