Introduction to DePIN: Bridging Blockchain and Physical Infrastructure

Decentralized Physical Infrastructure Networks, commonly known as DePIN, have emerged as a transformative force, integrating blockchain technology with physical infrastructure. This concept, thriving at the intersection of digital and physical realms, aligns with blockchain's core tenets - community ownership, transparency, and incentive alignment. DePIN's applications span various sectors, including WiFi networks, security cameras, and computation servers, marking a significant evolution in how we interact with and benefit from technology.

Understanding the DePIN Ecosystem

DePIN's landscape is diverse, encompassing decentralized storage networks like Arweave and Filecoin, innovative connectivity solutions such as Helium, and community-driven software platforms like Hivemapper. Each of these represents a unique facet of DePIN, united by common themes of collective ownership and distributed infrastructure costs. These projects collectively contribute to an expanding economy of scale, inviting more users into an increasingly robust ecosystem.

The Evolution and Expansion of DePIN

Originally focusing on the physical aspects of technology, such as sensors and servers, DePIN has evolved to include consumer-centric applications, exemplified by projects like TRIP, a decentralized alternative to traditional ride-sharing services. This expansion reflects DePIN's growing scope, encompassing both hardware and data infrastructure under a singular, revolutionary concept.

Case Studies: Helium and Hivemapper

Helium, a pioneer in DePIN, began by decentralizing broadband infrastructure and later integrated cryptocurrency payments, becoming a standard-bearer in the crypto industry. However, challenges in maintaining interest and liquidity have prompted a strategic shift, with Helium transitioning to the Solana blockchain for enhanced scalability and coverage.

Hivemapper, another key player, aims to disrupt the mapping industry. By incentivizing users with HONEY tokens in exchange for shared dashcam footage, Hivemapper assembles a decentralized map, challenging established players like Google Maps. This project exemplifies DePIN's potential to create an efficient, decentralized data infrastructure.

Emerging Players: Teleport and IoTeX

Teleport, a decentralized competitor to Uber, and IoTeX focusing on privacy-centric IoT devices represent the diverse applications of DePIN. Teleport's focus on a fair, decentralized data marketplace and IoTeX's emphasis on secure, blockchain-powered devices illustrate the broad impact DePIN can have on various industries.

Impact on the Blockchain Ecosystem and Governance

DePIN's growth significantly influences the broader blockchain ecosystem. Its consumer-facing nature drives demand for high-performance, composable blockchain platforms. Furthermore, as DePIN projects mature, they increasingly adopt decentralized autonomous organizations (DAOs) for governance, potentially expanding DAOs' roles from managing digital assets to overseeing physical infrastructure.

DePIN's Remarkable Resurgence: A Promising Theme for 2024

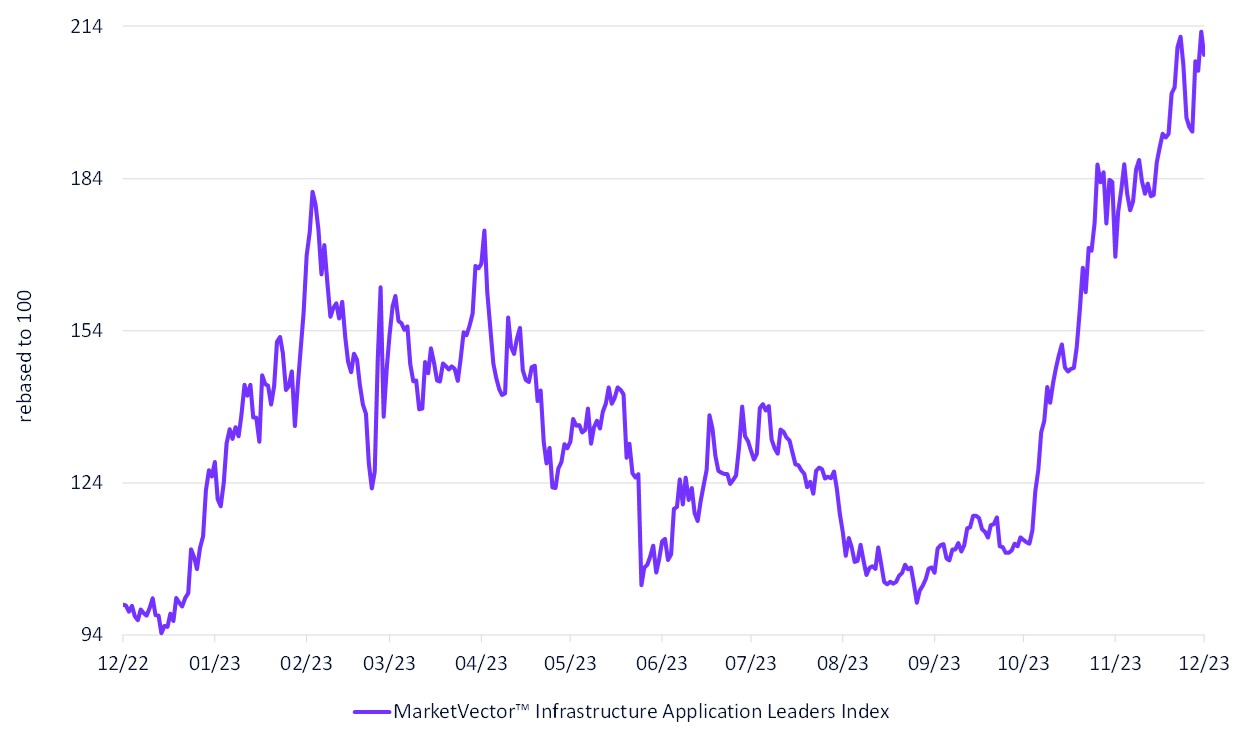

In the latter part of 2023, DePIN tokens witnessed a remarkable comeback, reflecting renewed investor confidence in the decentralized physical infrastructure sector. This resurgence is notably tracked by our Infrastructure Application Index, which showcases a significant uptick in DePIN token performance since mid-October. This positive trend underscores the growing recognition of DePIN's potential to revolutionize both the blockchain and the broader technological landscape.

MarketVectorTM Infrastructure Application Leaders Index

17/12/2023-17/12/2023

Source: MarketVector. Data as of December 17, 2023.

Get the latest news & insights from MarketVector

Get the newsletterRelated: