In our continuous journey through the dynamic world of digital assets, wee excited to spotlight our latest insights. We\ve coalesced our thoughts in a recent op-ed, "Staking can modernize the Ethereum ETF," authored by our Digital Asset Product Strategist, Martin Leinweber, alongside Joshua Deems from Figment.

Here's a succinct breakdown for you:

The Evolution of Ethereum ETFs: While initial Ethereum ETFs have been straightforward, we believe there's room for growth and sophistication, much like the equity ETF space.

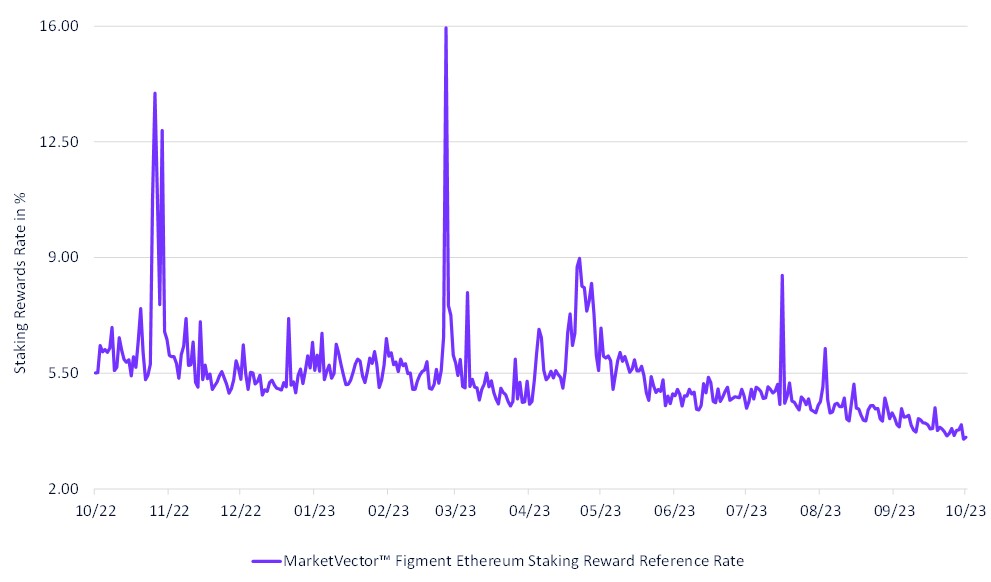

Staking - Ethereum's Lifeblood: Staking isn't just a trend; it's Ethereum's heartbeat. By bonding Ethereum to validators, investors not only enjoy rewards but also bolster Ethereum's overall security. The MarketVector Figment Ethereum Staking Rewards Reference Rate is reflecting the daily annualized rewards rate.

Elevated Investor Returns: Incorporating staking rewards provides a holistic Ethereum experience, potentially amplifying returns beyond mere price tracking.

Post-Merge Dynamics: Since the 2022 Merge, Ethereum's deflationary trajectory emphasizes the importance of staking.

Balancing Returns and Liquidity: A case study suggests a possible strategic approach: stake 50% of Ethereum ETF holdings and integrate a liquid staking protocol for an added 30%, ensuring both returns and liquidity are optimized.

In essence, as Ethereum ETFs rise in prominence, the interplay of staking and liquidity will be paramount. We invite you to delve into the full op-ed for a richer perspective.

MarketVectorTM Figment Ethereum Staking Reward Reference Rate

16/10/2022-16/10/2023

Source: MarketVector. Data as of October 16, 2023.

Get the latest news & insights from MarketVector

Get the newsletterRelated: