Ethereum staking has just crossed a major threshold

With the SEC’s approval of ETH ETFs that include staking, Ethereum has entered a new phase: it is no longer just a growth asset—it is now officially a yield-bearing instrument for traditional investors.

This unlocks powerful benefits:

- Onchain rewards, brought into brokerage portfolios

- Intraday liquidity and regulated structures

- Validator performance as a new alpha source

But there is a catch: most benchmarks used today do not capture the real yield Ethereum generates. That is a serious problem for ETF sponsors, analysts, and advisors.

Where Ethereum Yield Really Comes From

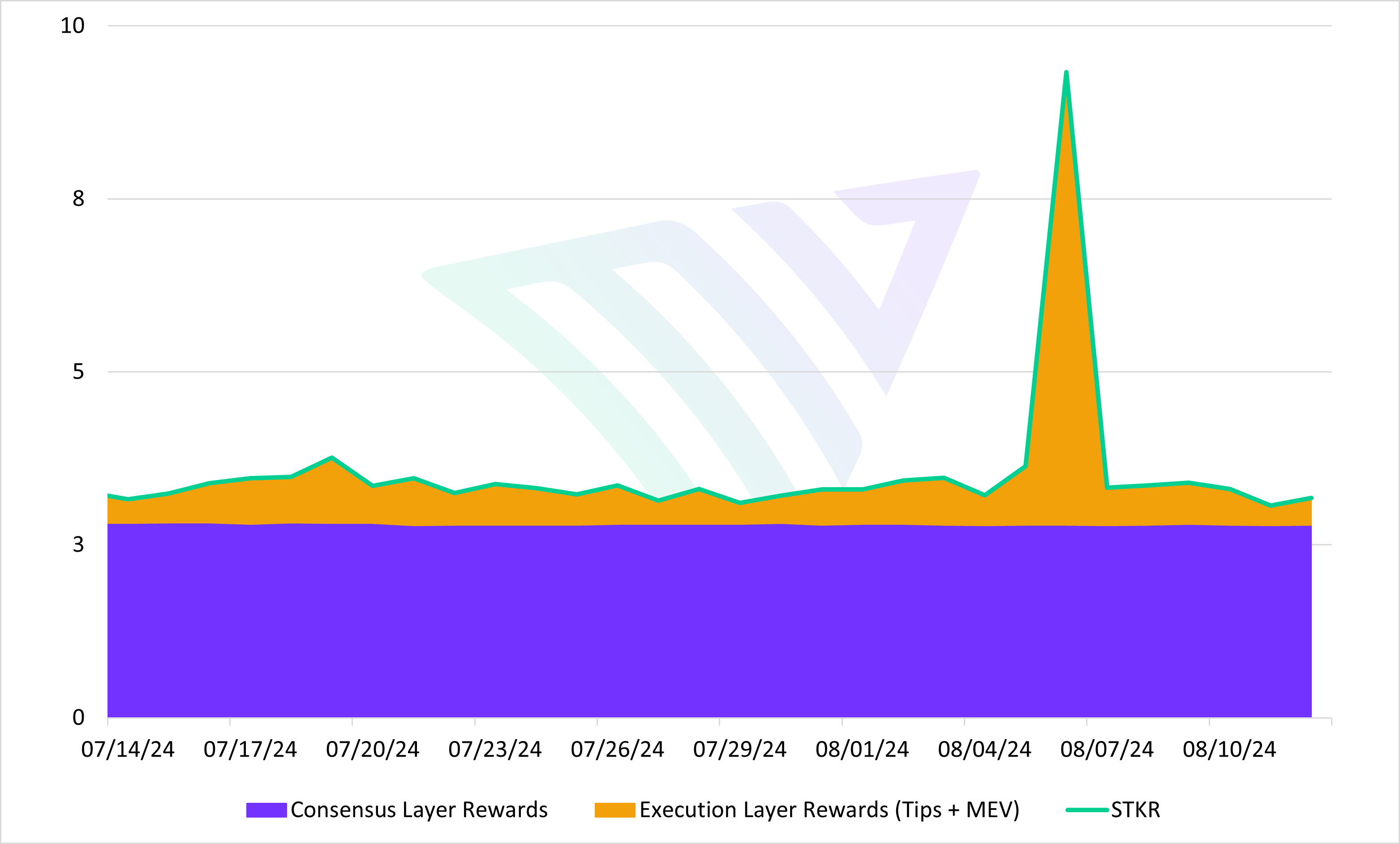

Staking rewards come from two distinct layers:

- Consensus Layer (CL): Predictable base issuance paid per validator.

- Execution Layer (EL): Variable gas tips and MEV (Maximal Extractable Value) earned from building blocks.

While CL rewards decline as more ETH is staked, EL rewards are:

- Activity-driven

- Validator-dependent

- Uncapped during volatility

During periods of heightened market activity, MEV and gas tips can significantly exceed Ethereum’s base issuance. Yet, many ETF disclosures and staking benchmarks continue to overlook these execution-layer rewards. The chart below illustrates this dynamic during the Yen-Carry Crash event in August 2024, where extreme crypto market volatility led to a sharp spike in MEV and tips. This resulted in execution-layer rewards comprising a substantially larger share of total staking returns, highlighting the importance of accounting for these components when assessing real-world staking yields.

Source: MarketVector Indexes, Data as of August 12, 2024.

The Performance Gap: Not All Validators Are Equal

What most investors do not realize is this:

Professional staking providers with MEV infrastructure consistently outperform the network average.

They achieve this by:

- Connecting to multiple MEV relays

- Running low-latency builders

- Avoiding slashing events through disciplined operations

This performance edge is real, and it materially boosts yield. If your validator is not capturing MEV, you are leaving yield behind.

That is why ETF sponsors and institutions must ask:

- What percentage of EL rewards are being captured?

- Is the provider using MEV-boost and multiple relays?

- Are slashing events being avoided?

- Are staking rewards reinvested to grow the fund’s staked balance and NAV?

Why the Right Benchmark Matters

Most current benchmarks only reflect CL rewards or smoothed trailing averages. They fail to capture:

- Spikes in MEV during periods of volatility

- Validator-specific execution income

- Slashing penalties and downtime risks

A benchmark that excludes EL rewards is not a real benchmark.

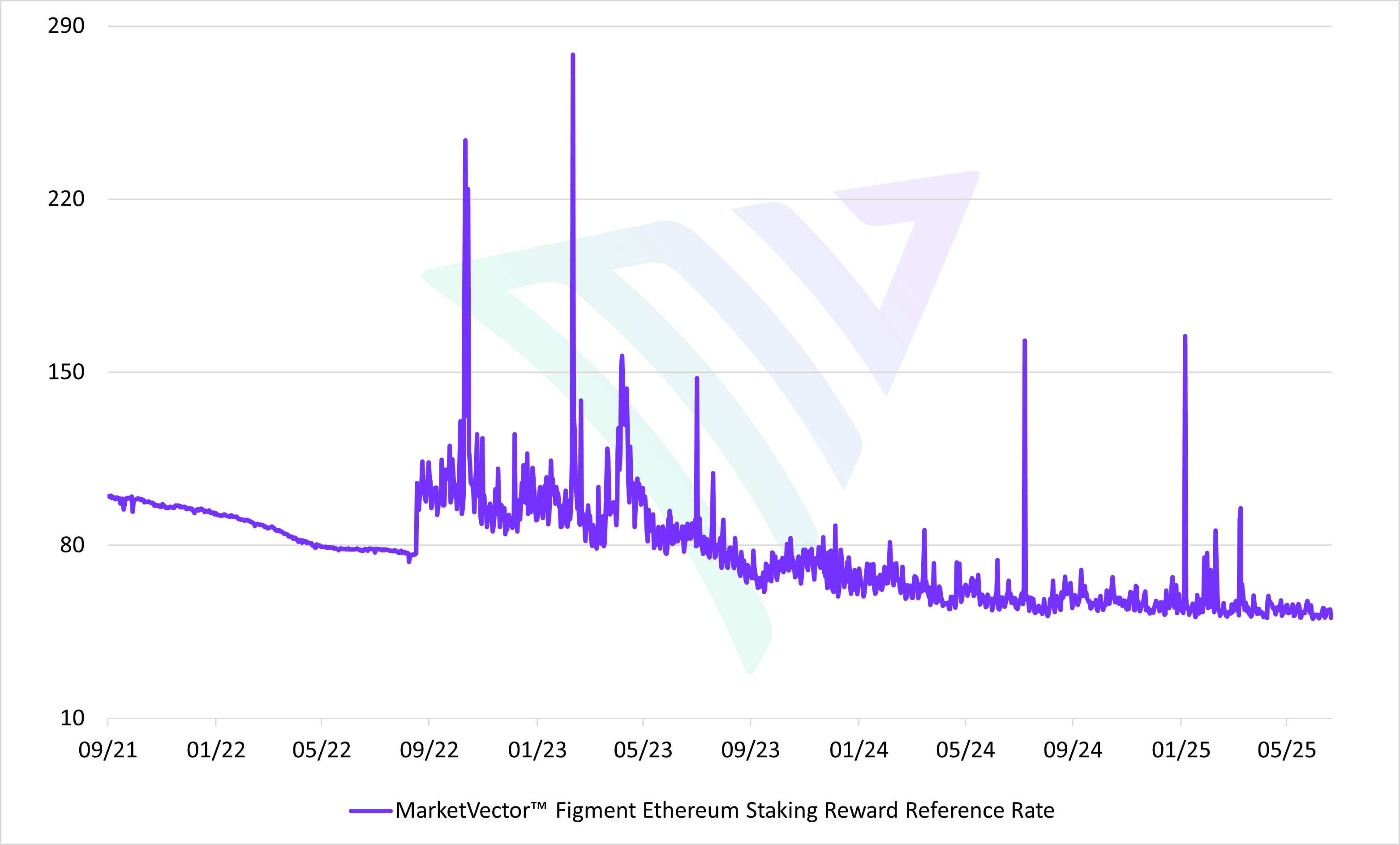

That is why we built STKR—the MarketVector™ Ethereum Staking Reward Reference Rate.

- Includes CL + EL rewards, plus slashing adjustments

- Published daily using transparent methodology

- Reflects actual validator earnings across the whole network

Source: MarketVector Indexes, Data as of July 20, 2025.

The Bottom Line

Ethereum is yielding. Regulated products are launching. Institutional allocators need clarity and precision.

The market has shown time and again that the most transparent products attract the most assets—because investors value transparency over promises.

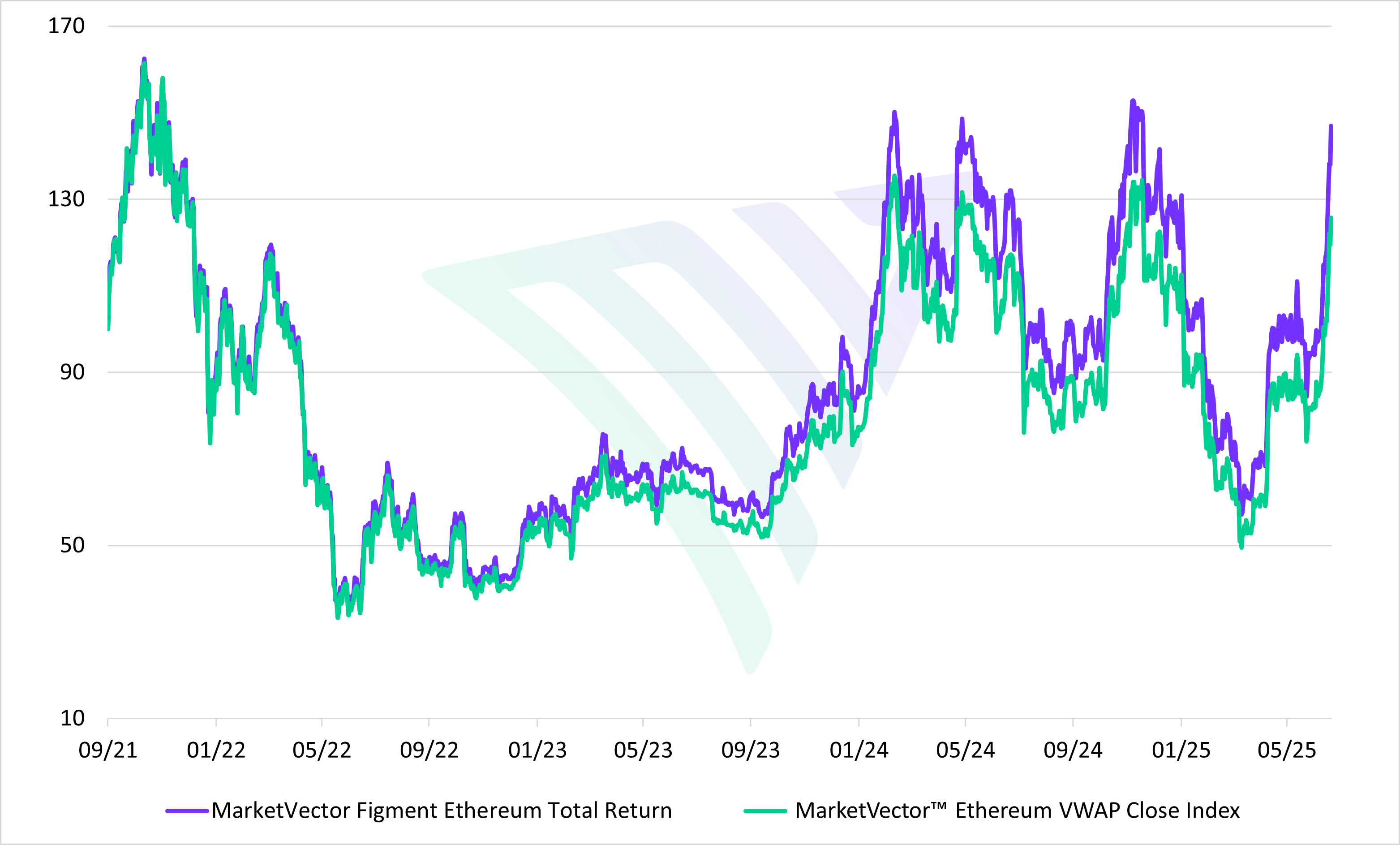

When STKR is combined with an Ethereum price index to produce the MarketVector™ Figment Ethereum Total Return Index (MVETHTR), the result is clear: long-term outperformance that reflects both price and staking yield.

Source: MarketVector Indexes, Data as of July 20, 2025.

ETF issuers that rely solely on spot price indexes or incomplete staking metrics risk substantial tracking error—and ultimately, investor disappointment. The divergence in annualized returns can exceed 4.2%, a margin too significant to ignore in performance-sensitive products.

Comprehensive, transparent benchmarks like STKR and MVETHTR are essential to ensuring alignment between performance, expectations, and product integrity.

Get the latest news & insights from MarketVector

Get the newsletterRelated: