With the Super Bowl quickly approaching (February 12), it is timely to talk about the emergence of online gambling. In 2022, the global online and mobile gambling market recorded a valuation of USD 63.53 billion and is expected to grow at a compound annual growth rate (CAGR) of 11.7% from 2023 to 2030.

The legalization approval in the United States has had a big part to play in the growth rates and projections. But still (as of January 3rd, 2023), only 22 out of the 50 US states have legalized online and mobile sports betting. There are some very large states out of the 28 states that do not allow mobile or online gambling, namely Florida (only in-person is legal), California, and Texas meaning there is still plenty of room to run in terms of growth. For reference, New York implemented their legalization of online and mobile sports betting on January 8th, 2022. In 2022 alone, New Yorkers placed 16 billion USD at online or mobile sportsbooks.

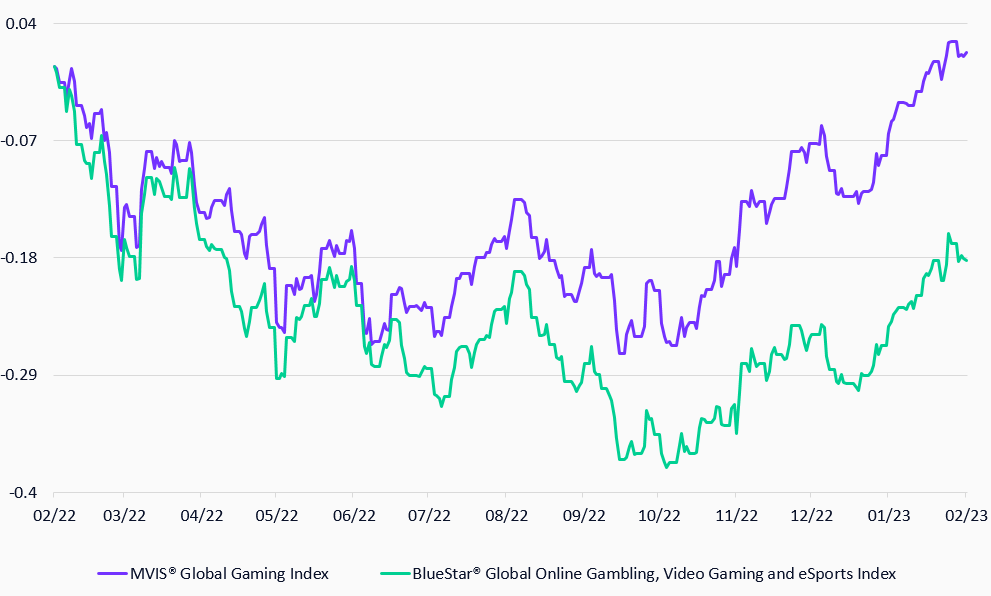

With more US states legalizing sports betting and international countries growing an extremely fast rate (European and Asian countries), online and mobile sports betting globally is just getting started. Investors can track the performance of global gambling and gaming industry with MarketVectorTM Indexes such as BlueStar® Global Online Gambling, Video Gaming and eSports Index (BVGOG) or MVIS® Global Gaming Index (MVBJK).

MVIS® Global Gaming Index and BlueStar® Global Online Gambling, Video Gaming and eSports Index

9/2/2021-9/2/2023

Source: MarketVector IndexesTM. Data as of February 9, 2023.

The BlueStar® Global Online Gambling, Video Gaming and eSports Index (BVGOG) tracks the performance of the largest and most liquid companies involved in the online gambling, video gaming and eSports industries. This is a modified market cap-weighted index, and only includes companies that generate at least 50% of their revenue from online gambling, video gaming and/or eSports. BVGOG covers at least 90% of the investable universe of each the online gambling and video gaming/eSports segments.

The MVIS® Global Gaming Index (MVBJK) tracks the performance of the largest and most liquid companies in the global gaming industry. This is a modified market cap-weighted index, and only includes companies that generate at least 50% of their revenue from casino and casino hotels, sport betting (incl. Internet gambling and racetracks) and lottery services as well as gaming services, gaming technology, and gaming equipment. MVBJK covers at least 90% of the investable universe.

Get the latest news & insights from MarketVector

Get the newsletterRelated: