The unconventional resource shale oil story in the U.S. is clearly being recognized by the stock market: Exploration & Production stock prices are up. However, these companies are being rewarded «in advance» for some of their reserves that are not yet proven. Proving those reserves, leading to production, will entail a massive amount of drilling, a quantum leap more than is currently being undertaken. The opportunity awaiting the oil service companies is similarly huge.

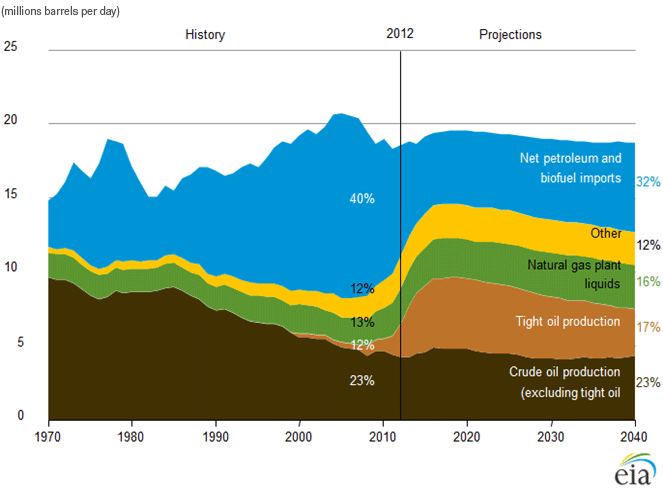

U.S. Petroleum and other Liquid Fuels Supply by Source, 1970-2040

Source: EIA, Annual Energy Outlook 2014 Overview

Over the past year, the technology of fracking has been enhanced, expanded and optimized. Horizontals are now longer and the service intensity of the hydraulic fracturing has increased. That is, more fractures per length of horizontal. As the number of fractures has increased, so too, as a result, has the requirement for both more fluid and proppant, i.e. sand or ceramic materials. These, in turn, need more trucks to transport them, more facilities to recycle them and more plant to utilize them. All these are provided by the oil services companies.

Get the latest news & insights from MarketVector

Get the newsletterRelated: