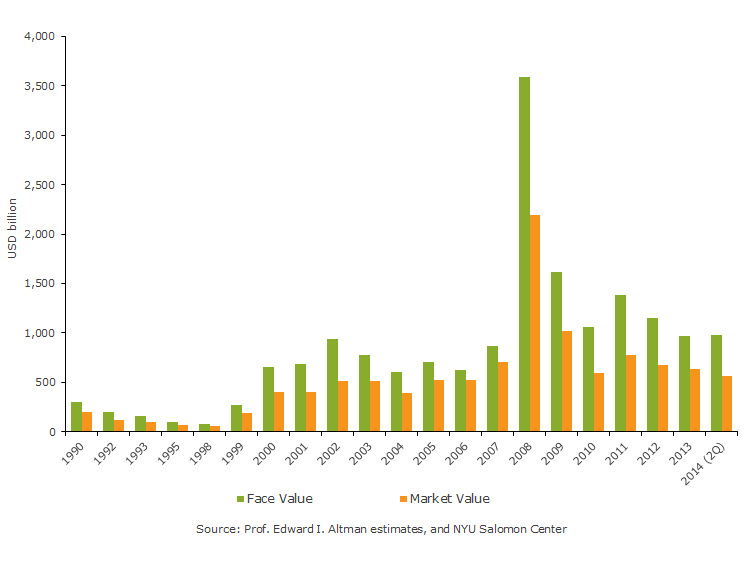

While most investors are familiar with stocks and bonds, a niche category of professional investors, currently more than 250 companies, concentrates on the securities of struggling companies. Distressed and Defaulted bonds, bank loans and other debt has grown from USD 300 billion face value in 1990 to a high of USD 3.6 trillion at the height of the great financial crisis, with a current face value of about USD 950 billion (USD 560 billion market value).

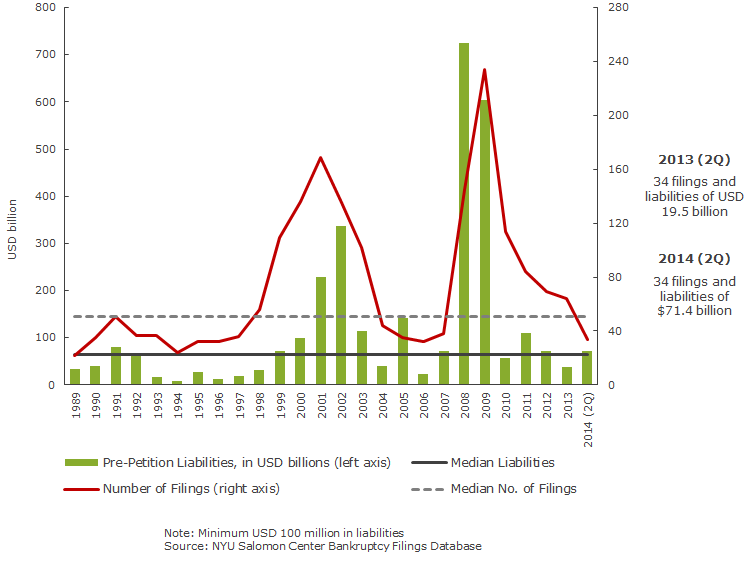

Distressed bonds have a yield at least 1,000bp (10%) above the government rate, currently at least 12.5% (10-year maturities). Defaulted bonds and loans have ceased paying interest, in many cases in connection with a bankruptcy filing. In the first-half 2014, 33 companies with more than USD 100 million in liabilities filed for Chapter 11, with total liabilities of USD 71.0 billion. We are still currently in a benign credit cycle, but I expect these statistics to spike significantly in the next stressed cycle, perhaps in 2015-2017.

Size of U.S. Defaulted and Distressed Debt Market, 1990-2014 (USD bn)

Bankruptcy Filings and Liabilities, 1989-2014

Get the latest news & insights from MarketVector

Get the newsletterRelated: