In the semiconductor industry, "fabless" refers to companies focusing exclusively on designing and developing microchips while outsourcing their manufacturing to specialized fabrication plants, or foundries. This model allows fabless companies to concentrate resources on innovation and product optimization. By leveraging this structure, fabless firms like NVIDIA, AMD, and Qualcomm are at the forefront of creating the chips that power everything from artificial intelligence to smartphones.

Here are some of the current trends and developments in the fabless segment:

Rise of AI-Optimized Chips

U.S. fabless firms are at the forefront of designing chips specifically optimized for artificial intelligence (AI) and machine learning workloads.

NVIDIA’s H100 GPUs are redefining AI training and inference, large language models (LLMs), and recommender systems.

Advances in Chiplet Technology

Chiplets—smaller modular components that can be integrated into a single package—are becoming a game-changer. Companies like AMD are leading in multi-chip module (MCM) designs that enhance performance while keeping costs down.

Recent research shows chiplet-based designs can improve power efficiency by up to 30%, opening new doors for high-performance computing.

Photonics and Optical Chips

Fabless firms are exploring silicon photonics, which uses light instead of electricity for data transfer within chips.

Marvell Technology is working on integrating photonics for data centers, promising bandwidths that are at least 2x faster than traditional methods. Research focuses on reducing the cost of photonic integration, making it viable for consumer markets like AR/VR and autonomous vehicles.

Quantum-Ready Semiconductors

Though still in its infancy, quantum computing is influencing semiconductor research. Fabless companies are designing chips that can interface with quantum processors or simulate quantum algorithms.

NVIDIA’s cuQuantum SDK is accelerating quantum research by optimizing classical simulations of quantum circuits on GPUs. Studies suggest hybrid quantum-classical chips could revolutionize cryptography and material science.

Edge Computing Revolution

Fabless companies are designing chips for edge devices that process data locally rather than rely on the cloud.

Qualcomm’s Snapdragon platform leads in low-latency AI processing for smartphones and IoT devices. New research involves integrating AI accelerators directly into microcontrollers for real-time applications like robotics and drones.

Addressing Supply Chain Vulnerabilities

The U.S. fabless sector is highly dependent on overseas foundries, leading to research into alternatives:

DARPA’s Electronics Resurgence Initiative funds collaborations between fabless firms and U.S.-based foundries to explore new materials like Gallium Nitride (GaN) for military and aerospace applications. Studies on distributed manufacturing propose splitting chip production steps across multiple geographies to minimize disruptions.

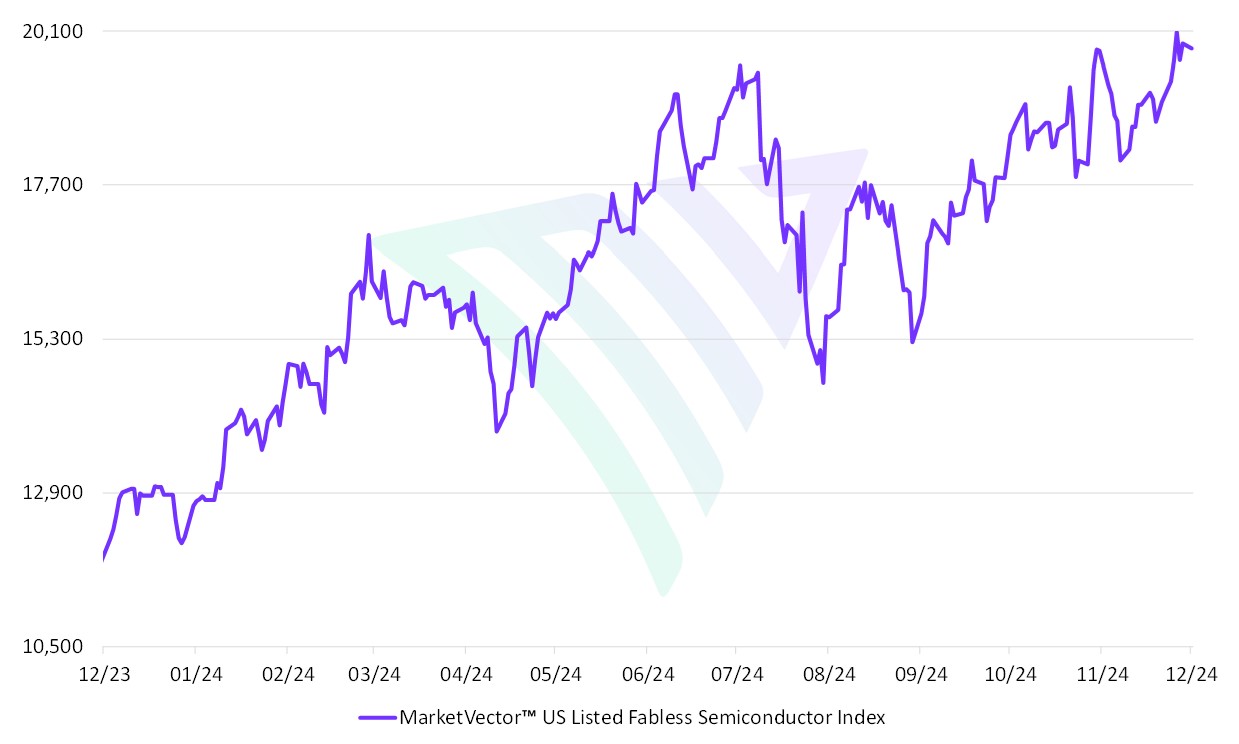

MarketVectorTM US Listed Fabless Semiconductor Index (MVSMHX), which tracks the US-listed fabless companies was up ~42% YTD 2024.

Source: MarketVector. Data as of December 9, 2024.

For more information on our family of indexes, visit www.marketvector.com.

Get the latest news & insights from MarketVector

Get the newsletterRelated: