Iran, often overshadowed by geopolitical complexities and economic sanctions, presents significant latent potential for investors. Despite the country being shaped by geopolitical challenges and economic sanctions, it possesses considerable hidden potential for investors, contingent upon the resolution of current sanctions. With its diverse economy, abundant natural resources, and strategic geographic location, Iran offers a range of opportunities for growth and diversification, should the regulatory landscape evolve.

While oil and gas remain central to the economy, Iran is gaining recognition as an emerging market with growth in key sectors. The companies featured in this report span energy, finance, steel, and automotive manufacturing, offering insight into the country's expanding industrial capacity.

Economic Outlook for Iran

According to the World Bank (1), Iran’s economy is expected to grow in the coming years, though at a slower pace compared to other regional economies. The country's ongoing diversification efforts, particularly in manufacturing, steel, automotive, and banking, indicate gradual growth despite the impact of sanctions.

- GDP Growth: Iran's projections for 2025 indicate a GDP growth rate of 2% to 2.8%, driven by a recovery in non-oil sectors and domestic consumption (1).

- Exports: While oil exports remain a major contributor, Iran's non-oil exports are rising, particularly in the steel and automotive sectors. The country is expanding its export markets in the Middle East and Central Asia, aiming to strengthen trade relationships with neighboring countries.

- Diversification Efforts: Iran is working to diversify its economy, focusing on technology, renewable energy, and agriculture, which present long-term growth opportunities for foreign investors.

- Inflation and Fiscal Stability: Although inflation remains a concern, the World Bank (2) projects that inflation rates will stabilize in 2025/ 26, while inflation decelerated in 2023/24.

Insights from the International Monetary Fund (IMF)

The following key data from the International Monetary Fund (IMF) provides a comprehensive overview of Iran's economic performance and outlook, shedding light on its growth prospects, diversification efforts, and ongoing challenges in recent years:

- GDP Growth Forecast: The IMF (3) projects Iran's GDP to grow by 3.1% in 2025.

- Economic Diversification: Non-oil exports account for just 11% of Iran's GDP, below the average of 24.2% in upper-middle-income countries (4).

- Trade Relationships: 37% of Iran’s non-oil exports go to China, reflecting a concentrated trade partnership (4).

- Energy Subsidies: In 2022, Iran’s energy subsidies amounted to $163 billion, representing 27% of its GDP (5).

- Financial Sector Sanctions: Despite partial sanctions relief, Iran’s financial system faces significant restrictions, limiting its global banking relations.

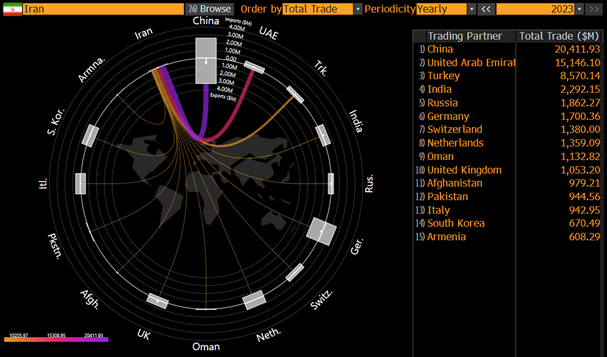

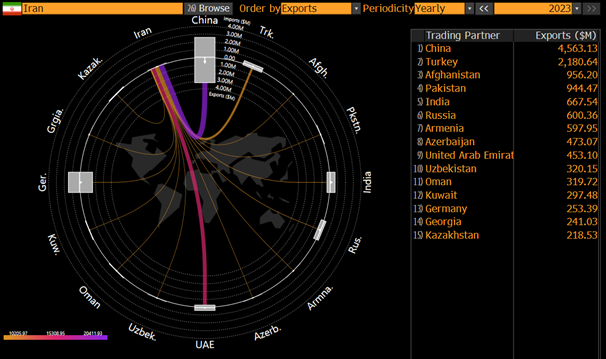

Total Trade and Exports

To further illustrate Iran’s economic positioning, the following figures detail its trade relationships and export performance.

Exhibit 1 highlights Iran’s top trading partners in 2023, with China as the largest partner, accounting for $20.4 billion in total trade. The UAE, Turkey, and India also feature prominently.

Exhibit 1: Iran Total Trade, 2023. Source Bloomberg (6).

The Exhibit 2 exports figure shows that China remains the largest recipient of Iranian exports at $4.5 billion, followed by Turkey and Afghanistan.

Exhibit 2: Iran Export, 2023. Source Bloomberg (6).

Iranian Companies in the MarketVector™ Total Global Equity Index (MVTGLE)

As of the Q1 2025 Review, the MVTGLE Index gains exposure to the Iranian market through the following companies:

- Iran National Copper Industries Co.

As one of Iran’s largest copper producers, this company plays a critical role in the global copper supply chain, benefiting from rising demand driven by green energy and infrastructure projects. - Esfahan Mobarakeh Steel Co.

The largest steel manufacturer in the Middle East supplies steel to industries such as construction, automotive, and machinery. With strong positioning, it is set for growth as demand for construction materials and infrastructure projects increases. - Esfahan Oil Refining Co.

A key player in Iran's energy sector, the company ensures domestic energy security, contributing to the country’s long-term energy goals despite ongoing sanctions. - Mellat Bank of Iran

One of Iran’s leading financial institutions offering retail, corporate, and investment banking services. It continues to thrive despite sanctions, supported by a growing middle class and expanding businesses. - Iran Khodro Industrial Group

The largest automobile manufacturer in Iran focuses on affordable vehicles for the domestic market and regional exports. The company is also exploring opportunities in electric vehicle development. - Social Security Investment Company of Iran

Operating in Iran’s pension and social security sector, it plays a vital role in supporting the country’s social security reforms.

The composition of Iranian companies within the MVTGLE Index reflects the sector diversification of the country's listed companies.

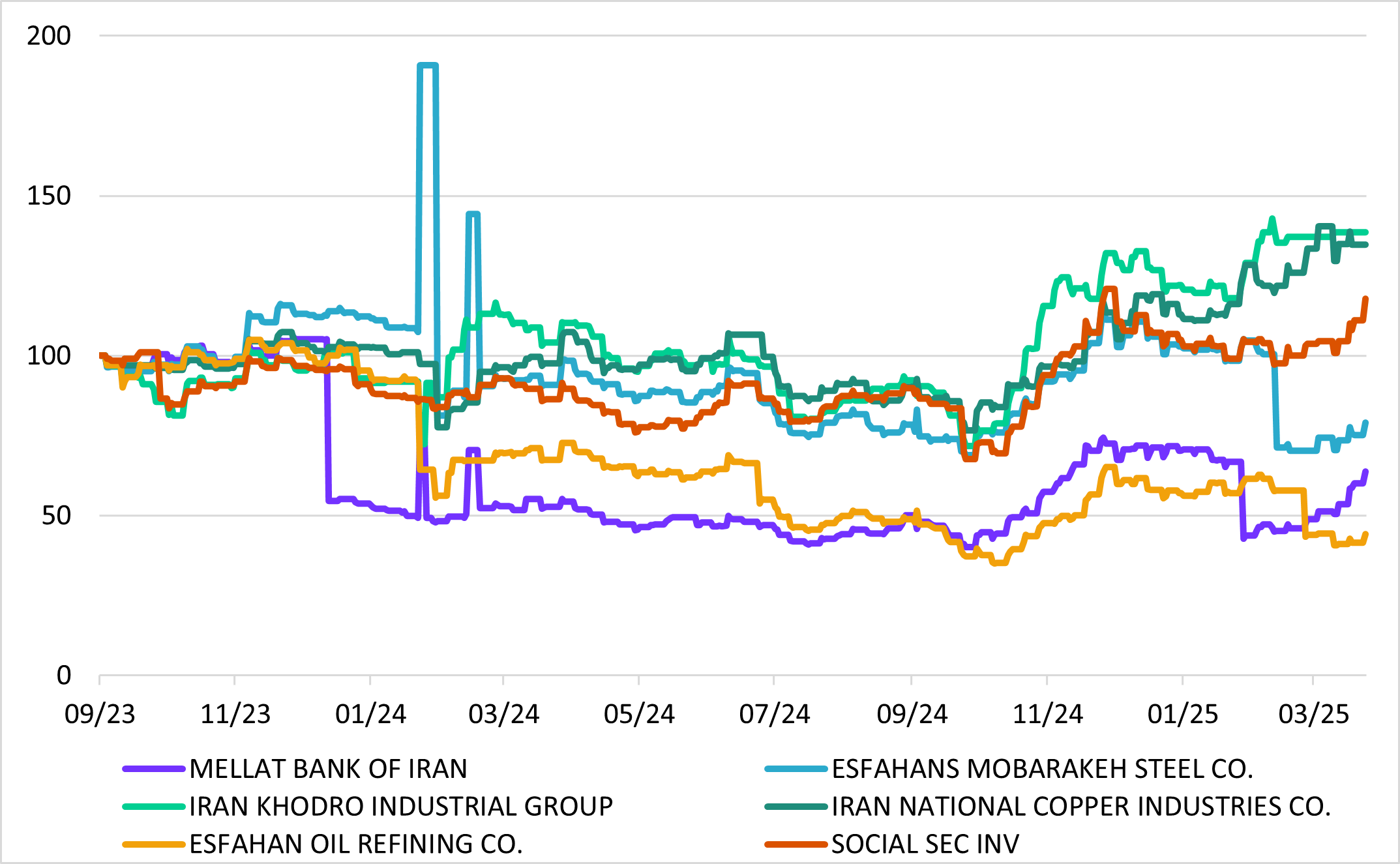

Performance of Iranian Companies in the MVTGLE Index (Review Q1 2025)

The charts below track the performance of Iranian companies in the MVTGLE Index (as of the Q1 2025 review). The data highlights significant momentum starting from June 2024.

Closing Price (USD) rebased to 100 of performance of Iranian Companies in the MVTGLE Index (Review Q1 2025)

Chart 1. Closing Price (USD) performance rebased to 100, of Iranian Companies in the MVTGLE Index (Review Q1 2025) since their addition to the Index. Source: MarketVector Indexes GmbH. (7)

Iran country Market Cap (Full) in MarketVectorTM Total Global Equity Index

in MVTGLE.png)

Chart 2. Combined Market Cap (Full) Performance of Iranian Companies in the MVTGLE Index (Review Q1 2025) since their addition to the Index. Source: MarketVector Indexes GmbH. (7)

Investment Opportunities

1. Heterogeneity of the Iranian market

Iran's market is notably heterogeneous, unlike other emerging markets that may be dominated by sectors such as banking and telecommunications. The Iranian market includes a diverse mix of industries, ranging from energy and manufacturing to technology and pharmaceuticals, offering investors a broader spectrum of opportunities. However, this diversity is tempered by the impact of sanctions, which have restricted access to international capital and limited foreign participation, affecting the overall liquidity of stocks.

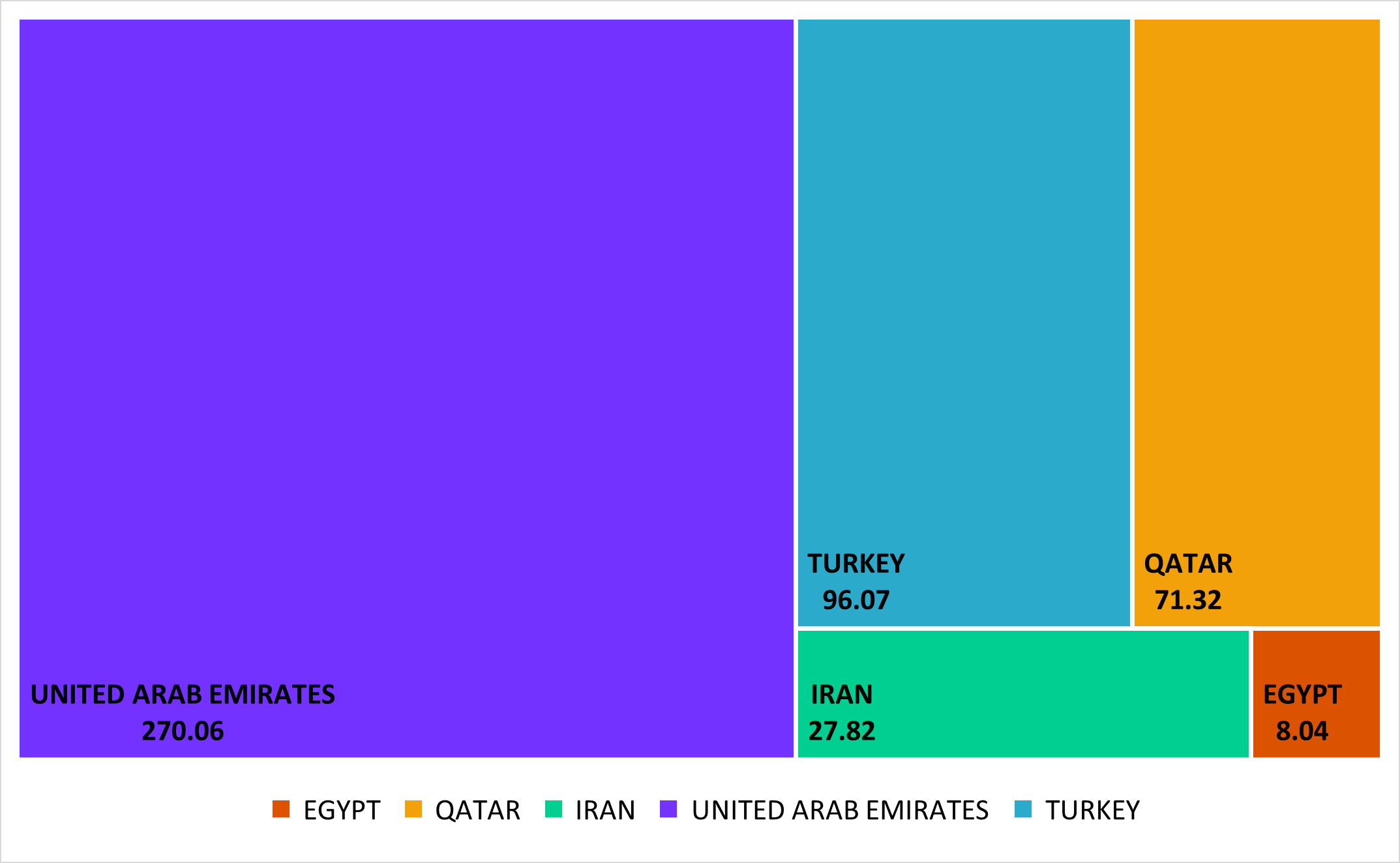

2. Size of the Iranian market

As shown below in Figure 1, despite the constraints posed by sanctions, the Iranian market size remains significant, with a growing number of listed companies and a relatively developed infrastructure in key sectors. In the scenario of easing sanctions, the market infrastructure could develop positively, allowing the market size to align more closely with that of its Middle Eastern neighbors, unlocking greater opportunities for growth and investment.

Market size of main Middle East countries in MVTGLE (bln USD)

Figure 1. Market size of main Middle East countries in MVTGLE (bln USD) as of 31.03.2025. Source: MarketVector Indexes GmbH. (7)

3. Liquidity of the market

Iran's financial market faces liquidity challenges due to sanctions, limited foreign investment, and insufficient market infrastructure. However, as sanctions evolve, there is greater potential for liquidity improvement and market expansion, which could unlock the country's investment opportunities.

Conclusion

The Iranian companies included in the MarketVector™ Total Global Equity Index (MVTGLE) represent a diverse range of industries crucial to Iran’s economic future. Despite sanctions and political risks, these companies are poised for growth, fueled by Iran’s ongoing diversification efforts, large domestic market, and industrial capacity.

Investors willing to navigate these complexities and engage with local partners might find significant upside potential in Iran’s emerging sectors.

Sources

International Monetary Fund (IMF) – Iran

https://www.imf.org/en/Countries/IRN

World Bank – Iran. ECONOMIC MONITOR: Sustaining Growth Amid Rising Geopolitical Tensions Spring 2024. P. 11, 19

International Monetary Fund (IMF) - Iran

Source for the IMF's projections and economic insights on Iran.

https://www.imf.org/en/Countries/IRN

https://www.imf.org/external/datamapper/NGDP_RPCH@WEO/KAZ/TKM

International Monetary Fund (IMF) eLibrary. P.11/ 12

Source for specific data about Iran's economic diversification and trade relations.

https://www.elibrary.imf.org/view/journals/002/2018/094/article-A002-en.pdf

MarketVector Indexes.

International Monetary Fund (IMF). IMF Fossil Fuel Subsidies. Data: 2023 Update. P. 27.

https://www.imf.org/-/media/Files/Publications/WP/2023/English/wpiea2023169-print-pdf.ashx

Bloomberg

Source for the trade data and performance figures of Iranian companies in 2023.

https://www.bloomberg.com

Iranian Companies in the MVTGLE Index (Review Q1 2025).

| Bloomberg Ticker | Name | ISIN |

| XTEH_MSMI1 | IRAN NATIONAL COPPER INDUSTRIES CO | IRO1MSMI0000 |

| XTEH_FOLD1 | ESFAHANS MOBARAKEH STEEL CO. | IRO1FOLD0009 |

| XTEH_PNES1 | ESFAHAN OIL REFINING CO. | IRO1PNES0000 |

| XTEH_BMLT1 | MELLAT BANK OF IRAN | IRO1BMLT0007 |

| XTEH_IKCO1 | IRAN KHODRO INDUSTRIAL GROUP | IRO1IKCO0008 |

| XTEH_TAMN1 | SOCIAL SEC INV | IRO1TAMN0006 |

Get the latest news & insights from MarketVector

Get the newsletterRelated:

About the Author:

Antonio Fons Palomares is an Index Specialist at MarketVector Indexes™ ("MarketVector"). He is primarily responsible for the research, development, and maintenance of MarketVector Indexes™ across all asset classes. Antonio holds a Master's Degree in Financial Engineering from the Business Administration Institute (IAE) of the University of Poitiers, France, and a Bachelor's Degree in Economics and Business Administration from the University of Paris-Saclay, France. He has cleared the CAIA Level 1 exam.

For informational and advertising purposes only. The views and opinions expressed are those of the authors but not necessarily those of MarketVector Indexes GmbH. Opinions are current as of the publication date and are subject to change with market conditions. Certain statements contained herein may constitute projections, forecasts, and other forward-looking statements, that do not reflect actual results. It is not possible to invest directly in an index. Exposure to an asset class represented by an index is available through investable instruments based on that index. MarketVector Indexes GmbH does not sponsor, endorse, sell, promote, or manage any investment fund or other investment vehicle that is offered by third parties and that seeks to provide an investment return based on the performance of any index. The inclusion of a security within an index is not a recommendation by MarketVector Indexes GmbH to buy, sell, or hold such security, nor is it considered to be investment advice.