Futures serve as important functions in price discovery. The introduction of perpetual futures is enabling the crypto world to use traditional functionality to disrupt an established system.

A futures contract is a legal agreement that allows two parties to trade an asset at a specified time in the future. Futures contracts are traded on a futures market and the settlement of the assets happens at the expiry date. A perpetual futures contract is a futures contract that never expires; thus, it can be held indefinitely.

The value of the futures contract is linked to the underlying value of the assets, investors can trade futures by funding a margin account, set as a percentage value of the futures contract derived from the value of the underlying asset. As the price moves in the underlying asset, the margin requirement will also move, and the difference must be settled between the parties, limiting the risk of default on either side.

For crypto assets, perpetual futures allow investors to take a leveraged position to gain exposure without having to take delivery of the assets and without the need to roll over contracts as they approach expiration. Although the daily margin requirements reduce default risk and custody risks, it does not eliminate counterparty risk or valuation risk for esoteric assets.

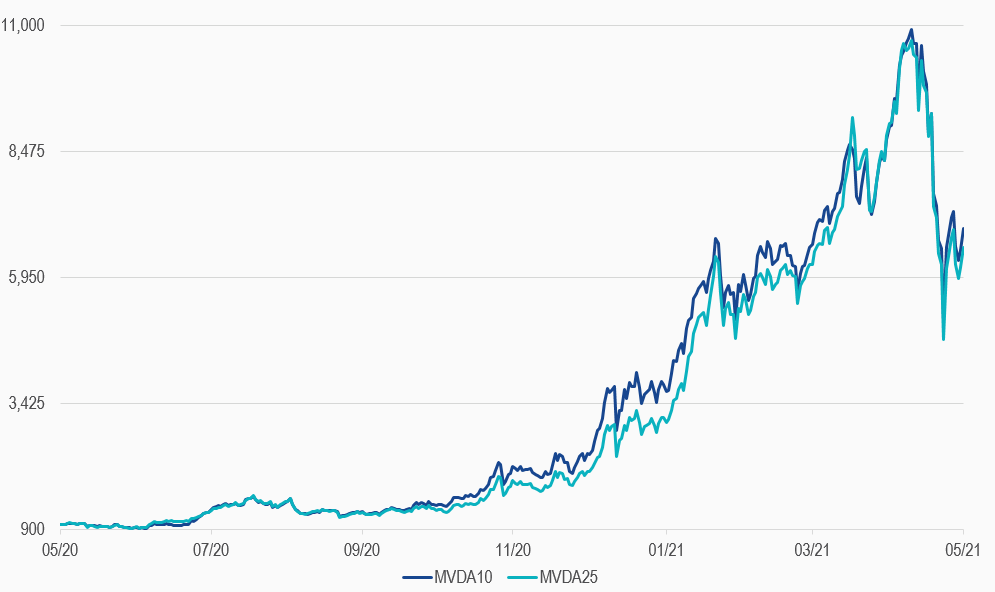

For highly volatile assets, it is critically important to have transparent index prices when determining the value required to maintain the value of the margin account, the futures contract and the underlying asset. MV Index Solutions GmbH (MVIS®) and CryptoCompare recently announced the licensing of the MVIS CryptoCompare Digital Assets 10 Index (ticker: MVDA10) and MVIS CryptoCompare Digital Assets 25 Index (ticker: MVDA25) for the launch of two new perpetual futures products allowing investors more options to gain exposure to crypto assets and buildout derivative options.

MVIS CryptoCompare Digital Assets 10 Index and

MVIS CryptoCompare Digital Assets 25 Index

31/05/2020-31/05/2021

Get the latest news & insights from MarketVector

Get the newsletterRelated:

Joy Yang is Global Head of Index Product Management at MV Index Solutions (MVIS). She is responsible for managing MVIS products and services to accelerate innovation in financial index design and adoption. Joy brings more than 25 years of investment experience to MVIS, having led teams delivering index and quantitative-active investment solutions at Arabesque Asset Management, Dimensional Fund Advisors, Vanguard, Aberdeen Standard Investments, AXA Rosenberg and Blackrock. Joy has an MBA from the University of Chicago Booth School of Business, and a BS in Electrical Engineering from Cooper Union’s Albert Nerken School of Engineering.

The article above is an opinion of the author and does not necessarily reflect the opinion of MV Index Solutions or its affiliates.