Unlike previous Hidden Gems articles, this piece is less focused on individual countries and instead highlights the regional coverage of the Eastern Caribbean Securities Exchange (ECSE), headquartered in St. Kitts and Nevis.

The ECSE serves the following eight countries in the Caribbean:

- Anguilla (population approx. 15,000)

- Antigua and Barbuda (approx. 100,000)

- Dominica (approx. 70,000)

- Grenada (approx. 110,000)

- Montserrat (approx. 5,000)

- St. Kitts and Nevis (approx. 50,000)

- St. Lucia (approx. 180,000)

- St. Vincent and the Grenadines (approx. 110,000)

These eight nations also make up the Eastern Caribbean Currency Union (ECCU), sharing the Eastern Caribbean Dollar (XCD) as their common currency. While Anguilla and Montserrat remain British Overseas Territories, the other six countries gained full independence from Britain in the 1970s and 1980s.

As of 2024, the region's per capita GDP ranges between USD10,000 and USD 25,000, with Dominica slightly below USD 10,000. This positions the Eastern Caribbean ahead of countries like Brazil and several Eastern European nations in terms of wealth. (Source: IMF estimate, www.IMF.org)

Given the region's small population—significantly fewer than 700,000 inhabitants—the stock market is also quite limited in terms of the number of listings, market capitalization, and liquidity. Currently, only 13 companies are listed, representing six of the eight sovereign states, with Anguilla and Montserrat not covered at all. The average daily trading volume per company is typically below USD 1,000, with only occasional instances exceeding this amount.

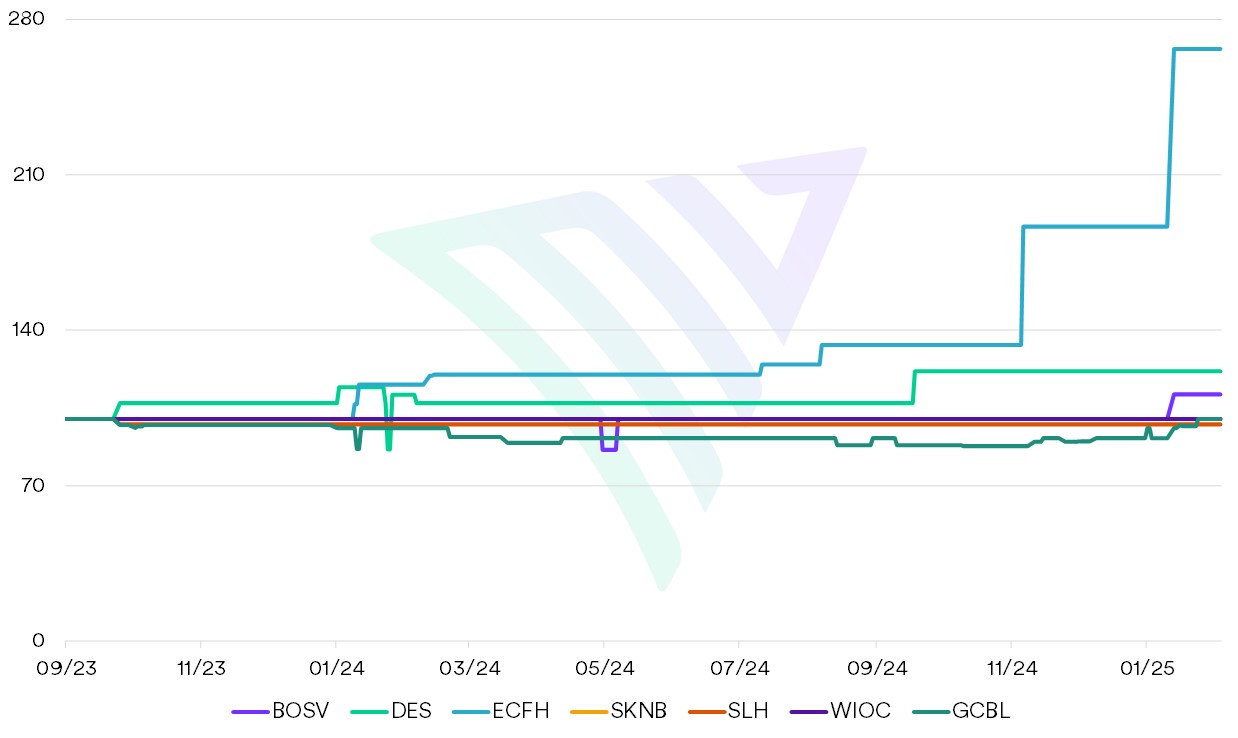

According to the rules of the MarketVectorTM Total Global Equity Index (MVTGLE), any country with at least one listed company is included in the index. Based on the most recent review, the following stocks are currently part of the index:

- The West Indies Oil Company Ltd. (WIOC) – Antigua and Barbuda

- Dominica Electricity Services Ltd. (DES) – Dominica

- Grenada Co-operative Bank Ltd. (GCBL) – Grenada

- The St. Kitts Nevis Anguilla Trading and Development Company Ltd. (TDC) – St. Kitts and Nevis

- S. L. Horsford & Company Ltd. (SLH) – St. Kitts and Nevis

- St. Lucia Electricity Services Ltd. (SLES) – St. Lucia

- Bank of St. Vincent and the Grenadines Ltd. (BOSV) – St. Vincent and the Grenadines

Despite their inclusion, the combined float-adjusted market capitalization of these seven companies is less than USD 200 million, with three of them valued at under USD 10 million.

Nevertheless, the index represents a diverse range of sectors, offering some level of industry diversification.

Stock performance ECSE 5 years for all 7 Comps.

Source: ECSE, www.ecseonline.com.

Image source: World Meteorological Organization.

For more information on our family of indexes, visit: www.marketvector.com.

Get the latest news & insights from MarketVector

Get the newsletterRelated: