As the crypto space grows more competitive, institutional investors are increasingly debeating which blockchain ecosystem will lead the market are intensifying. Ethereum (ETH), known for its institutional adoption, and Solana (SOL) remain two of the most talked-about contenders. But which one is poised to gain greater adoption in 2025?

Let’s dive into a comprehensive analysis to explore their potential catalysts, past performance, and future prospects.

The Q1 and Yearly Performance Myth

Ethereum has historically been considered the dominant smart contract platform, with notable seasonality in its Q1 performance. For instance:

- In 2017, post-halving, ETH delivered a 160% return in Q1.

- In 2021, ETH skyrocketed by 526% in Q1.

However, a deeper analysis reveals that Solana’s trajectory might mirror Ethereum’s historical patterns. For example:

- Solana’s bottom at USD 8 in 2023 mirrors Ethereum’s 2019 bottom at USD 88.

- Both blockchains experienced significant recoveries in the early stages of their respective bull runs, showcasing similar upward momentum.

This suggests that it might not be Ethereum specifically benefiting from Q1 seasonality but rather the leading smart contract blockchain with the most activity and adoption. In 2025, Solana may take on this role.

Catalysts for Ethereum in 2025

Ethereum’s dominance is deeply rooted in its robust ecosystem and widespread institutional adoption, making it a cornerstone for blockchain investments. Here’s how Ethereum’s key drivers align with institutional investor priorities in 2025:

- Institutional Liquidity:

- ETH leads in Total Value Locked (TVL) with USD 61.8 billion compared to SOL’s USD 10.8 billion.

- Ethereum dominates the stablecoin market, with 53.8% of all stablecoins on its network.

- Real-World Asset (RWA) Adoption:

- Major institutions like BlackRock, UBS, and MasterCard are building on Ethereum.

- Ethereum is the largest platform for RWAs, making it the go-to blockchain for institutional use cases.

- ETF Evolution:

- Ethereum already has ETFs in the market. In 2025, these ETFs might include staking yields, offering investors an additional 3.01% return annually.

- Coinbase’s Base Layer:

- Ethereum’s layer-2 scaling solution, Base, continues to thrive, supporting decentralized applications (dApps) and the burgeoning AI narrative.

- Developer and Ecosystem Growth:

- Despite slow transaction speeds, Ethereum’s robust development roadmap ensures continuous upgrades.

MarketVector™ Ethereum Benchmark Rate

Source: MarketVector. Data as of January 28, 2025.

Catalysts for Solana in 2025

Solana has emerged as a high-growth blockchain ecosystem, appealing to retail and institutional investors alike. Its lightning-fast transaction speeds, low fees, and growing U.S.-based adoption make it a compelling option for scalable institutional trading platforms.

- Retail and Institutional Adoption:

- Visa, PayPal, and Franklin Templeton have all launched projects on Solana, showcasing its growing institutional appeal.

- Retail investors flock to Solana for its affordability, as seen with popular wallets like Phantom outperforming Coinbase Wallet in usage.

- High Staking Yield:

- Solana offers a 7.16% staking yield, significantly higher than Ethereum’s 3.01%.

- This makes Solana an attractive option for ETF inclusion, with analysts from JP Morgan forecasting 5x the relative inflow to market cap compared to Ethereum.

- Battle-Tested Resilience:

- Solana has processed 10% of Nasdaq’s daily trading volume in a single day—an achievement unmatched by any blockchain, including Ethereum.

- Innovative Upgrades:

- The Firedancer upgrade will improve decentralization and increase transaction throughput, addressing previous congestion issues.

- Made in the USA:

- As a U.S.-based blockchain, Solana could benefit from regulatory and political support, especially with growing nationalistic tendencies in tech policy.

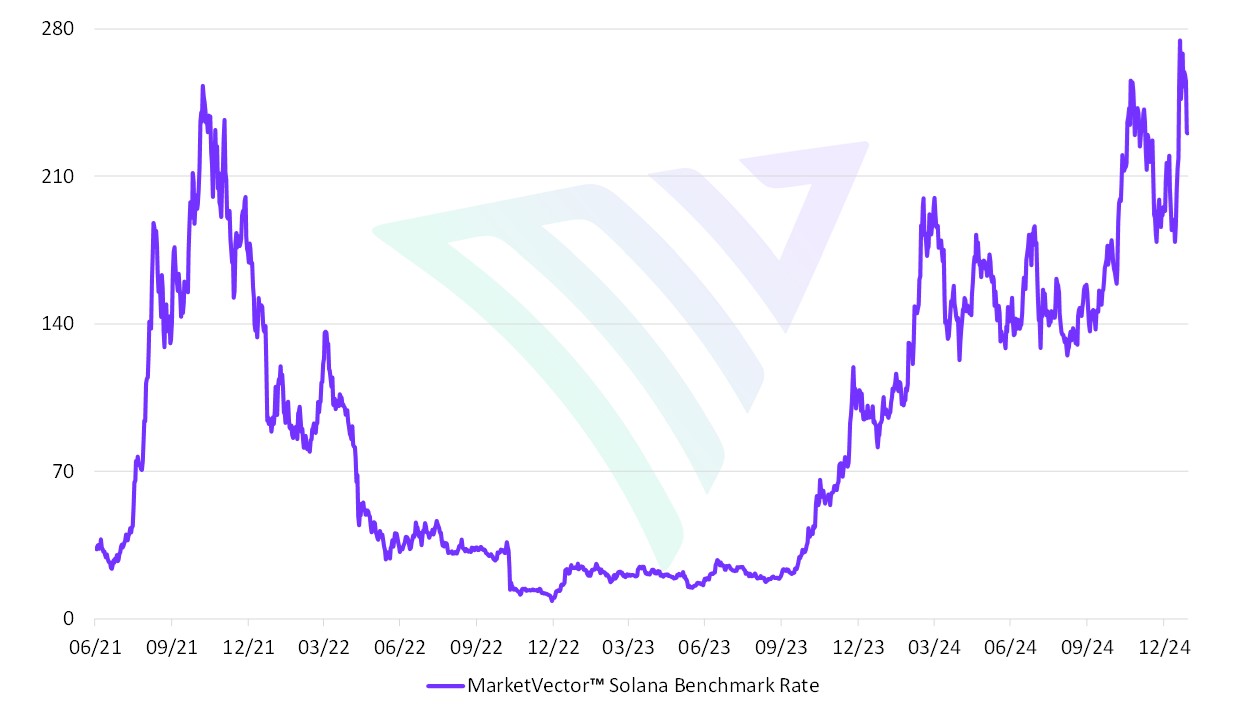

MarketVector™ Solana Benchmark Rate

Source: MarketVector. Data as of January 28, 2025.

Comparing Ecosystems

| Feature | Ethereum (ETH) | Solana (SOL) |

|---|---|---|

| Staking Yield | 3.01% | 7.16% |

| TVL | USD 61.8 billion | USD 10.8 billion |

| Stablecoin Dominance | 53.8% | Less significant |

| Institutional Support | Strong (BlackRock, UBS, MasterCard) | Growing (Visa, PayPal, Franklin Templeton) |

| Transaction Speed | Slower, costly | Faster, cheaper |

| Retail Adoption | Moderate | High |

Source: MarketVector, Token Terminal, Defillama, Stakingrewards. Data as of January 27, 2025.

The Verdict: ETH or SOL in 2025?

The ultimate question is whether 2025 will see more institutional adoption or retail-driven growth:

- If institutions lead, Ethereum's dominance in RWAs, liquidity, and ETFs positions it as the clear winner.

- If retail adoption accelerates, Solana’s speed, affordability, and strong community engagement make it a formidable contender.

Given the faster pace of retail adoption, Solana may show relative strength against Ethereum in 2025, especially in the early stages of the bull market. However, Ethereum remains a safer, long-term bet for institutional-driven growth.

Final Thoughts

At the end of the day, it really depends on what institutional investors believe the future holds for the crypto market. If you think institutional adoption is inevitable and just around the corner, Ethereum’s position as the institutional favorite gives it the upper hand. But if you believe the next cycle will continue to be driven by fast, innovative, and retail-focused solutions, Solana might take the lead.

Get the latest news & insights from MarketVector

Get the newsletterRelated: