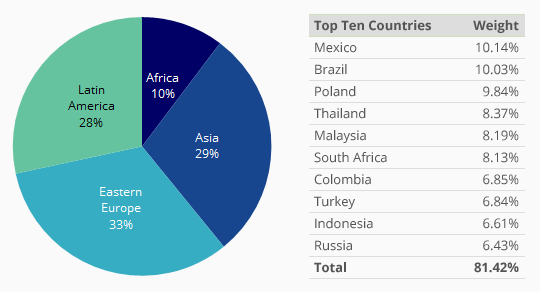

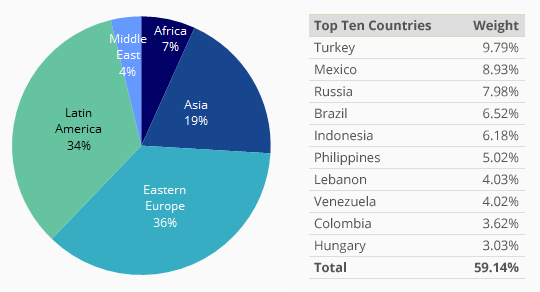

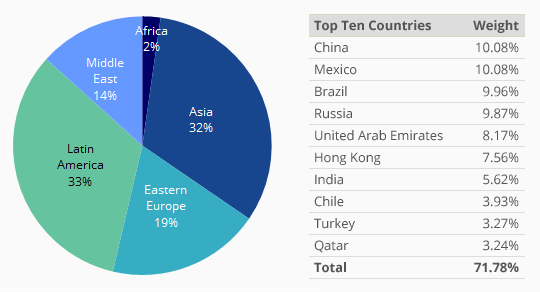

Among the three major buckets in the Emerging Markets Aggregate Index – hard currency sovereign, local currency sovereign, and hard currency corporate – the most balanced exposure from a geographical perspective appears to be in the corporate space. The corporate index also includes a number of middle-eastern states that are not represented in the sovereign indices. Versus corporates, the sovereign indices have heavier concentrations in Eastern Europe and less exposure to Asia. These differences are much more acute in the case of hard currency sovereigns.

The advantages of adding corporates to a portfolio:

- added diversification by issuer, country, and region;

- increased exposure to higher growth Asian countries;

- higher yield and lower duration than sovereigns.

EM Local Currency Sovereign

EM Hard Currency Sovereign

EM Hard Currency Corporate

All data as of 29 Oct 2014 — Source: FactSet, MVIS

Get the latest news & insights from MarketVector

Get the newsletterRelated: