Decoding the Power of Single Token Indexes

Indexes cater to a multitude of customer requirements in the diverse landscape of cryptocurrency trading. Although standard index prices already offer significant value, widely-accepted benchmark reference rates have been fine-tuned to allay investor concerns about potential price manipulation, temporal gaps, and exchange failures.

Specifically derived from Bitcoin - arguably the superstar of cryptocurrencies with its unmatched trading volume - these benchmark reference prices have found a special place in the resolution of financial derivatives, computation of a fund's net asset value (NAV), and notably, in the valuation of exchange-traded funds (ETFs).

ETFs and ETPs - exchange-traded investment instruments - are priced based on the net asset value of their underlying holdings. For a Bitcoin ETF, its value is directly related to the price of Bitcoin. Therefore, a reliable, consistent, and fair measure of Bitcoin's price is crucial, which is the role of the reference rate. By providing an accurate reflection of the actual price of Bitcoin, the reference rate ensures that the ETF's valuation is both transparent and fair. This is critical for the investors as it affects the trading prices of the ETF shares on the stock exchange. And by generating a reliable, regulated, and universally recognized reference point for top crypto assets, a more secure and trustworthy ecosystem for the development of this innovative asset class is created.

Deconstructing the BBR: An Investor-friendly Breakdown

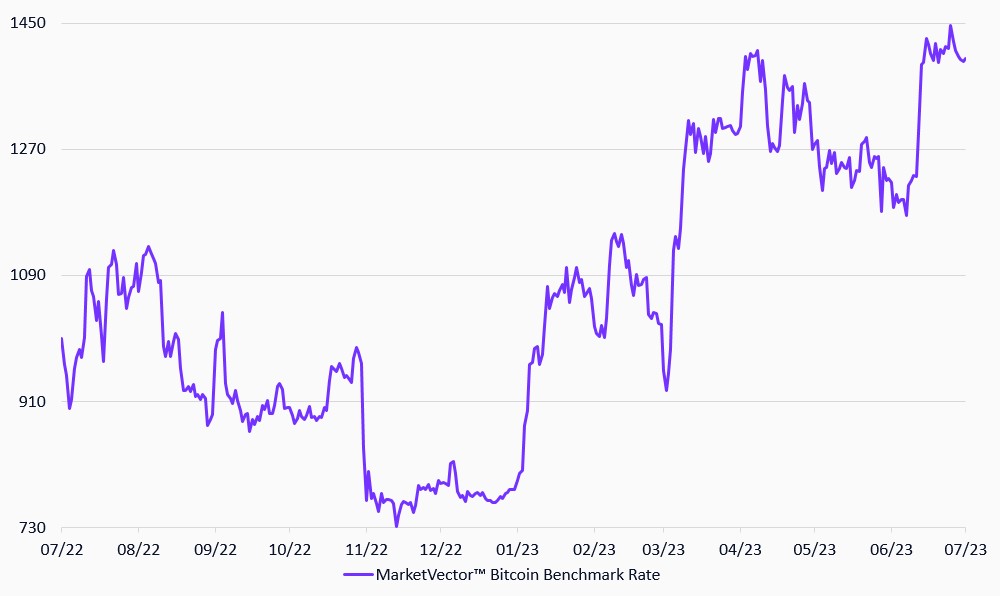

For digital asset investors, the MarketVectorTM Bitcoin Benchmark Rate (BBR) is an indispensable tool for understanding the market value of Bitcoin. Designed with a focus on accuracy, reliability, and resilience against market manipulation, the BBR is a robust tool in the investor's toolkit. Here's a breakdown of its sophisticated methodology:

- Medians Over Averages

Finding the middle value in a series can be skewed by extraordinarily high or low numbers. Using medians over averages helps reduce the influence of outliers, providing a more accurate representation of the 'middle' value. In the BBR context, medians ensure that the price is less influenced by extreme Bitcoin prices on a particular exchange.

- Volume-Weighting Medians

Investors often want more than just the median value; they're interested in the frequency and significance of each value. This is where a volume-weighted median comes in handy. It takes into account the volume of Bitcoins traded at each price. By incorporating volume-weighting, the BBR neutralizes the effect of numerous smaller trades that might otherwise skew the median. Unlike a traditional median, a volume-weighted median includes a weighting element - in this case, the size of the trade - thereby providing a more detailed analysis. The volume-weighted median selects the first price where 50% or more of the total volume is accumulated, ensuring a robust price methodology.

- 20 Equal Parts: Fair and Representative

Understanding Bitcoin's price necessitates data capture at multiple intervals, akin to monitoring weather patterns. The BBR method divides an hour into 20 equal parts, or 'partitions', to calculate the median price in each. This results in a thorough view of the market conditions throughout the day, updated every 15 seconds on a rolling one-hour period.

By incorporating medians, volume-weighting, and partitioning, the BBR offers a reliable snapshot of Bitcoin's price. Manipulating this rate would require substantial resources and effort, making the BBR a formidable shield against market manipulation.

MarketVectorTM Bitcoin Benchmark Rate

09/07/2022-09/7/2023

Source: MarketVector IndexesTM. Data as of July 9, 2023.

MarketVectorTM BBR: Underpinning a Robust Data Set

The quality of data inputs for benchmark reference rates in cryptocurrency is paramount. A meticulous selection of exchanges, careful consideration of liquidity, and reliance on USD pairing are essential to ensure the accuracy and reliability of these rates.

- Exchange Selection

Bitcoin trading spans a multitude of markets and exchanges globally. However, given the variations in trading volumes and practices, not all exchanges can be trusted equally. Selecting the right exchanges becomes critical when trading or developing a pricing index. The chosen exchanges must effectively manage market manipulation, liquidity, pricing, and arbitrage. The BBR relies on the top five exchanges based on the exchange benchmark supplied by industry leader CCData.

- USD Pairing

Designed to resist temporary price swings and outlier prices, BBR exclusively includes trades between BTC and USD. It avoids alternate currency pairs, crypto-to-crypto trading, and transactions involving USDT or other stablecoins in the BTC-USD order book.

Accuracy is Indispensable for Trust – and Efficient Markets

In the rapidly evolving world of crypto, benchmark rates must be as trustworthy as a Swiss watch. Specifically derived from Bitcoin - broadly considered the superstar of cryptocurrencies with its unmatched trading volume - these benchmark reference prices have found a special place in the pricing of financial derivatives. As investors and regulators focus on digital assets like Bitcoin, a robust pricing mechanism is indispensable. Similar to the components of a Swiss watch that work in harmony to ensure accurate timekeeping, robust benchmark rates keep pricing anomalies in check and provide highly accurate price signals in the dynamic crypto market. They are the essential components that uphold the integrity of the crypto market: keeping pricing anomalies in check, and providing highly-accurate price signals, a crucial factor in the dynamic crypto market.

Get the latest news & insights from MarketVector

Get the newsletterRelated:

About the Author:

Martin Leinweber works as a Digital Asset Product Strategist at MarketVector IndexesTM providing thought leadership in an emerging asset class. His role encompasses product development, research, and communication with the client base of MarketVector IndexesTM. Before joining MarketVector IndexesTM, he worked as a portfolio manager for equities, fixed income, and alternative investments for almost two decades. He was responsible for the management of active funds for institutional investors such as insurance companies, pension funds, and sovereign wealth funds at the leading German quantitative asset manager Quoniam. Previously, he held various positions at one of Germany's largest asset managers, MEAG, the asset manager of Munich Re and ERGO. Among other things, he contributed his expertise and international experience to the establishment of a joint venture with the largest Chinese insurance company PICC in Shanghai and Beijing. Martin Leinweber is co-author of “Asset-Allokation mit Kryptoassets. Das Handbuch “(Wiley Finance, 2021). It’s the first handbook about integrating digital assets into traditional portfolios. He has a Master's in Economics from the University of Hohenheim and is a CFA Charter holder.

For informational and advertising purposes only. The views and opinions expressed are those of the authors but not necessarily those of MarketVector Indexes GmbH. Opinions are current as of the publication date and are subject to change with market conditions. Certain statements contained herein may constitute projections, forecasts, and other forward-looking statements, which do not reflect actual results. It is not possible to invest directly in an index. Exposure to an asset class represented by an index is available through investable instruments based on that index. MarketVector Indexes GmbH does not sponsor, endorse, sell, promote, or manage any investment fund or other investment vehicle that is offered by third parties and that seeks to provide an investment return based on the performance of any index. The inclusion of a security within an index is not a recommendation by MarketVector Indexes GmbH to buy, sell, or hold such security, nor is it considered to be investment advice.