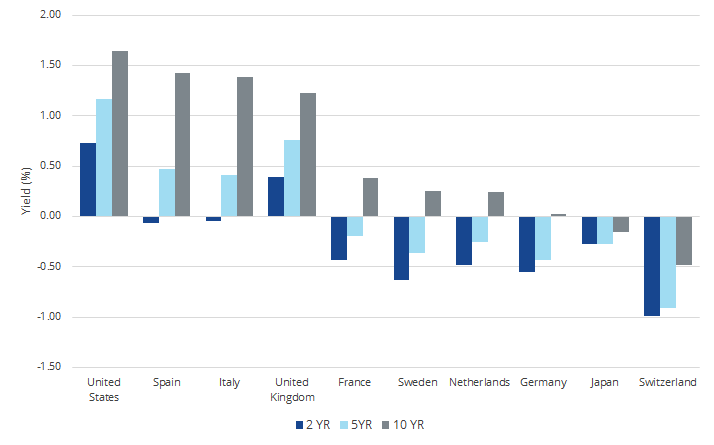

At the end of May this year, negative-yielding fixed-rate government debt breached the USD 10 trillion level, up 5% from USD 9.9 trillion when the figure was calculated on April 25. Of the USD 10.4 trillion total, according to Fitch Ratings, some USD 7.3 trillion was long term and USD 3.1 trillion short term.

With Japan the largest source, some 14 countries had negative-yielding debt. How much negative yielding debt there is outstanding at any one time is a moveable feast (or famine, if you will), depending, of course, on the volatility in sovereign bond markets.

But negative-yielding debt is not confined to sovereigns only, according to Tradeweb, the total for corporate bonds at the beginning of June stood at USD 380 billion.

Many are waiting with a certain trepidation to see if, as Bill Gross at Janus Capital recently said, these government bonds really are a «supernova that will explode one day». Or are bond markets telling us something we do not want to hear?

Government Bond Yields

Source: Bloomberg

Get the latest news & insights from MarketVector

Get the newsletterRelated: