Brazil’s economy stands at a crossroads in 2025, balancing between the headwinds of inflation, high interest rates, and serious fiscal concerns, and the tailwinds of a strengthening equity market and a stabilizing currency. While South America’s largest country ended 2024 with one of the worst performances across global markets, early signs of a turnaround are emerging, particularly in key equity segments such as small-cap and domestic-exposed stocks.

Macroeconomic Challenges: Inflation and Fiscal Pressures

Inflation remains a significant concern, with forecasts indicating a rise in consumer prices. The government is projecting an inflation rate of 4.8% for 2025, while market analysts expect it to be higher, around 5.58%, marking the 18th consecutive week of increase [Folha de S. Paulo – Feb 15, 2025 ].

In response, the Central Bank of Brazil has implemented monetary tightening measures, raising the benchmark interest rate to 13.25% in January 2025 and strongly hinted at another hike of that size in March. These elevated interest rates increase borrowing costs, potentially dampening investment and consumer spending. High public debt further complicates the economic environment.

With gross public debt around 96% of GDP [Valor Economico – Feb 13, 2025], Brazil faces challenges in managing its finances effectively. The high debt level increases the burden of interest payments, which can strain the budget and limit fiscal flexibility. This fiscal rigidity complicates efforts to achieve a primary surplus, which is essential for stabilizing debt to GDP ratio.

Tax Reform and Fiscal Adjustments

As of February 2025, Brazil is advancing with its tax reform, aiming to simplify the tax system and promote economic growth. The reform introduces significant changes, including the unification of several taxes into a dual Value Added Tax (VAT) system. These changes are designed to eliminate tax cascading and reduce the overall tax burden.

In January 2025, the first part of the reform was approved, and the second part is expected to be voted on later this year. The implementation of the new tax system is scheduled to begin in 2026. While the reform is expected to enhance efficiency and stimulate investment, it also presents challenges, including potential revenue shortfalls and the need for careful implementation to maintain fiscal stability.

Ensuring fiscal neutrality will be crucial to prevent unintended economic distortions while fostering a more competitive business environment.

Shifting Political Landscape: Positive Dynamics for Domestic Stocks

Political uncertainty is adding another layer of complexity to Brazil’s economic landscape. President Luiz Inácio Lula da Silva’s approval ratings have dropped to 24% from 35% in December, while disapproval has risen to 41%, according to Datafolha [Datafolha Institute de Pesquitas – January 22, 2025]. High food prices have been a major factor in this decline, eroding public confidence. Additionally, concerns over Lula’s health have raised doubts about his ability to seek a fourth term, even among allies.

At the same time, São Paulo Governor Tarcísio de Freitas, a former infrastructure minister under Jair Bolsonaro, is gaining traction as a pro-market candidate. The State of São Paulo, which accounts for 31% of Brazil’s GDP [The Rio Times – November 29, 2024 ], has seen strong economic performance under his leadership, earning him support from financial markets.

As the 2026 elections approach, his rising prominence could influence investor sentiment, particularly if he is seen as a stabilizing force for economic policy and fiscal reforms.

Market Turnaround: Small-Caps and Domestic Stocks Lead Recovery

For the first time in almost two years, the Brazilian Real has halted its steady depreciation versus the US Dollar, and since the start of 2025 it has strengthened more than 7% – from approximately BRL 6.30/USD 1 to BRL 5.75/USD 1 this week. The stabilization and appreciation of the Brazilian real enhances the attractiveness of local assets, potentially boosting foreign investment.

Despite a challenging 2024 where Brazilian equities underperformed sharply against both developed and key emerging markets, the prospects for 2025 look promising. With inflation slowing and with it an end to interest rate increases as early as next month, we believe it is not premature to consider some “green shoots” of optimism in the Brazilian equity market.

Sectors such as consumer durables, electronic technology, and consumer services have demonstrated growth; sectors like education and healthcare are highlighted for their growth potential due to economic leverage and organic growth; and sectors like finance, particularly banks connected to agriculture, are also benefiting from favorable interest rates and dividend yields.

All of these elements point to robust domestic demand.

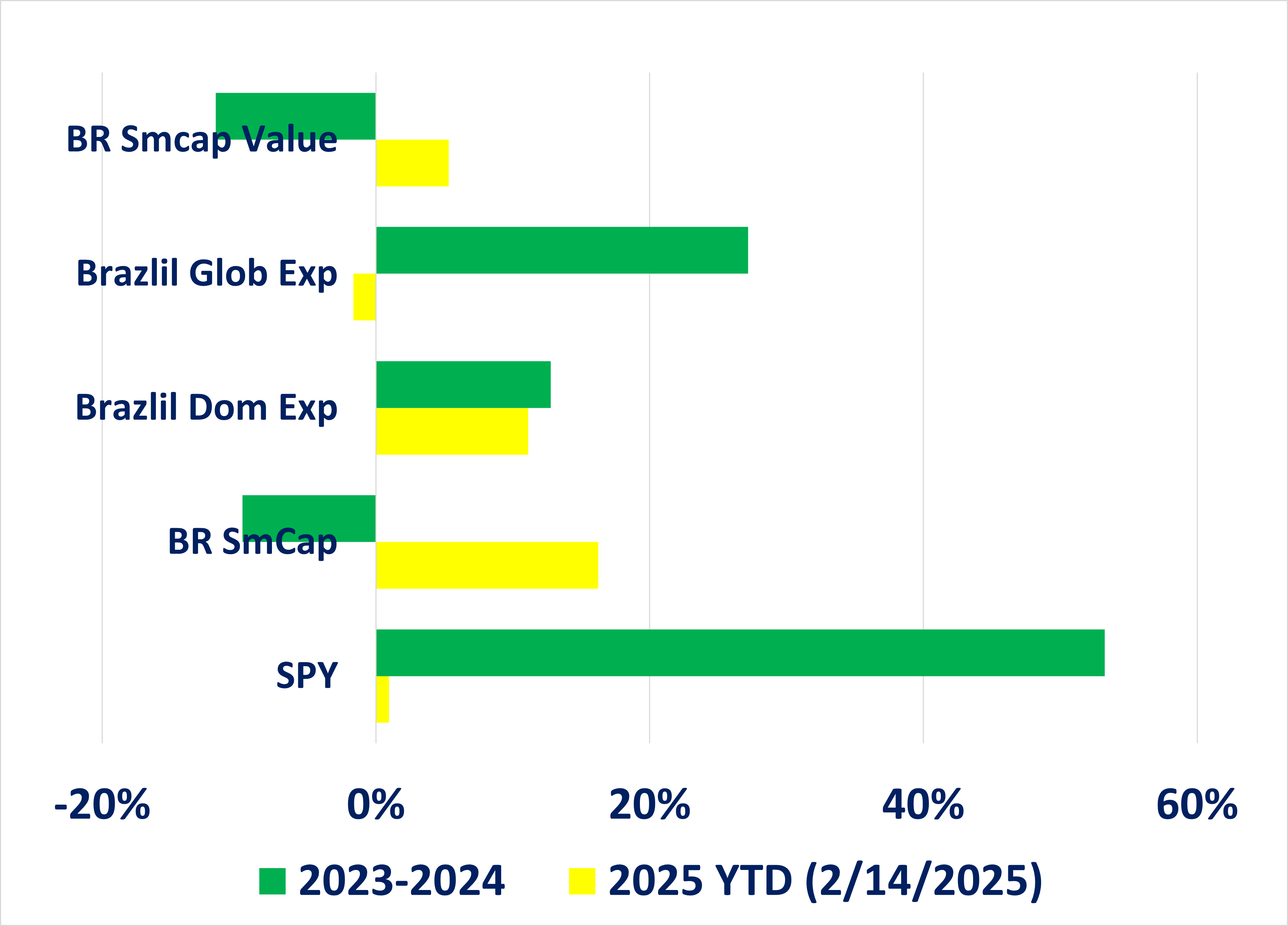

MarketVector’s Brazil indexes highlight how different segments are responding to changing economic conditions:

- MVIS® Brazil Small-Cap Index (MVBRF): Leading the recovery, this index has posted a 17% YTD gain, driven by renewed investor interest in domestic-focused and growth-oriented stocks. After steep losses in 2024, small-cap stocks are rebounding on expectations of peaking interest rates and an improving consumer outlook.

- MarketVectorTM Brazil Domestic Exposure (BRL) Index (MVBRDE): Up 12% YTD, this index reflects improving sentiment toward companies with significant local revenue exposure. The resilience of Brazil’s labor market and social transfer programs have bolstered consumer demand.

- MarketVectorTM Brazil Global Exposure (BRL) Index (MVBRGE): While outperforming small-cap and domestic indexes in 2024, this index posted a -2% YTD loss driven by uncertainty around commodity prices and a global trade fragility.

Exhibit: Brazil Performance

Source: MarketVector. Data as of February 14, 2025.

Looking Ahead: Balancing Risks and Opportunities

While major challenges such as bringing inflation under control and fiscal stability remain, one can make a case for cautious optimism regarding Brazil's economic trajectory in 2025. The government's proactive measures, combined with a resilient equity market and a strengthening currency, suggest potential for economic stabilization and growth.

Small-cap and domestic-focused indexes are leading the charge, presenting an opportunity for investors seeking exposure to one of the most undervalued markets in the world.

Investors and policymakers will need to navigate this complex environment carefully, balancing short-term challenges with long-term opportunities.

For more information on MarketVector Indexes, visit: www.marketvector.com.

Get the latest news & insights from MarketVector

Get the newsletterRelated: