Unraveling Staking Rewards: Why Theye Crucial for Institutions

With the burgeoning rise of cryptocurrencies, the conversation about staking rewards is becoming increasingly pivotal. The paramount question that resonates is: Why do institutions require a dependable staking rewards rate, and what are the challenges it intends to tackle?

The Diverse World of Staking Rates

Venture into the realm of Ethereum, and youe met with an array of staking rates, each varying depending on the platform of choice. This diversity, while advantageous, also presents a complex landscape for institutions. The solution? An index that encompasses the entirety of Ethereum’s activities, thereby becoming a standard-bearer of transparency. Such a measure not only creates an industry benchmark akin to the traditional LIBOR or SOFR but also establishes a gold standard for cryptocurrency staking rewards.

The Evolution of ETH Reference Rate

Drawing parallels with the traditional finance world, Ethereum’s daily annualized rate stands out due to its transparent, observable, and replicable nature. Powered by the blockchain’s unalterable and transparent data, entities like MarketVector have elevated this standard by publishing the rate every day of the week. But the adaptability doesn’t end here; with time, there's potential for hourly rates, allowing for an array of products to be launched upon its establishment.

Ethereum: The Internet’s Bond

Ethereum, renowned as the largest proof of stake protocol, is often referred to as the "internet bond." But what if, in this vast landscape, there existed a foundational rate? A yardstick that functions similarly to a yield curve or a forward market? This would pave the way not only for futures that hedge and speculate but also set the tone for a fair rate for all investors. Regardless of individual performance, this reference rate would guide investors about the expected returns.

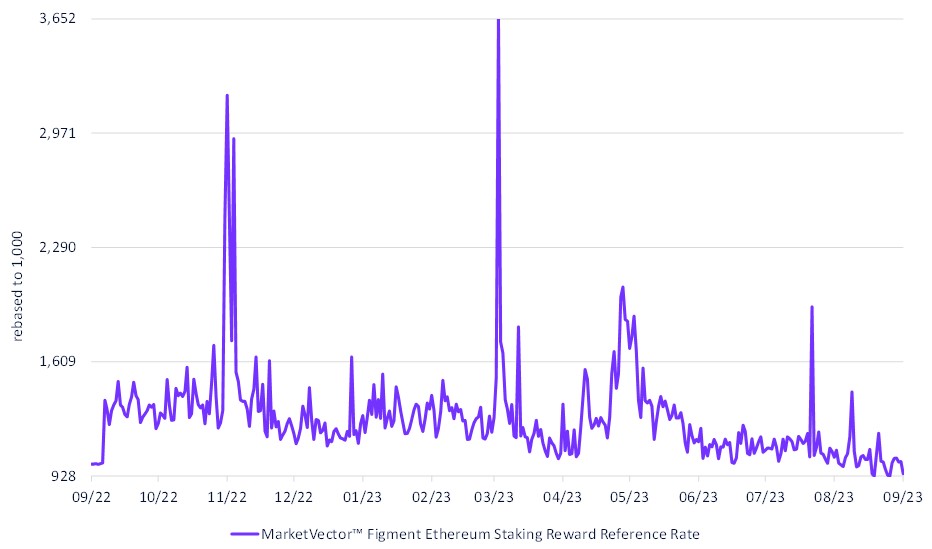

MarketVectorTM Figment Ethereum Staking Reward Reference Rate: A Closer Look

Delve deeper into the MarketVectorTM Figment Ethereum Staking Reward Reference Rate, and youe introduced to a comprehensive system. While the reference rate delineates staking rewards, the Total Return Index (TRI) adds another layer, factoring in pricing inputs, making the overall rate calculation intricate yet accurate.

Applications for Institutions: The Expanse of Possibilities

For institutions, the staking rewards rate and its associated metrics open up a world of opportunities:

Asset Management Products: With the potential for total return ETH staking funds, there's a broader horizon for benchmarking best practices.

Derivatives: Encompassing everything from forward curves to unlocking derivatives, it's a treasure trove for financial enthusiasts. Unique financial instruments like the basis swap and floating-for-floating swaps mark a new era in cryptocurrency.

Moreover, these rewards rates bring forth uncorrelated revenue streams, becoming especially intriguing for hedge funds and family offices. With strategies like fixing to variable swaps, validators can witness reduced volatility, creating a more stable revenue stream. The inherent structure of Ethereum staking yields further makes holding onto floating inventory a calculated risk.

The Future Landscape of Staking Rewards

In conclusion, as the lines between cryptocurrency and traditional finance continue to merge, the role of staking rewards becomes undeniably central. From ensuring transparency to facilitating a range of financial products, this is just the beginning of a transformative journey for the crypto ecosystem.

MarketVectorTM Figment Ethereum Staking Reward Reference Rate

9/10/2022-9/10/2023

Source: MarketVector. Data as of September 10, 2023.

Get the latest news & insights from MarketVector

Get the newsletterRelated: