The Price of Gold is not Driven by the Same Supply/Demand Fundamentals as Many Other Commodities.

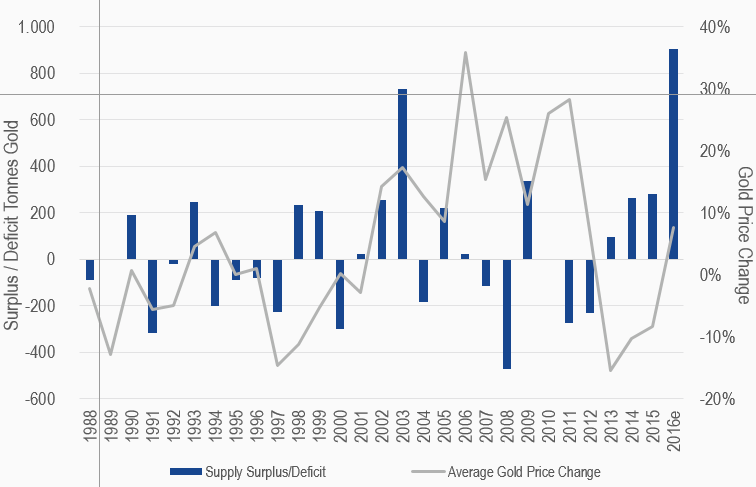

Since 1988 there are many years when the gold price rose when there was a physical surplus. Likewise, there are also years when the price fell and there was a deficit. We believe there are three possible reasons for this:

- The global physical gold market is difficult to measure accurately

- The huge above ground stores of gold

- Investment drivers in the paper gold market can overwhelm the physical market

As 88% of global trading volume occurs in New York and London, we believe the dominant driver of gold prices is Western investment demand. Western investors and others use gold to monetize their views on currencies, interest rates, geopolitical risk, systemic financial risk, central bank policies, inflation, deflation, and tail risk.

Gold Supply versus Price Change

1988-2016

Source: Thomson Reuters GFMS; Bloomberg; Vaneck. Data as of December 31,2016.

Not intended to be a forecast of future events, a guarantee of future results or investment advice.

Current market conditions may not continue.

Get the latest news & insights from MarketVector

Get the newsletterRelated: