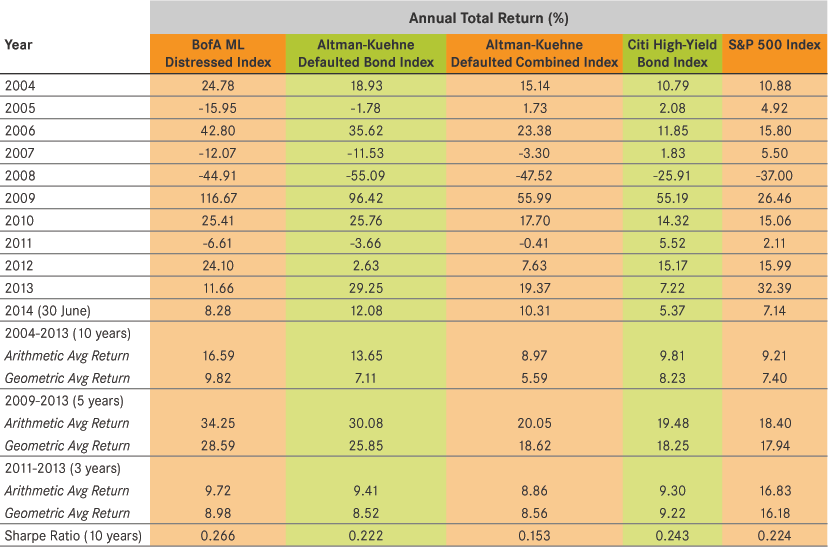

Portfolios of Distressed Corporate Bonds (with yields greater than 10% above U.S. Treasuries) and Defaulted Bonds (bonds trading after default) clearly outperformed S&P 500 stocks and high-yield (HY) bonds over the 10-year period 2004-2013, as well as for the last five and three year periods. The Bank of America Distressed Bond Index had an average annual return of 16.6% (9.82% geometric mean); the Altman-Kuehne Defaulted Bond Index returned 13.7% per year over the same 10-year period. This compares favorably with the 10-year S&P average annual return of 9.2% and the Citi HY Index average of 9.8%. Sharpe ratios (returns adjusted for volatility) also show superior 10-year performances.

In 2014 (through June 30), Distressed and Defaulted Bond portfolios have continued to outperform common stocks and HY bonds.

Comparison of Returns for Distressed and Defaulted Corporate Bonds

vs. S&P 500 Common Stocks and High-Yield Bonds

Past performance is not indicative of future performance.

Sources: BofAML, Citi, Standard & Poor's, NYU Salomon Center

Get the latest news & insights from MarketVector

Get the newsletterRelated: