Introduction: From "Fat Protocol Thesis" to "Fat App Thesis"

A recent paradigm shift in the valuation of crypto tokens has emerged, with the "Fat Protocol Thesis" giving way to the "Fat App Thesis." This article will explore the implications of this change for professional investors and examine how it impacts the valuation of blockchain applications and tokens.

The Origins of the Fat Protocol Thesis

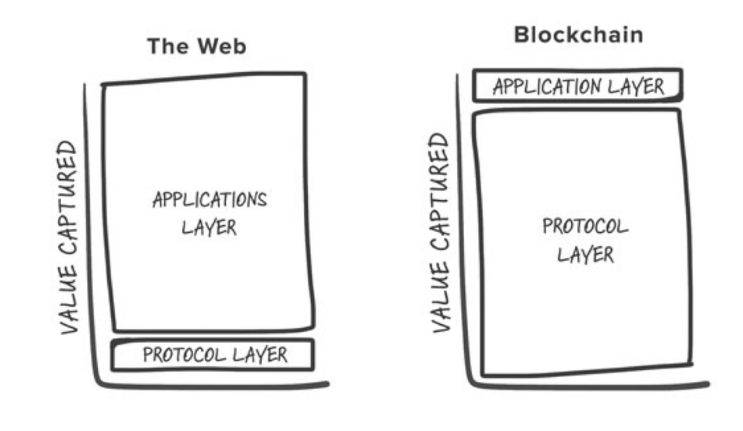

The "Fat Protocol Thesis" was first introduced by Joel Monegro in 2016 to explain the differences in value accrual between the Internet and blockchain applications. He argued that web infrastructure allowed applications to retain most of the value over underlying protocols, while blockchains retained almost all value at the base protocol level, giving rise to the term "Fat Protocol."

Monegro's argument was based on two key factors: the shared data layer, which led to greater competition and reduced barriers of entry, pushing fees close to zero, and the existence of a protocol token, which created a flywheel effect driving token price appreciation and attracting more network adopters.

Source: https://www.usv.com/writing/2016/08/fat-protocols/

The Shift to the Fat App Thesis

While the Fat Protocol Thesis has held true so far, with base layer tokens like $ETH, $BTC, $AVAX, $SOL, and $MATIC performing well, a new paradigm is emerging. Applications are finally achieving product-market fit, and individual tokens are gaining value. As a result, investors are considering multi-token indexes as a way to invest in this new landscape.

Cash Flow Becomes King

One significant shift in this new paradigm is the focus on cash flow. Fees and revenue generated are now the primary measures of success, replacing total value locked (TVL). Cash flow can also reveal where value accrues along the transaction pipeline, providing insight into the most valuable layers of a blockchain.

Applications Building Moats and Retaining Value

As blockchain applications continue to grow, they are finding ways to build moats in liquidity and user retention. By achieving an "unforkable state," these applications can maintain their fees without being undercut by competitors, allowing them to accrue more value. Furthermore, some applications are already designing methods to mitigate or absorb maximum extractable value (MEV), further enhancing their value proposition.

The Benefits of a Market Cap Weighted Token Index in the Fat App Thesis Era

The "Fat App Thesis" is an emerging concept, and a broad market cap weighted token index may potentially provide investors with some advantages, such as diversification, exposure to various applications, interaction with new opportunities, simplified portfolio management, and wide-ranging involvement with layer 1 protocols. This investment strategy might be well-positioned to capture the value generated by the ongoing paradigm shift in the crypto space, allowing investors to benefit from both the growth of successful applications and the underlying base layer protocols.

MarketVectorTM Digital Assets 25 Index

31/12/2014-1/5/2023

Source: MarketVector IndexesTM. Data as of May 1, 2023.

Get the latest news & insights from MarketVector

Get the newsletterRelated: