Mobile money platforms are now becoming more widespread throughout sub-Saharan Africa. Kenya, like much of Africa, has a large unbanked population that engages in small, mostly cash, transactions.

Amongst others, Kenya’s biggest telecom operator has developed a successful mobile money platform (MPesa) to service these people. This peer-to-peer money transfer system allows people to deposit cash through a network of over 90'000 kiosks.

Once the money is deposited in an account, the system can then be used to transfer it to other individuals, pay bills, and pay for transactions – all through a simple mobile phone. This system alone is now ubiquitous across Kenya, with 19 million users out of a total population of 45 million people.

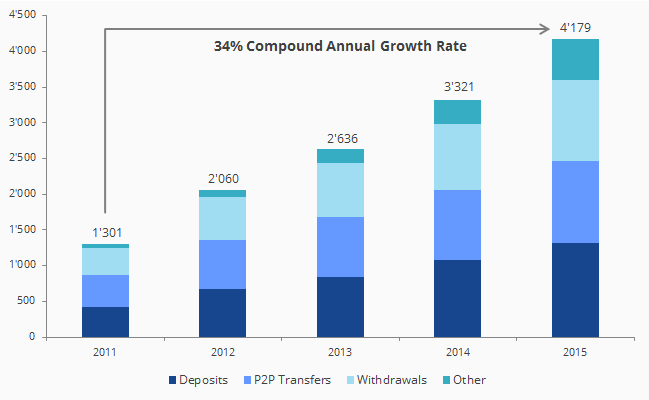

MPesa: Value Transacted

(Kenyan Shillings Bn)

Source: Safaricom

About the Authors:

David I. Feygenson (MS, Finance and Economics, London School of Economics; BS, Economics, The Wharton School, University of Pennsylvania) is a Senior Emerging Markets Equity Analyst at VanEck. Mr. Feygenson has over a decade of buy-side investment experience and previously held positions at Wellington Management Co and Mirae Asset Global Investments.

The article above is an opinion of the author and does not necessarily reflect the opinion of MV Index Solutions or its affiliates.

Get the latest news & insights from MarketVector

Get the newsletterRelated: