Introduction: The Viral Power of Meme Coins

“Who controls the memes, controls the universe” – Elon Musk

Meme coins have surged in popularity and visibility, reshaping our understanding of digital currencies and their potential impact on financial markets. From the unexpected rise of Dogecoin to the innovative introduction of Bonk, meme coins have transitioned from internet jokes to powerful market influencers. This article delves into the significant role that meme coins play in today's crypto landscape, highlighting their growth, cultural integration, and the speculative nature that drives their appeal.

Meme Coins and Traditional Finance: A Comparative View

The rise of meme coins can be paralleled with traditional financial concepts. Like collectibles or artwork, whose value is significantly influenced by cultural and subjective factors, meme coins derive much of their value from community engagement and the social consensus around their potential. This mimetic value, while often seen as a speculative force, is a powerful driver in the markets, akin to the way investor sentiment can sway stock prices or luxury goods can fluctuate in price based on brand perception. For instance, gold and Bitcoin are seen as stores of value not just for their physical or technical merits but also due to a collective belief in their worth. This belief propagated through cultural and social narratives, solidifies their status as reliable assets for wealth preservation.

From Cultural Gags to Crypto Staples

Initially perceived as mere internet gags, meme coins like Dogecoin have outperformed traditional investments, tapping into the cultural zeitgeist and gaining traction through celebrity endorsements and social media virality. Dogecoin itself once started as a humorous critique of cryptocurrency speculation, has witnessed remarkable growth, boasting a market capitalization that once reached USD 85 billion.

The appeal of meme coins extends beyond their humor. They serve as an entry point for individuals often excluded from traditional financial systems. These digital assets provide a platform for financial engagement that is less regulated and more accessible, embodying a form of financial nihilism that resonates particularly with younger generations. This demographic, disillusioned by conventional investment pathways such as real estate or stock markets, finds meme coins an enticing alternative that aligns with their internet-savvy and risk-tolerant nature.

Speculation and Community: The Dual Engines Driving Meme Coins

Speculation plays a pivotal role in the lifecycle of meme coins. It not only initiates their journey in the financial markets but also paves the way for broader applications beyond mere gambling. For example, Las Vegas casinos have diversified their revenue streams to include entertainment and dining, paralleling how meme coins can evolve to encompass more than just speculative assets.

The community aspect cannot be overstated. Meme coins often foster strong, vibrant communities that contribute to their use and value. Bonk, for instance, became a mascot for the Solana blockchain, demonstrating how community engagement can revitalize interest and support for blockchain ecosystems. This community-driven approach is crucial for maintaining relevance and ensuring longevity in the volatile crypto market.

The Financialization of Internet Culture

What sets meme coins apart in the digital currency space is their ability to monetize internet culture. Memes, which are inherently viral, now have the potential to be tokenized, creating a new asset class that merges cultural influence with financial speculation. This phenomenon illustrates a shift towards a more immersive involvement of internet dynamics in financial systems, where the value of a digital asset can be as much about its cultural significance as its potential for economic return.

Conclusion: The Future of Meme Coins in Crypto Markets

As we look toward the future, meme coins represent more than just speculative bubbles; they are at the forefront of a shift in how we perceive and interact with money. Their ability to engage communities, drive cultural conversations, and offer alternative financial participation paints a picture of a dynamic and evolving market segment. With continued innovation and community engagement, meme coins may well persist as significant players in the broader landscape of digital currencies.

In summary, meme coins are not just a passing internet fad but a robust category of digital assets that reflect and capitalize on the zeitgeist of internet culture. Their growth and persistence underscore a broader movement towards integrating internet-based cultural phenomena with tangible economic activities, paving the way for new forms of investment and market interaction in the digital age.

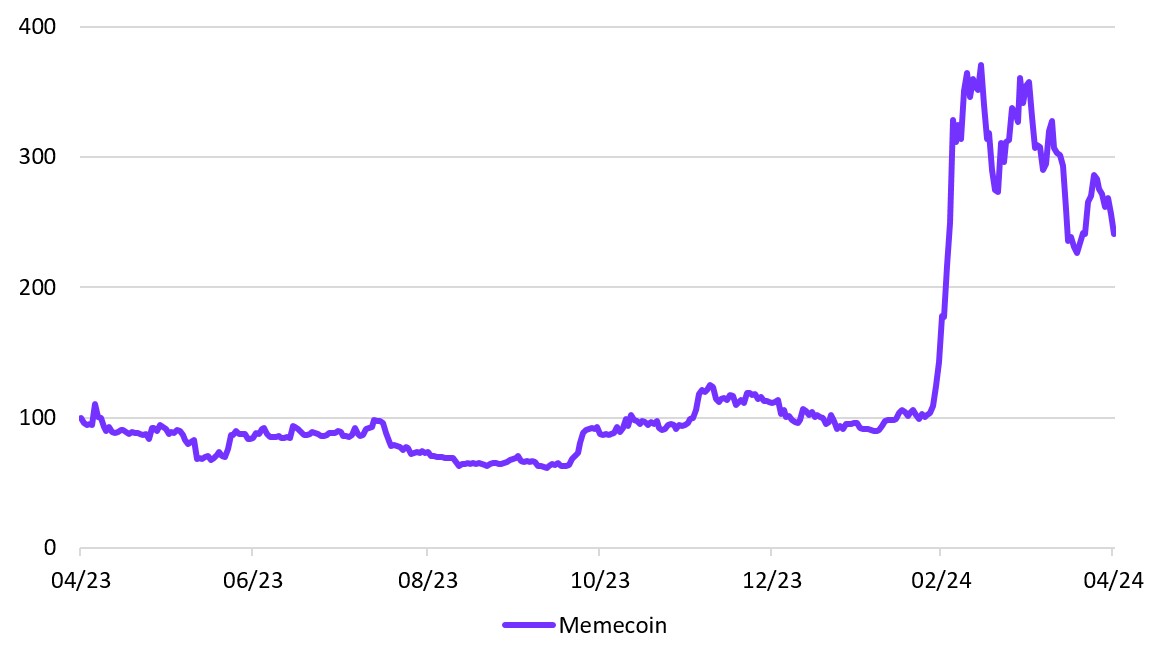

Introducing the MarketVectorTM Meme Coin Index (MEMECOIN)

To further enhance the investment landscape, MarketVector has launched the MarketVectorTM Meme Coin Index (MEMECOIN), a modified market cap-weighted index. This index is specifically designed to track the performance of the six largest meme coins, identified and classified by MarketVector as "meme coins" with approved availability from custodians. The index components are subject to a maximum weighting cap of 30% to ensure diversification and are reviewed on a monthly basis to maintain relevance with market changes. This development provides a structured approach to investing in the dynamic and often whimsical world of meme coins.

LTM Performance of the MarketVectorTM Meme Coin Index

Source: MarketVector. Data as of April 30, 2024.

For more information on our family of indexes, visit www.marketvector.com.

Get the latest news & insights from MarketVector

Get the newsletterRelated: