The recent move by Trump Media to trademark "Made in America ETF" has sparked debate - not just about whether the phrase is trademarkable, but about what it truly represents in an investment context. Escalating tariff wars, shifting trade alliances, evolving regulatory policies are disrupting global dynamics and reshaping the competitive landscape. Against this backdrop, a US-focused strategy, whether in traditional or digital assets, may offer a clearer lens into American economic resilience.

“Made in America?”

While many large-cap US indexes are composed of American-domiciled companies, their revenues often tell a different story. Some of the biggest names in these indexes generate a substantial portion, if not the majority, of their revenue overseas. This exposure ties their performance to external macro forces, making them more sensitive to global trade dynamics, currency fluctuations, and geopolitical risks. As a result, there can be a stark contrast between businesses driven by global demand and those more directly linked to the domestic economy.

In environments where policy shifts favor domestically oriented firms through tax incentives, trade protections, or infrastructure investment, while creating headwinds for companies with greater foreign exposure, these performance differences may become even more pronounced. For investors seeking to capture true American economic resilience, it is increasingly important to differentiate between companies benefiting from US focused growth and those vulnerable to global uncertainties.

This distinction is equally critical in the digital asset space, where regulatory risk plays a defining role. Unlike traditional equities, crypto assets do not generate revenue in the conventional sense, but their jurisdiction and regulatory environment heavily influence their adoption, development, and market performance. The US is emerging as an increasingly favorable jurisdiction for blockchain innovation, with clearer regulatory frameworks, growing institutional participation, and a robust capital market infrastructure supporting digital assets. As regulatory clarity improves, US-based crypto assets may benefit from stronger investor confidence and institutional inflows, while those tied to uncertain or restrictive jurisdictions could face headwinds.

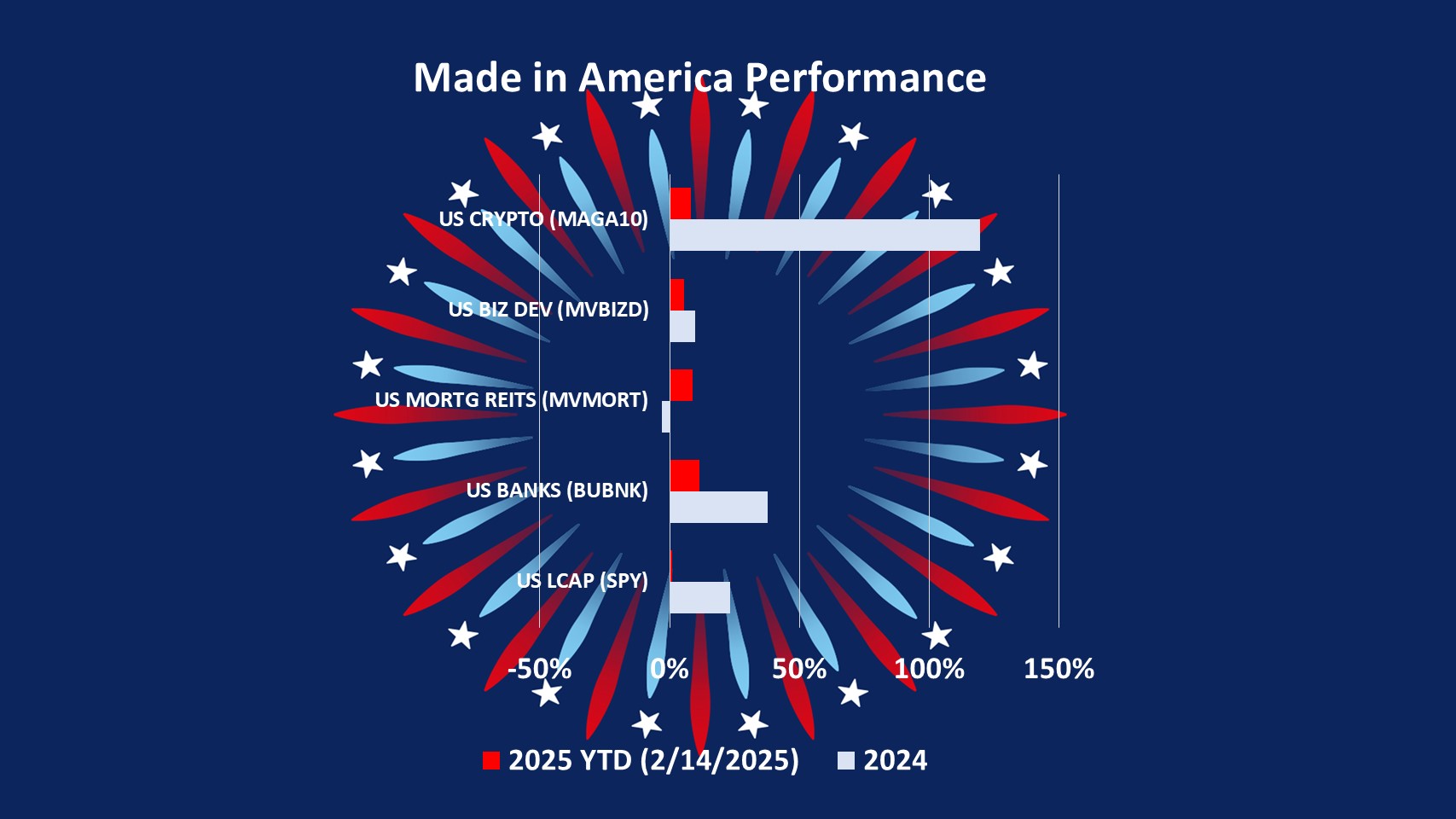

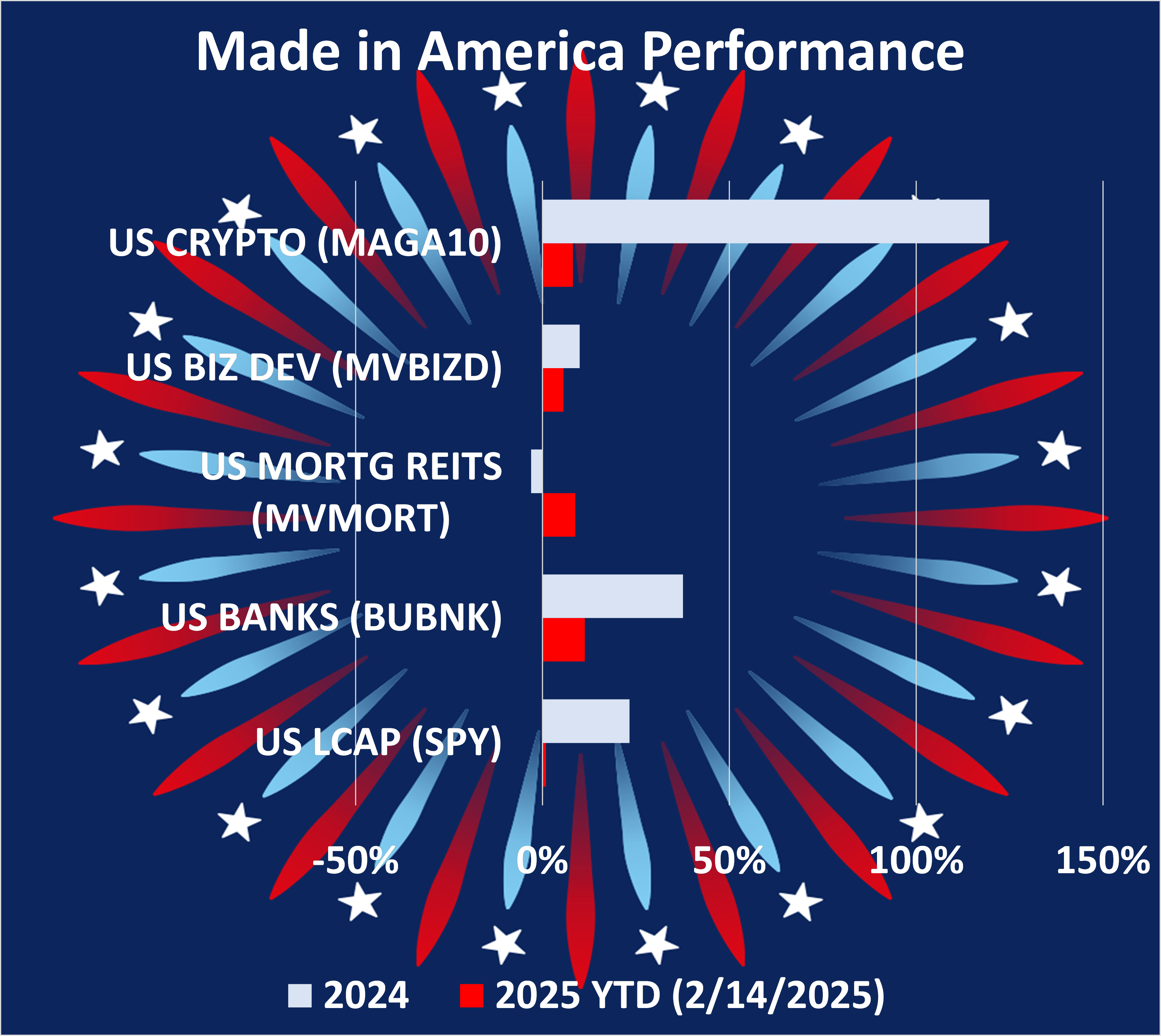

Looking at performance YTD, several US-focused themes stand out:

- BlueStar® Top 10 US Banks Index (BUBNK): Anchored in domestic credit markets and financial regulation, these institutions reflect improving profit opportunities with easing regulations.

- MVIS® US Mortgage REITs Index (MVMORT): Tied to the US housing market and interest rate environment, they provide exposure to easing real estate financing trends.

- MarketVectorTM US Business Development Companies Liquid Index (MVBIZD): Key players in private credit and mid-market financing, which are crucial for supporting American businesses.

- MarketVectorTM American Crypto Leaders Index (MAGA10): Focused on US-based blockchain and digital asset projects, an emerging frontier of financial innovation will benefit with US regulatory clarity.

Each of MarketVector indexes offers a more direct representation of US themes that may withstand or benefit from on-going trade disputes, foreign policy shifts and regulatory developments.

Exhibit: US-focused Performance

Source: MarketVector. Data as of February 14, 2025.

"Made in America!"

Whether or not "Made in America ETF" ever becomes a reality, the concept raises a bigger question: How should investors define and track US economic strength? As global trade policies and regulatory frameworks continue to shift, it may be time for investors to rethink how they measure American exceptionalism in the markets.

For more information on MarketVector, visit www.marketvector.com.

Get the latest news & insights from MarketVector

Get the newsletterRelated: