Yesterday's FOMC decision increased volatility, significantly altering market dynamics and materially changing the sentiment. Adjustments in rate expectations have introduced heightened uncertainty, impacting key crypto levels. With the crypto landscape changing at breakneck speed, investors and enthusiasts alike are asking the big question: Where is the market headed next? Though no one can predict the future with absolute certainty, understanding recurring patterns—especially those tied to U.S. election cycles—offers valuable clues.

The Power of Post-Election Cycles

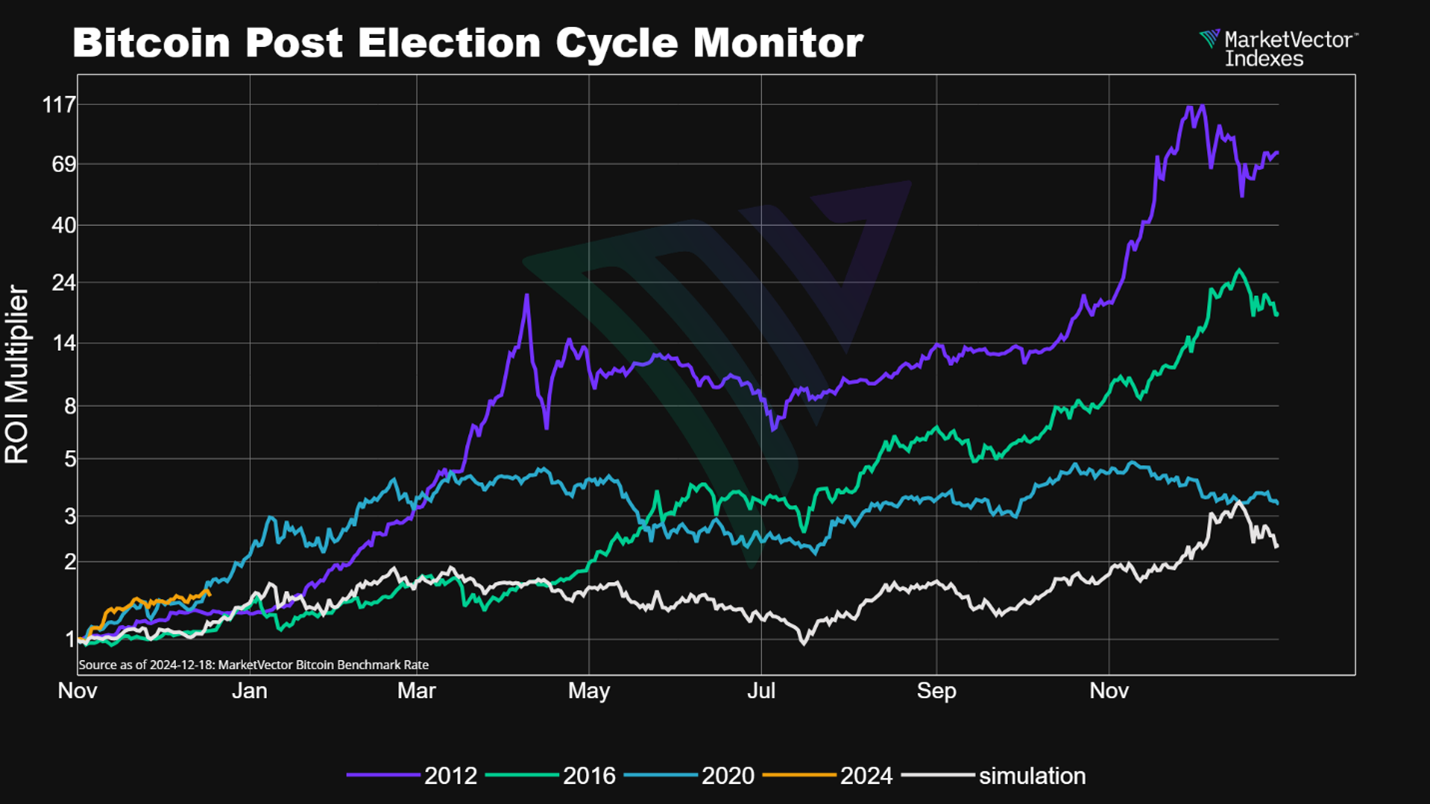

Our Crypto Cycle Monitor takes a unique approach by anchoring its analysis around U.S. election timelines. Starting from the November elections in 2012, 2016, 2020, and now 2024, we’ve studied the crypto market’s return on investment (ROI) through the end of the following year. This post-election framework highlights how investor sentiment, policy shifts, and regulatory uncertainty can shape market performance over these pivotal periods.

Our 2025 Simulation

Drawing on patterns observed in prior election cycles, we construct a projected path that harmonizes historical performance data with an updated outlook for the upcoming cycle. By beginning with a baseline of mean returns from previous periods, we integrate a carefully calibrated scaling factor that accounts for the decay from cycle to cycle—reflecting the law of diminishing returns—and then adjust daily return paths. We applied this methodology to the MarketVectorTM Bitcoin Benchmark Rate, the MarketVectorTM Ethereum Benchmark Rate, and to the MarketVectorTM Digital Assets 100 Small-Cap Index (representing the performance of the 50 smallest digital assets in the top 100), ensuring that each projection preserves the characteristic shapes and rhythms of the past while capturing evolving market conditions. The result is a nuanced perspective on how these indexes might perform moving forward.

Recent Trends & Familiar Patterns

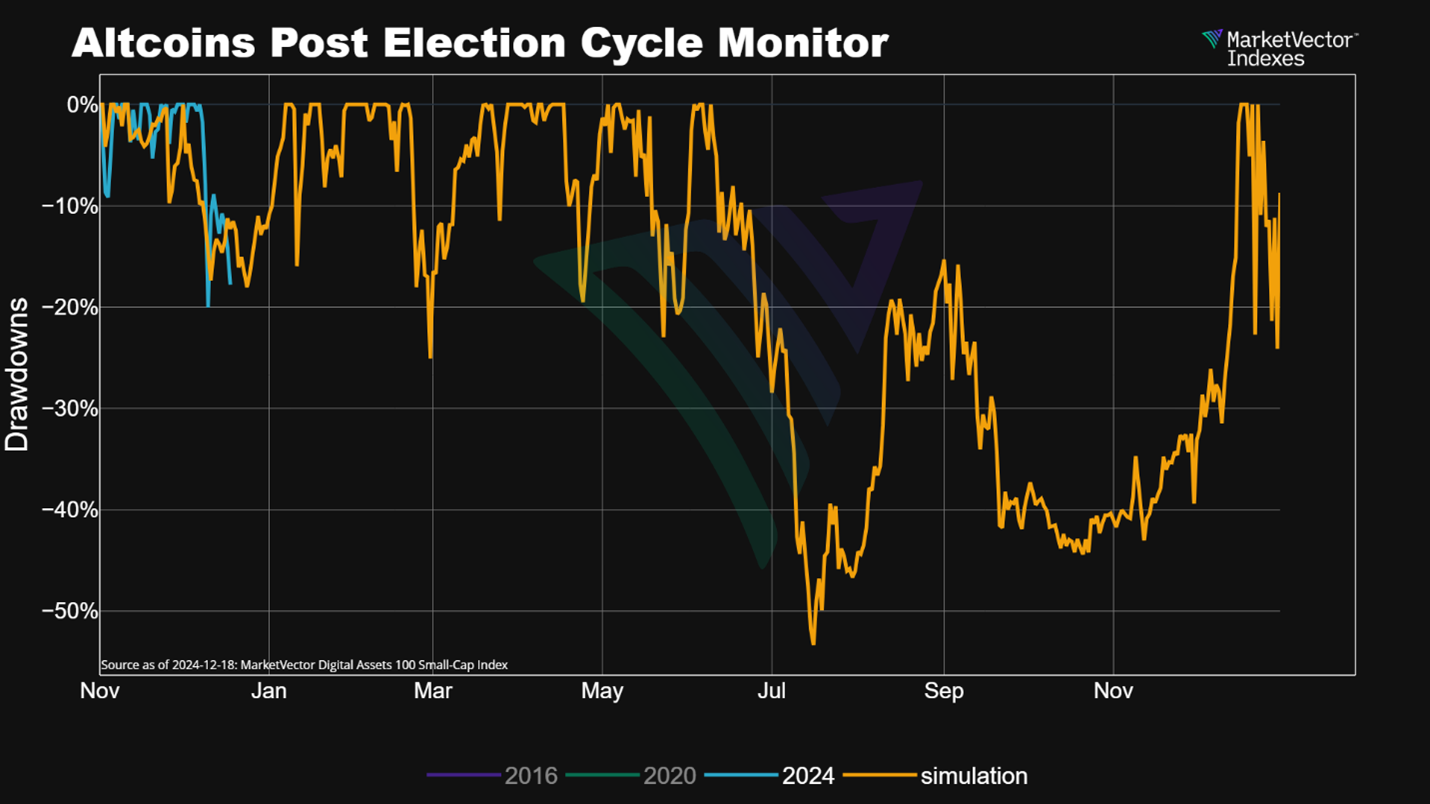

- Altcoin Pullbacks: December’s 20% decline in altcoins is entirely in line with historical patterns, reflecting a normal level of volatility in the early part of the post-election year. This current cycle aligns closely with the double-dip pattern observed in our simulation, demonstrating that what we are witnessing is not unusual, even if market participants attempt to convince you otherwise. Historically, such drawdowns tend to occur until June, setting the stage for even larger declines—often exceeding 50%—during the subsequent summer months.

Source: MarketVector. Data as of December 18, 2024.

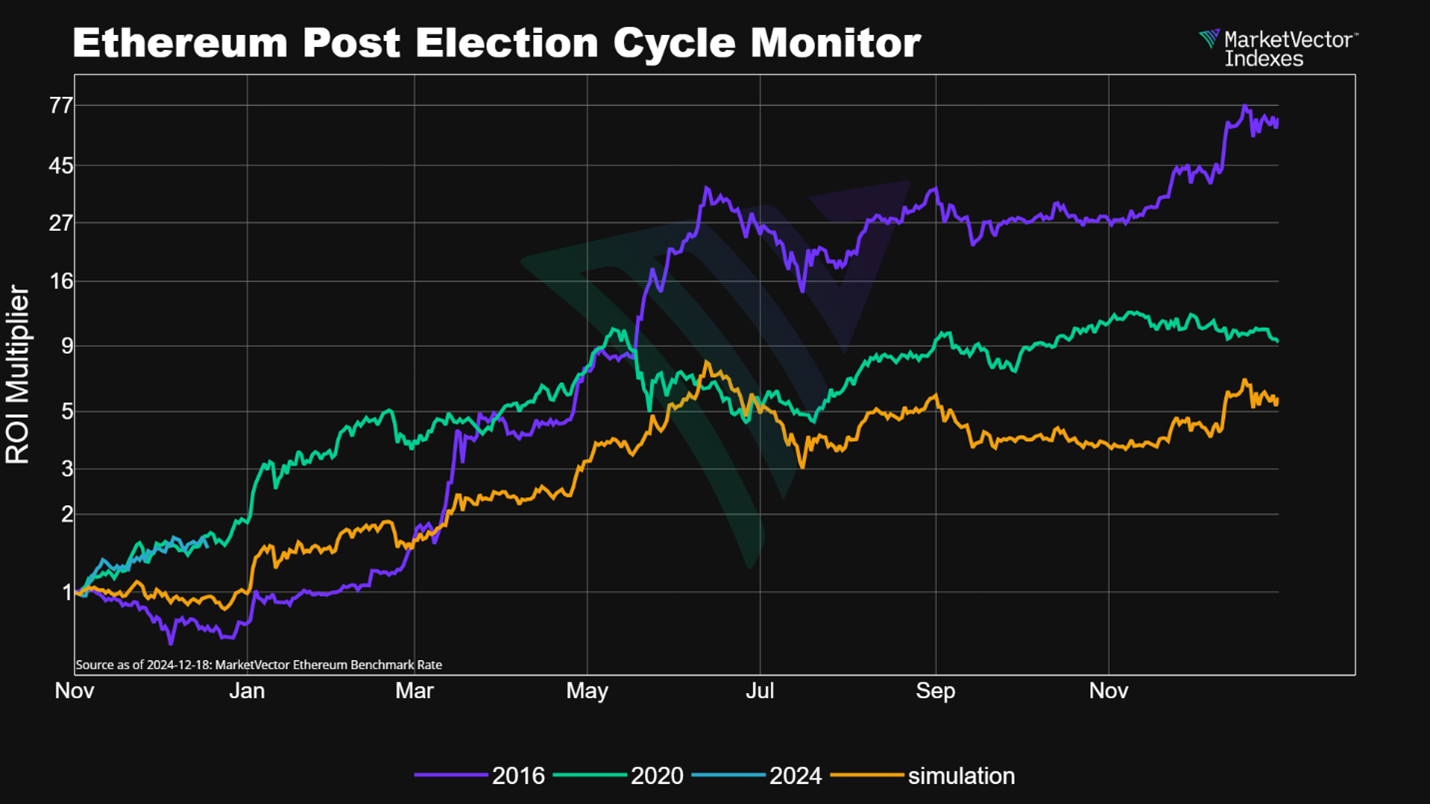

- Ethereum’s Echo: Ethereum’s trajectory remains remarkably similar to its 2020 profile, suggesting that fundamental drivers and market sentiment continue to rhyme with the past.

Source: MarketVector. Data as of December 18, 2024.

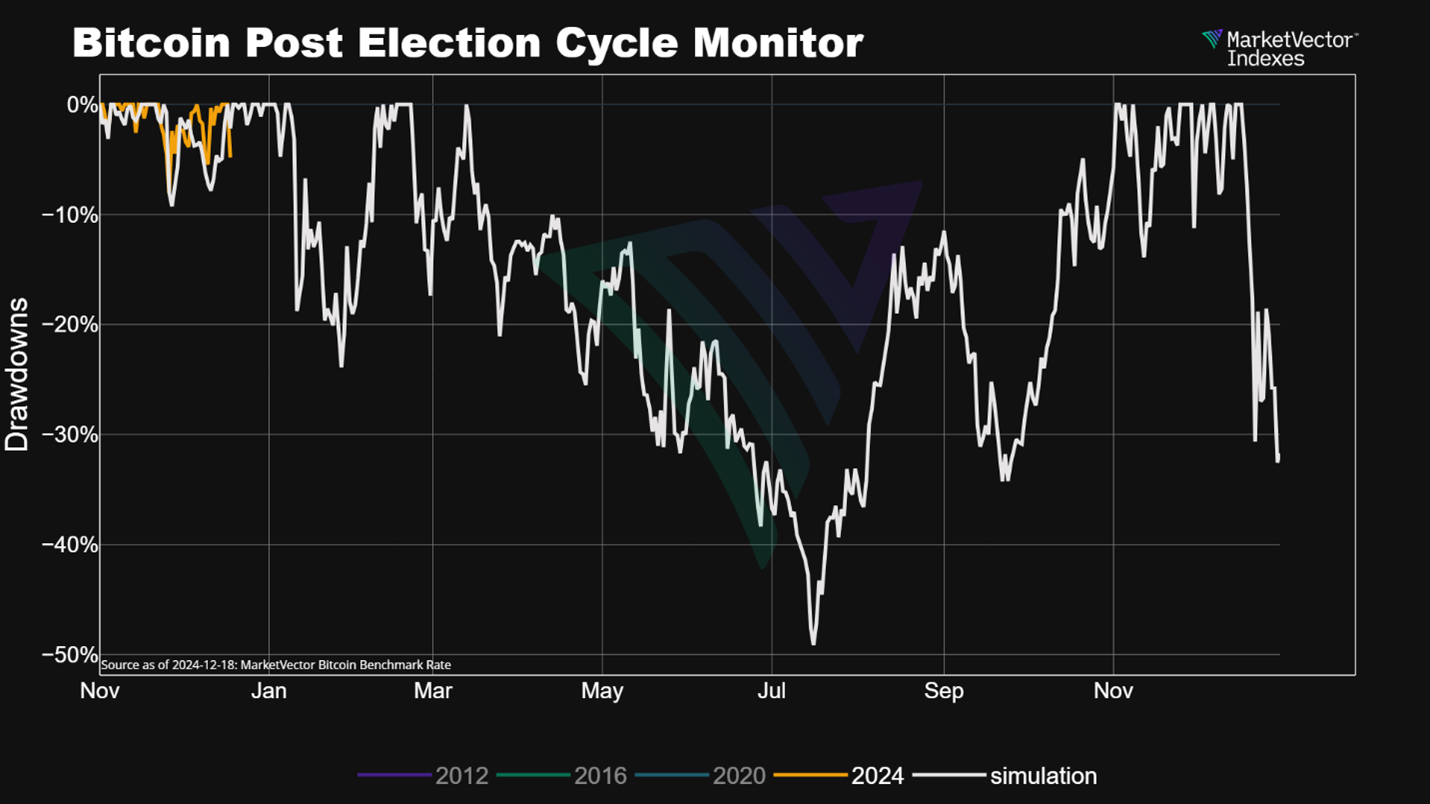

- Bitcoin’s Resilience: The FOMC decision yesterday increased volatility, resulting in a 5% dip—still below the 10% correction typically expected during this phase of the cycle. Even a routine 10% to 20% pullback in Bitcoin aligns with historical norms from previous post-election cycles. As shown below, the drawdowns so far have been milder than what past cycles suggest is standard.

Source: MarketVector. Data as of December 18, 2024.

While short-term volatility has often paved the way for longer-term gains, the current cycle appears to be “left-translated,” as Bitcoin’s price currently sits well above the projected trajectory. A contributing factor may be the recent rumor that former President Trump is considering an executive order to establish a strategic Bitcoin reserve in the U.S.—a development that would likely alter the market’s course and introduce new uncertainty about where the price could ultimately settle.

Source: MarketVector. Data as of December 18, 2024.

Summer months have traditionally tested investors’ resolve, with prolonged drawdowns that can halve portfolio values before a late Q3/Q4 rally sets the stage for the next upswing.

Where Could We Be Headed?

The question on everyone’s mind: Will a new U.S. administration or changing regulatory frameworks rewrite crypto’s playbook? While we can’t say for sure, historical patterns suggest certain seasonal and cyclical forces remain robust. The long-term outlook is based on our projection line, considering the past cycles and factoring in diminishing returns.

If these cycles continue to hold sway, and if the scaling factor calibrates expectations properly, we might see by the end of 2025:

- Bitcoin approaching USD 163,000

- Ethereum eyeing the USD 12,000 to USD 14,000 range

- Altcoins collectively rising around 5.5x from current levels

Important Note: These are extrapolations, not guarantees. Always conduct your own research and carefully weigh your risk tolerance before making decisions. Crypto remains a high-volatility landscape, and no historical pattern can promise future results.

Expect Huge Drawdowns along the way

As the table shows, the first half of the post-election year often experiences drawdowns of around 20%. These periods of decline are typically precursors to the next upward movement. Notably, all indexes here, share a pattern of larger, more prolonged drawdowns during the summer months—setting the stage for their final push upward. In fact, drawdowns of 50% or more are not unusual, even for Bitcoin. During this phase, Bitcoin, Ethereum and our Altcoin Index tend to follow a similar drawdown pattern, which is both consistent and intriguing.

| First Half Of 2025 | 2025 | |||||||

| Max Drawdown | Annualized Volatility | Longest DD Period | Average DD Period | Max Drawdown | Annualized Volatility | Longest DD Period | Average DD Period | |

| Altcoins | -25.07% | 76.14% | 36 | 8 | -53.36% | 99.86% | 190 | 15 |

| Bitcoin | -23.93% | 68.30% | 36 | 8 | -51.74% | 77.84% | 256 | 19 |

| Ethereum | -24.06% | 96.32% | 40 | 7 | -61.07% | 104.04% | 202 | 13 |

Source: MarketVector.

Bitcoin Dominance & Maturing Market Dynamics

The shifting balance of Bitcoin dominance versus altcoins tells its own story. Endless token creation no longer ensures each new coin finds a significant audience. The market has grown more discerning, allowing Bitcoin to retain a gravitational pull that was less certain in earlier cycles. While alt “seasons” will likely continue, their magnitude and timing could be more nuanced.

In Summary

- Expect More Volatility: In the last phase of the bull market, expect more volatility. Historical data repeatedly shows that mid-year slumps can be painful—but often precede renewed strength toward year-end.

- Rely on Patterns, Not Certainties: By considering market action post-U.S. elections and applying a scaling factor for diminishing returns, we gain a clearer, if still imperfect, view of what might lie ahead.

- Looking to 2025 and Beyond: The long-term outlook, built on our projection line and informed by past cycles, suggests significant potential gains—albeit less dramatic than in crypto’s early days.

The future remains a story yet to be written. But by looking through the lens of past cycles, we gain insights that can guide our perspective. If history’s cadence continues to play out, we may be on the cusp of another transformative chapter in the crypto narrative, set against a familiar but evolving backdrop of cyclical ebbs and flows.

Get the latest news & insights from MarketVector

Get the newsletterRelated: