There has been a lot of talk in the press ofinflation since the democrats have taken control of Washington. We find thismisplaced, as there is a difference between reflation, which is stimulating theeconomy to get back to normal growth, and excessive inflation, which is a risein wages and prices.

U.S. Market Inflation Expectations (5Years Ahead)

Source: Bloomberg, VanEck. Data as of December 2020.

This chart shows that inflation expectationshave simply returned to normal levels of around two percent, where they havebeen for decades. It also shows how inflation expectations cratered with thedeflationary shocks of the financial crisis in 2008 and the COVID crisis in2020. In both crisis, inflation expectation rebounded to historic norms. Goldis not reacting to inflationary pressures because there is not yet any evidenceof excessive inflation.

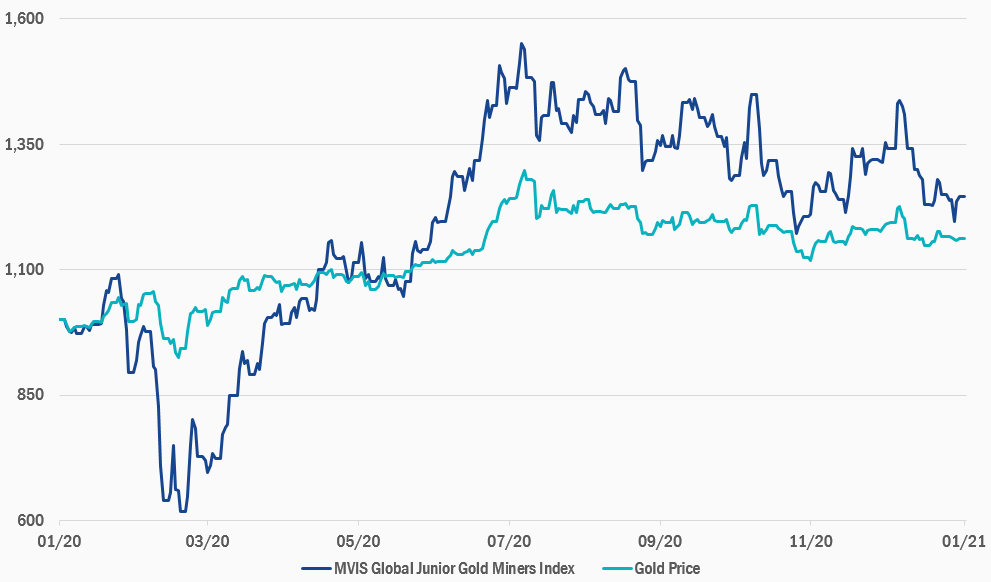

MVIS Global Junior Gold Miners Index vs. Gold Price

01/31/2020-01/31/2021

Get the latest news & insights from MarketVector

Get the newsletter

Related: