Nestled between Asia and Europe, Georgia has transitioned to a free market economy since 1991, after gaining independence from the Soviet Union. Despite geopolitical challenges, such as the occupation of Abkhazia and South Ossetia by Russia, Georgia's economic transformation has been noteworthy. Ranked 32nd in the 2024 Heritage Foundation’s Index of Economic Freedom, the country is currently seeing protests against the government’s efforts to implement Russia-like laws curtailing political freedom. Despite this situation, Georgia presents a unique investment landscape worth considering.

The Georgian Stock Exchange (GSE) and Its Limitations

However, institutional investors often find the Georgian Stock Exchange limited, with only three listed entities and three admitted to trading. Of these, only two companies, Bank of Georgia JSC (GEB) and Liberty Bank JSC (BANK), show any ‘on exchange’ liquidity at all in 2024. This is mainly due to high levels of majority ownership, resulting in very low float factors and reduced market interest.

Additionally, several major Georgian companies are not listed locally but have chosen to list their holdings internationally, particularly in London.

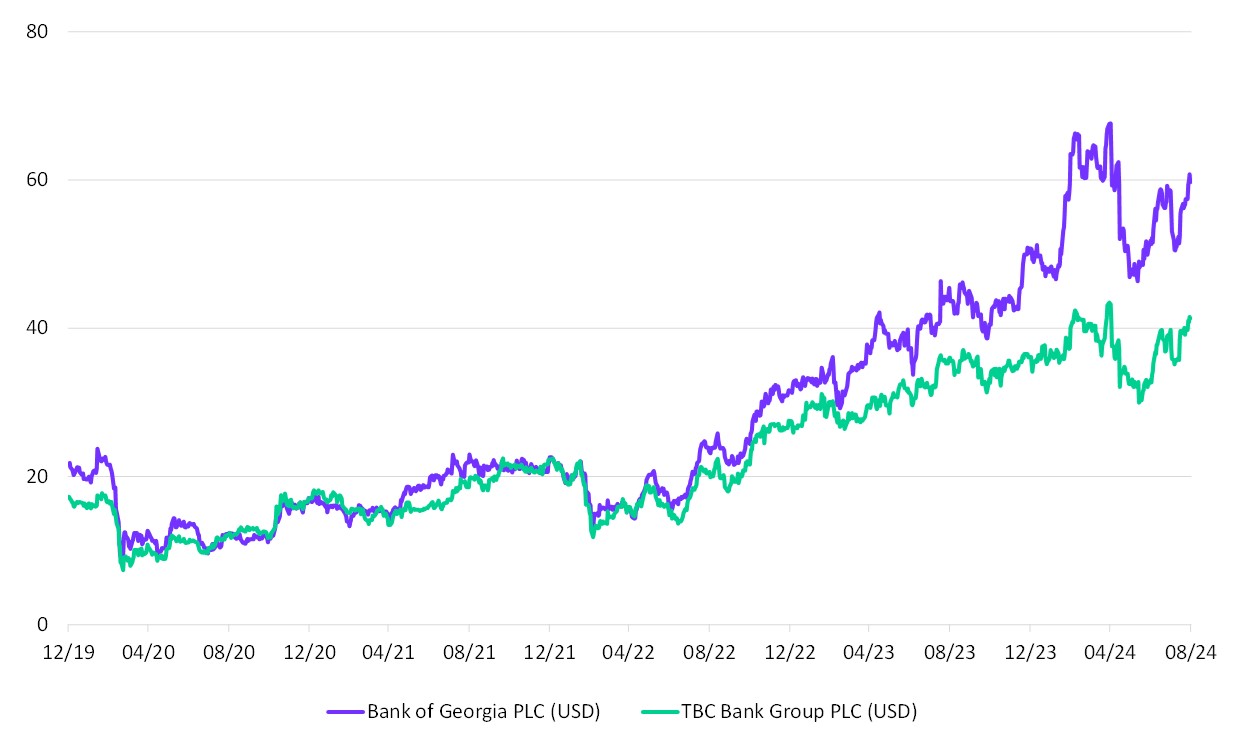

5-Years chart of BGEO and TBCG in USD

Source: London Stock Exchange.

MarketVector's Inclusion

MarketVector’s approach to navigating the Georgian investment landscape includes key Georgian firms, such as Bank of Georgia PLC (BGEO), which owns 99.56% of Bank of Georgia JSC, Georgia Capital PLC (CGEO), and TBC Bank Group PLC (TBCG). These firms provide robust liquidity and better exposure for institutional investments through their listings on the London Stock Exchange.

How MarketVector Tailors the Index

BGEO, TBCG, and CGEO represent Georgian equities for the universe of the MarketVectorTM Total Global Equity Index (MVTGLE). Presently, BGEO and TBCG are included in the index, while CGEO is excluded due to liquidity constraints.

To ensure local representation per index rules, MarketVector has selected BANK as the locally traded component, despite GEB being slightly more liquid but already included through BGEO.

By incorporating both locally traded and internationally listed Georgian firms, MarketVector offers a unique view of Georgian equities. This selection process highlights the potential of Georgia as an investment destination, complementing broader investment strategies with its economic freedom and growth potential.

Get the latest news & insights from MarketVector

Get the newsletterRelated:

About the Author:

Thomas Kettner is the Chief Operating Officer (COO) at MarketVector with global responsibility for the company's index business. Thomas is an indexing expert with more than 15 years of experience in the development and maintenance of indexes, focusing on developing indexes designed for financial products. He is supported by a team of more than 15 index specialists experienced in index administration and maintenance. Prior to joining MarketVector in 2012, he held various positions at leading index providers such as Dow Jones Indexes and STOXX Ltd. Thomas has a degree in Economics from the University of Konstanz, Germany, and is a CIIA graduate.

For informational and advertising purposes only. The views and opinions expressed are those of the authors but not necessarily those of MarketVector Indexes GmbH. Opinions are current as of the publication date and are subject to change with market conditions. Certain statements contained herein may constitute projections, forecasts, and other forward-looking statements, that do not reflect actual results. It is not possible to invest directly in an index. Exposure to an asset class represented by an index is available through investable instruments based on that index. MarketVector Indexes GmbH does not sponsor, endorse, sell, promote, or manage any investment fund or other investment vehicle that is offered by third parties and that seeks to provide an investment return based on the performance of any index. The inclusion of a security within an index is not a recommendation by MarketVector Indexes GmbH to buy, sell, or hold such security, nor is it considered to be investment advice.