Celebrating the MarketVectorTM-GammaRoad U.S. Equity Strategy Index: One Year of Success

This month marks the one-year anniversary of the launch of the MarketVectorTM-GammaRoad U.S. Equity Strategy Index (MVGMMA), a significant milestone for a strategy that aims to deliver equity-like returns while reducing downside risk. Over the past year, the index has consistently demonstrated its ability to adapt dynamically to changing market conditions, showcasing the power of a systematic approach grounded in robust risk management.

A Systematic Edge in Equity Allocation

The MVGMMA systematically evaluates three key risk drivers to guide its exposure to U.S. equities:

- Fundamental economic strength: a measure that compares the performance of economically sensitive commodities to the performance of gold.

- Consumer confidence: a measure that evaluates the strength or weakness of U.S. consumer confidence relative to its long-term and short-term trends.

- Price direction: a measure that considers the directional trend in prices of the SPY ETF.

By combining these signals, the index adjusts its equity exposure at the time of rebalancing from 0% to a maximum of 125%, allowing for significant flexibility to navigate market volatility while preserving the potential for upside growth.

2024: Adjusting to Evolving Market Conditions

MVGMMA launched on December 22, 2023, with historical data back to 1993. Following a cautious stance during periods of heightened market uncertainty in 2023, the strategy started 2024 shifting to an overweight position in U.S. equities. This reflected improving economic fundamentals, rising consumer confidence, and sustained positive price momentum.

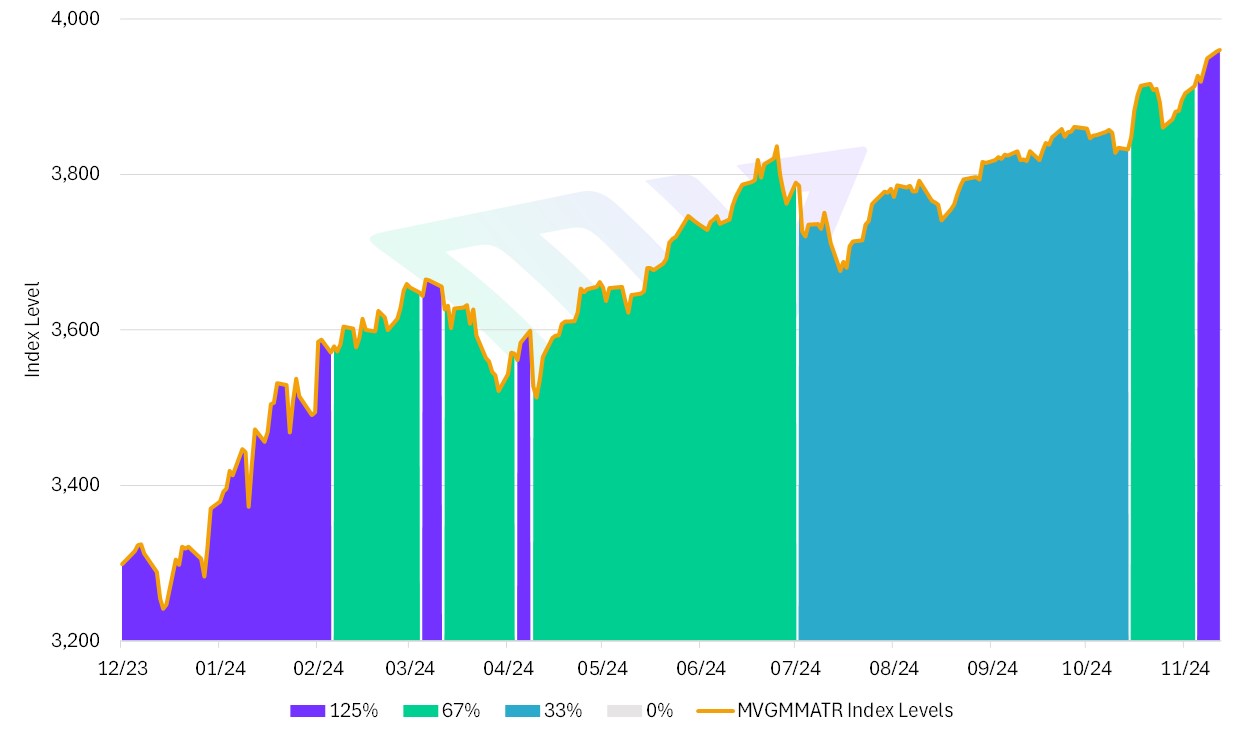

This year’s allocation adjustments underscore the index’s ability to respond to the weight of evidence and changes in the overall risk environment. The chart below illustrates the MVGMMA Index Levels and its U.S. equity position weights at the rebalancing time since December 22, 2023.

Exhibit: U.S. Equity Weight in the MarketVector™-GammaRoad U.S. Equity Strategy Index

Source: MarketVector. Data as of December 3, 2024.

Highlights From the Past Year

Resilience in Adverse Markets: During volatile periods in 2024, the index successfully reduced equity exposure to mitigate drawdowns, demonstrating the effectiveness of its systematic risk management.

Performance Consistency: Despite broader market fluctuations, the index delivered returns in line with expectations, reflecting its ability to achieve equity-like growth with reduced risk.

Looking Ahead

The MVGMMA Index’s innovative design and objective, repeatable process strategically position the strategy to navigate potential turbulence and opportunities in 2025. Utilizing its adaptive framework, the index is primed to address market challenges and evolving conditions.

As we celebrate this milestone, we remain committed to delivering innovative, high-quality strategies that empower investors to achieve their financial goals with confidence.

For more information on MVGMMA, visit www.marketvector.com/indexes/custom/marketvector-gammaroad-u-s-equity-strategy.

Get the latest news & insights from MarketVector

Get the newsletterRelated: