Located in the heart of Central Europe, Slovakia is a member of both the European Union and the Eurozone, with a population of approximately 5.5 million. It became an independent nation in 1993 following the peaceful dissolution of Czechoslovakia and is frequently praised for its rapid economic progress.

However, one institution stands out for its persistent underperformance: the Bratislava Stock Exchange (BSSE). Despite serving as the country’s official securities marketplace, the BSSE remains largely dormant, with minimal trading activity and a virtually nonexistent presence in global investment circles.

The Bratislava Stock Exchange (BSSE)

Established in 1991 as part of Slovakia’s transition to a market economy, the BSSE was initially energized by a mass privatization program similar to those in other post-communist countries. This led to the listing of numerous former state-owned enterprises. However, by the early 2000s, most of these companies — such as Slovnaft, SkyEurope Airlines, and Slovenská sporiteľňa — had been delisted, acquired, or ceased to exist altogether.

Today, the BSSE functions more as a regulatory formality than an active financial marketplace. IPOs are virtually nonexistent, and trading volumes are extremely low, dominated by bond transactions rather than equity trades. There is no evident pipeline of upcoming public offerings. Several structural challenges contribute to this stagnation: Slovakia has a limited institutional investor base, with few large domestic pension funds or asset managers actively allocating to local equities (The Slovak Spectator, 2025) (Brziaková, 2025).

Additionally, regulatory inefficiencies may discourage companies from listing (US Department of State, 2023). The market also lacks meaningful tax incentives or government-backed capital market development programs that could stimulate new activity, the focus is on manufacturing and job creation (Investment incentives, 2025). With limited participation from domestic investors and a weak equity culture, the exchange has largely disappeared from public awareness. In practice, most Slovak companies — particularly family-owned businesses and former privatized entities — have opted to remain private or to operate as subsidiaries of foreign corporations.

Slovakia in the MarketVectorTM Total Global Equity Index (MVTGLE)

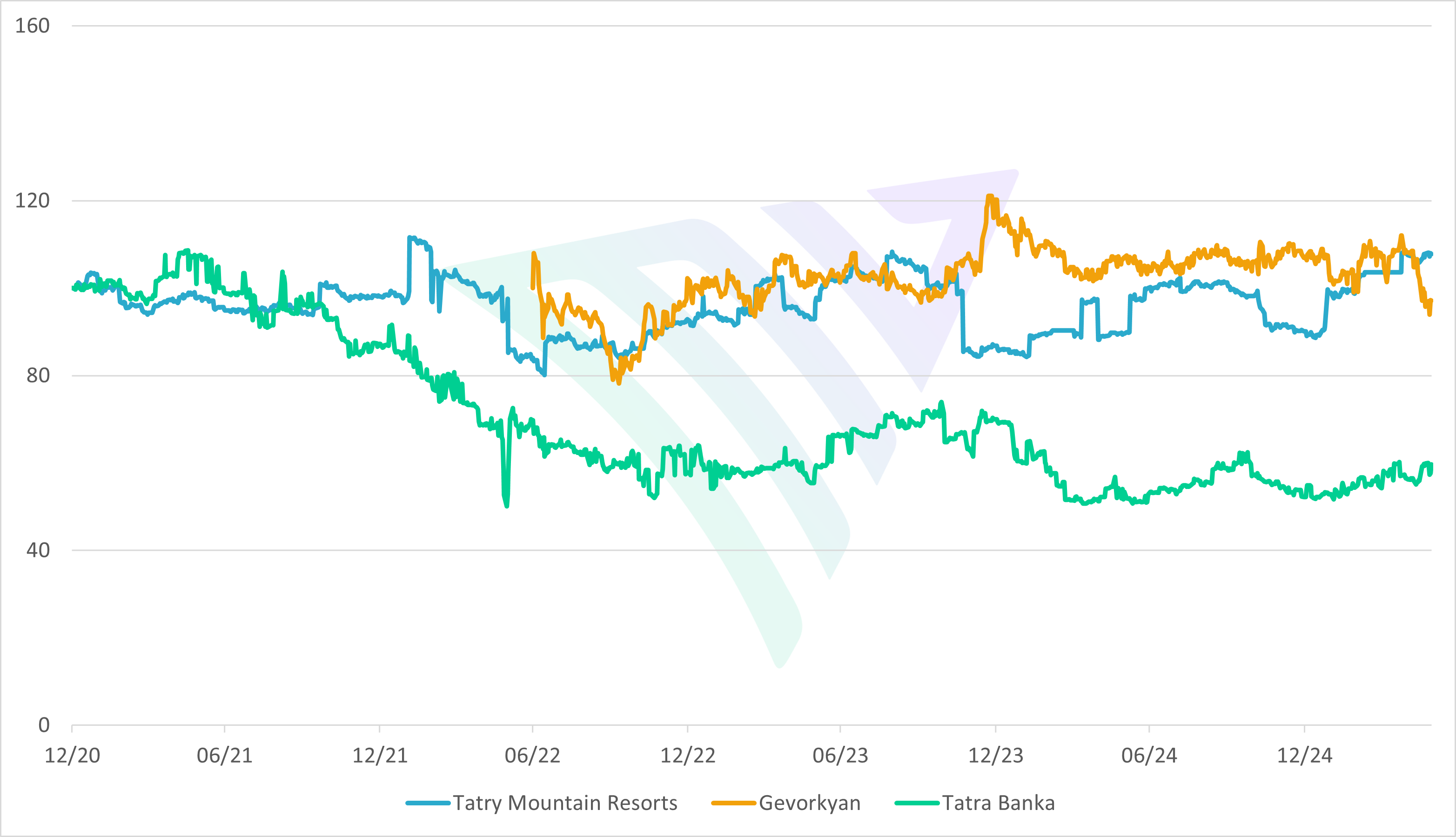

The MarketVector™ Total Global Equity Index (MVTGLE) currently includes three Slovak-related stocks:

- Tatra banka, a.s. (Ticker: TAT) – A leading Slovak bank

- Tatry Mountain Resorts, a.s. (TMR) – A key operator of mountain resorts and leisure facilities

These two companies are among the most liquid on the Bratislava exchange; yet, they trade on average less than USD 5,000 per day, making Slovakia's stock market the least liquid among EU member states when it comes to its "blue chips."

- Gevorkyan, a.s. (GEV) – A manufacturer in powder metallurgy, included in the index via its Czech listing in Prague, which offers far superior liquidity compared to any listing on the BSSE.

Source: Bratislava Stock Exchange, Prague Stock Exchange

Get the latest news & insights from MarketVector

Get the newsletterRelated: