In a significant development for the decentralized finance (DeFi) ecosystem, Uniswap has announced the launch of Unichain, a new Layer 2 solution designed to enhance scalability and value distribution. This move allows Uniswap to distribute economic value directly to UNI token holders through staking mechanisms, effectively bypassing the need to activate the contentious fee switch. By doing so, Uniswap sets a precedent for how DeFi protocols can capture and distribute value without compromising the incentives of liquidity providers.

Unichain: A Dedicated Layer 2 Solution for DeFi

Unichain is built on the OP Stack, within the Optimism Superchain, in collaboration with Flashbots. This specialized Layer 2 chain addresses Ethereum's scalability challenges by providing a high-performance environment tailored for DeFi applications. With faster transaction times and reduced fees, Unichain offers an attractive platform for users and developers seeking a more efficient DeFi experience.

By focusing on DeFi-specific optimizations, Unichain positions itself as a premier destination for decentralized exchanges, lending platforms, and other financial protocols. Uniswap intends to leverage its brand and existing user base to create a robust ecosystem that can compete with other Layer 2 solutions, potentially reshaping the DeFi landscape.

Distributing Economic Value Through Staking

One of the most impactful aspects of Unichain is its ability to distribute economic value to UNI token holders through staking. As of October 28, 2024, Uniswap has generated over USD 784 million in fees (Graph 1) this year, according to Token Terminal, further underscoring the economic potential of the platform.

Graph 1: On-chain Fees

Source: Token Terminal. Data as of November 11, 2024.

Traditionally, Uniswap faced pressure to activate its fee switch—a mechanism that would redirect a portion of trading fees from liquidity providers to token holders. However, activating the fee switch presented regulatory challenges. Redirecting fees to token holders raised concerns that the UNI token could be classified as a security, subjecting Uniswap to stringent regulatory scrutiny.

As a result, the UNI token was initially launched as a governance token without direct value accrual mechanisms. By introducing staking on Unichain, Uniswap offers an alternative path for value accrual that avoids these regulatory risks. UNI token holders can stake their tokens to participate in sequencer validation, contributing to the network's security and efficiency. By distributing rewards through staking, Uniswap enhances the utility of the UNI token while preserving the earnings of liquidity providers, maintaining a healthy ecosystem for all participants.

Moreover, UNI could serve as a template for other DeFi protocols looking to distribute economic value to their token holders. Many protocols have faced similar challenges, as being purely governance tokens limited their ability to share value with holders. Unichain’s staking mechanism opens the door for more projects to explore ways of providing direct returns to token holders, a development that could set a new standard across the industry.

Implications for Ethereum: A Double-Edged Sword

While Unichain's launch brings several advantages, it raises questions about its effect on Ethereum as an asset. On one hand, building on a Layer 2 solution alleviates congestion on the Ethereum mainnet, reducing gas fees and improving transaction speeds for users. This enhances the overall user experience and drives more activity within the Ethereum ecosystem.

On the other hand, the migration of significant DeFi activity to Unichain could detract from Ethereum's Layer 1 utilization. As more users and protocols move to Layer 2 solutions like Unichain, demand for block space on Ethereum's mainnet may decrease. Furthermore, the shift of value capture mechanisms away from Ethereum’s Layer 1 could impact ETH as an asset. If protocols increasingly rely on Layer 2 solutions for value accrual, ETH’s role as the primary utility and fee token could diminish, potentially affecting its valuation within the DeFi landscape.

The Importance of Seamless Interoperability Between Layer 2s

A critical factor in ensuring that Ethereum remains a robust and cohesive ecosystem is the seamless interoperability between Layer 2 solutions. As Layer 2 networks like Unichain proliferate, efficient communication and interaction between them become paramount.

Seamless interoperability is key to providing a unified user experience, preserving the composability of DeFi protocols, and maintaining Ethereum’s competitive advantage over other blockchain platforms. When different Layer 2 networks can interact easily, the Ethereum ecosystem feels like a unified whole rather than a fragmented collection of disparate chains.

Efforts to improve interoperability within the Ethereum community are crucial. By enabling seamless interactions between Layer 2s, Ethereum can mitigate the potential negative impacts of Layer 2 proliferation on Layer 1 utilization. Moreover, improved interoperability enables the cumulative benefits of innovations on different Layer 2s to be shared across the ecosystem. This fosters a collaborative environment where advancements on one Layer 2 enhance the functionality and performance of others, driving collective progress and reinforcing Ethereum's position as the leading platform for decentralized applications.

MarketVector Token Terminal Indexes: Focusing on Economic Traction

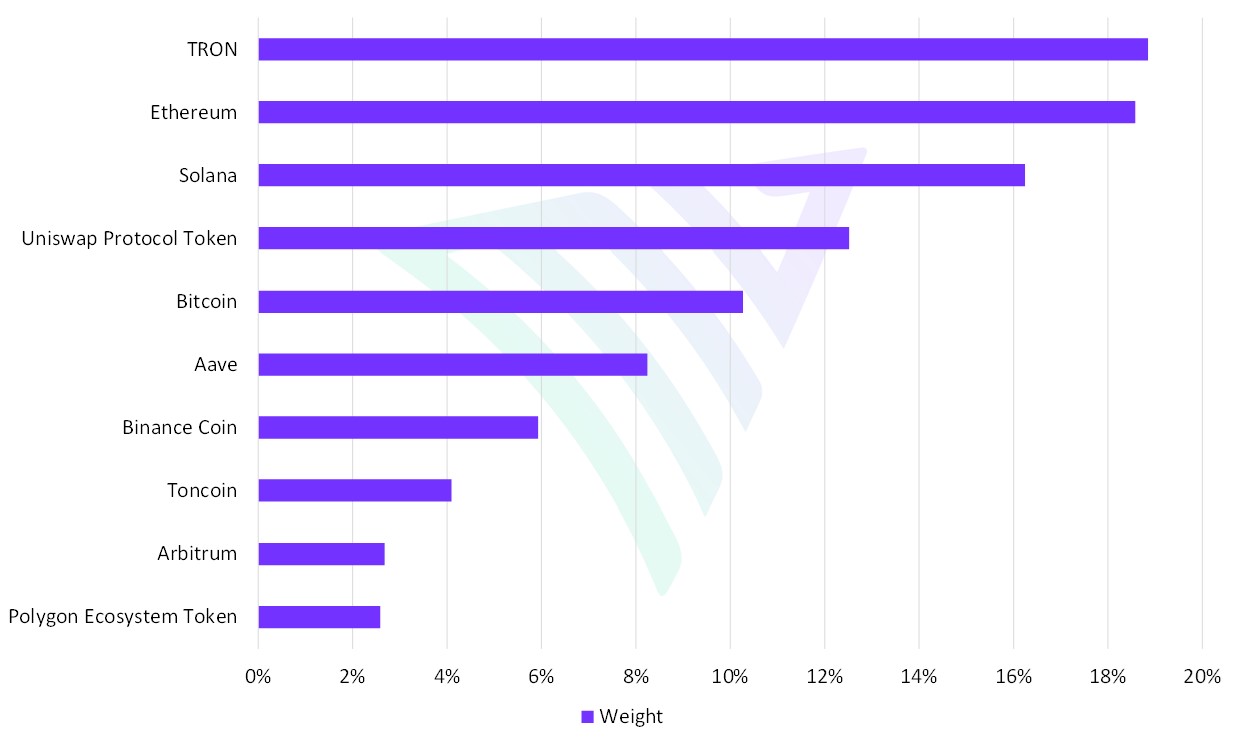

Unichain’s introduction underscores the importance of focusing on coins and tokens that demonstrate genuine value accrual based on fundamental on-chain data such as fees and active users Besides Uniswap, other DeFi, Layer 1, and Layer 2 tokens are the main components of the index. An alternative weighting method based on on-chain fees and active users helps create a significantly different profile than standard top-10 baskets, which often rely on market capitalization alone.

Graph 2: Component Weights: MarketVectorTM Token Terminal Fundamental Index

Source: MarketVector. Data as of November 11, 2024.

Indexes like the MarketVector Token Terminal Index concentrate on assets with real economic traction, distinguishing them from traditional top-ten indexes. Table 1 below shows the superior ratios of this index methodology compared to the Bitcoin Benchmark Rate. Over time, adding the right mix of coins based on strong fundamentals can help increase risk-adjusted returns.

Table 1: Index Ratios

| Total Return | CAGR | Sharpe Ratio | Max Drawdown | Annualized Volatility | |

| MarketVectorTM Bitcoin Benchmark Rate (BBR) | 204% | 33.26% | 0.69 | -76.44% | 63.39% |

| MarketVectorTM Token Terminal Fundamental Index (MVTT10F) | 277% | 40.92% | 0.77 | -78.72% | 74.30% |

Source: MarketVector. Data from December 31, 2020 to November 11, 2024.

By selecting tokens like UNI, which have clear mechanisms for value capture and distribution, investors align with projects that are not only innovative but also sustainable long-term. This approach reflects a growing trend in the crypto investment landscape, where emphasis is shifting toward assets that offer tangible returns and contribute meaningfully to the ecosystem. Unichain's model could be a tailwind for indexes like the MarketVectorTM Token Terminal Fundamental Index, as its selection and weighting criteria focus on assets with strong on-chain fundamentals like fees and active users.

Get the latest news & insights from MarketVector

Get the newsletterRelated: