Bosnia and Herzegovina is a country in Southeast Europe with a population of approximately 3.5 million people. It is situated between Croatia, Montenegro, and Serbia, with a coastline of only 20 kilometers along the Adriatic Sea. It is a relatively young state, having declared independence in 1992 following the breakup of Yugoslavia. This period was followed by a war that lasted until 1995, which was fought between ethnic groups. The largest ethnic group in Bosnia and Herzegovina is the Bosniaks, who make up around 50% of the population. They are followed by the Serbs, comprising approximately 30%, and the Croats, accounting for about 15%. Due to the war, the country’s political structure was established as two autonomous entities: the Federation of Bosnia and Herzegovina, which is predominantly Bosniak and Croat, and the Republika Srpska, which is predominantly Serb. Additionally, there is the small, jointly governed Brcko District, which is multi-ethnic.

The country is one of the economically weaker ones in Europe and has not yet become a member of the European Union. The challenges mentioned above contribute to several issues, such as inefficiencies and bureaucratic hurdles that are less prominent in other countries. They also result in some peculiarities in the context of stock markets:

- The currency is the Convertible Mark (BAM), which was originally pegged 1:1 to the Deutsche Mark and remains pegged to the Euro at the former exchange rate of the Deutsche Mark (1.95583).

- Both autonomous entities have their own stock exchanges: Sarajevo for the Federation and Banja Luka for the Republika Srpska, with companies typically listed within their respective entities.

- The largest companies in the country, such as Aluminij (aluminum), Holdina (oil), and Prevent (automotive), are not publicly listed.

According to the rules of the MarketVectorTM Total Global Equity Index (MVTGLE), both exchanges must be included in such cases:

- Listed in Sarajevo, MarketVector currently includes BH Telecom d.d. Sarajevo (ticker: BHTSR) as well as ASA Banka d.d. (IKBZPK2), formerly IK Banka d.d.

- Listed in Banja Luka, MarketVector currently includes Telekom Srpske AD (TLKM-R-A).

In summary, this exposure, representing the market through telecommunications and financial sectors, is typical for frontier markets. Liquidity in Bosnia and Herzegovina is generally low, with companies showing an average daily traded value of around 10,000 USD. Among the most liquid companies are those mentioned above. Another relatively liquid company is Bosnalijek d.d. (BSNLR), a pharmaceutical firm trading in Sarajevo, with an average daily traded value of approximately 5,000 USD, though it did not qualify for the index.

The total size of the market (full market capitalization) is approximately USD 11 billion.

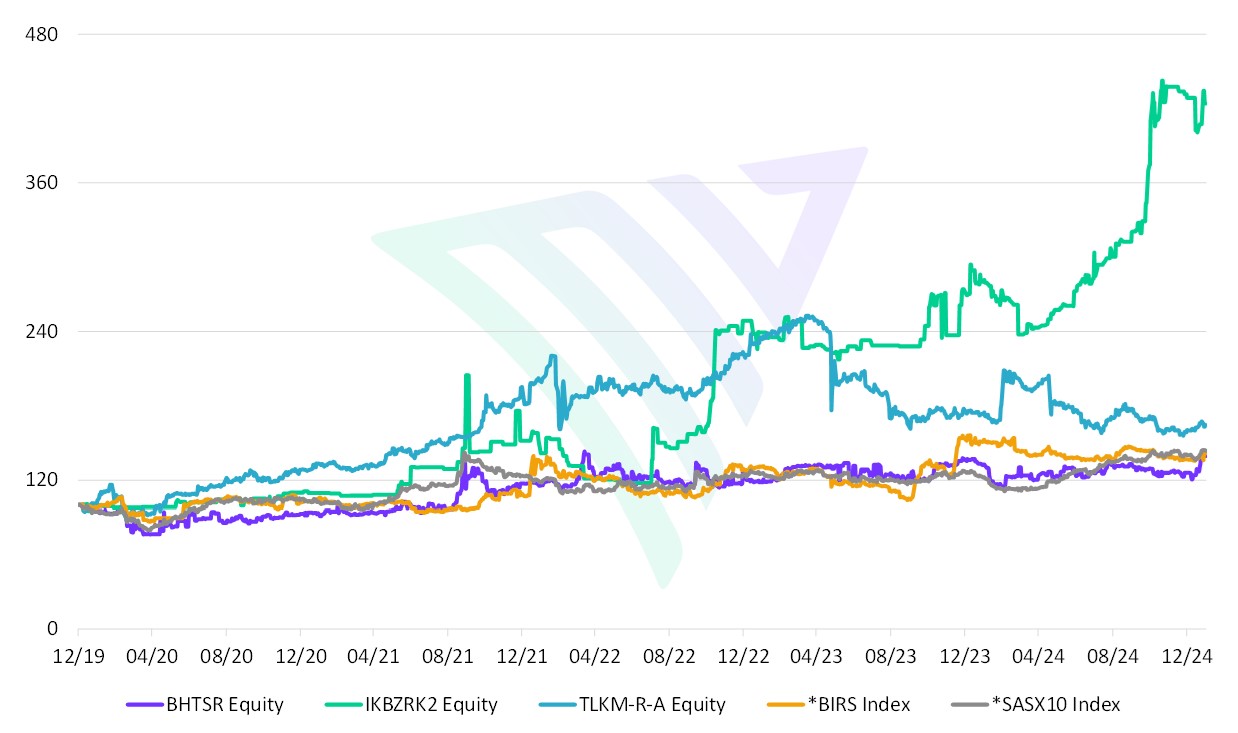

Performance of the Bosnian Markets

Source: Sarajevo Stock Exchange, Banja Luka Stock Exchange. Data as of January 31, 2025.

*BIRS (Berzanski Indeks Republike Srpske)

*SASX10 (Sarajevo Stock Exchange Index 10)

For more information on our family of indexes, visit: www.marketvector.com.

Get the latest news & insights from MarketVector

Get the newsletterRelated:

About the Author:

Thomas Kettner is the Chief Operating Officer (COO) at MarketVector with global responsibility for the company's index business. Thomas is an indexing expert with more than 15 years of experience in the development and maintenance of indexes, focusing on developing indexes designed for financial products. He is supported by a team of more than 15 index specialists experienced in index administration and maintenance. Prior to joining MarketVector in 2012, he held various positions at leading index providers such as Dow Jones Indexes and STOXX Ltd. Thomas has a degree in Economics from the University of Konstanz, Germany, and is a CIIA graduate.

For informational and advertising purposes only. The views and opinions expressed are those of the authors but not necessarily those of MarketVector Indexes GmbH. Opinions are current as of the publication date and are subject to change with market conditions. Certain statements herein may constitute projections, forecasts, and other forward-looking statements that do not reflect actual results. It is not possible to invest directly in an index. Exposure to an asset class represented by an index is available through investable instruments based on that index. MarketVector Indexes GmbH does not sponsor, endorse, sell, promote, or manage any investment fund or other investment vehicle that is offered by third parties and that seeks to provide an investment return based on the performance of any index. Including security within an index is not a recommendation by MarketVector Indexes GmbH to buy, sell, or hold such security, nor is it considered investment advice.