This article is the latest in our new "Index of the Month" series. In this series, we\ll spotlight an index that stood out prominently due to its market impact, performance swings, or noteworthy trends. Our goal is to unpack the indices shaping today's investment landscape.

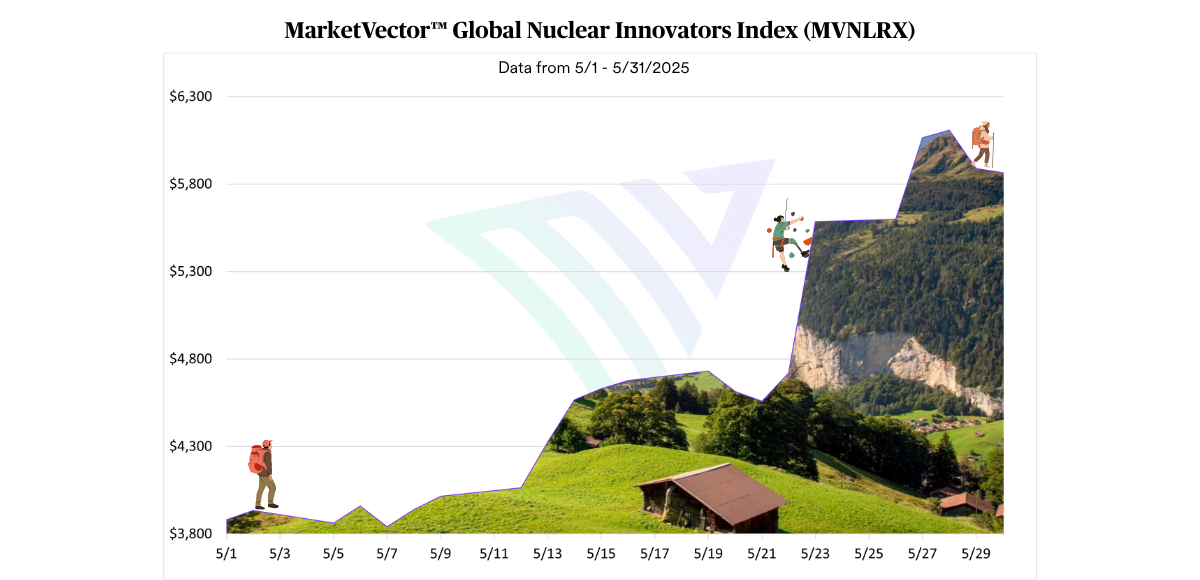

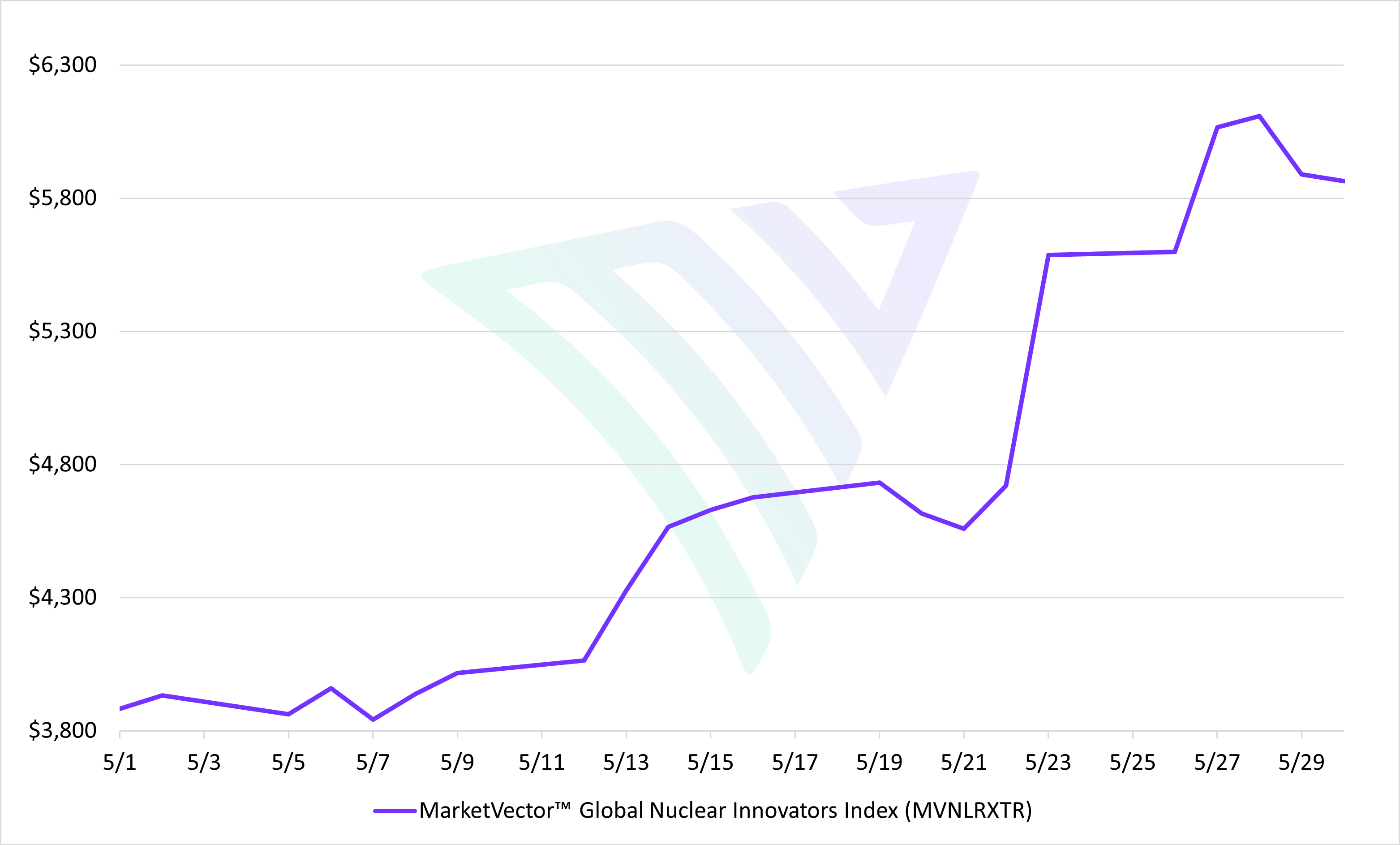

The MarketVector™ Global Nuclear Innovators Index (MVNLRXTR) delivered a standout performance in May, soaring +56% in May as nuclear energy regained center stage.

What’s driving the surge?

A fresh wave of policy support is breathing new life into the sector. President Donald Trump signed a series of executive orders in May aimed at streamlining regulations for next-generation nuclear reactors and strengthening domestic uranium supply chains. This policy momentum has sparked renewed investor interest and boosted sentiment across the nuclear ecosystem.

Why it matters

As the world accelerates towards AI and decarbonization, nuclear energy is increasingly viewed as a critical component. With its potential to provide consistent, low-carbon baseload power, nuclear innovation is gaining traction, and so are the companies leading the charge.

Exhibit: The MarketVector™ Global Nuclear Innovators Index (MVNLRXTR) May 2025 Performance

Top movers in the index include:

- $OKLO – pioneering small modular reactors

- $BWXT – advanced nuclear technologies and fuel services

- $SMR – commercial SMR development

- $LEU – uranium enrichment leader

- $NNE – nuclear infrastructure and solutions

Explore more

Learn about the MarketVector Global Nuclear Innovators Index (MVNLRX)

View MarketVector Index Performance

Get the latest news & insights from MarketVector

Get the newsletterRelated:

About the Author:

Joy Yang is the Global Head of Index Product Management at MarketVectorTM Indexes. She is responsible for managing MarketVector index products and services to accelerate innovation in financial index design and adoption. Joy brings more than 25 years of investment experience to MarketVector, having led teams delivering index and quantitative-active investment solutions at Arabesque Asset Management, Dimensional Fund Advisors, Vanguard, Aberdeen Standard Investments, AXA Rosenberg, and BlackRock. Joy has an MBA from the University of Chicago Booth School of Business and a BS in Electrical Engineering from Cooper Union’s Albert Nerken School of Engineering.

For informational and advertising purposes only. The views and opinions expressed are those of the authors, but not necessarily those of MarketVector Indexes GmbH. Opinions are current as of the publication date and are subject to change with market conditions. Certain statements contained herein may constitute projections, forecasts, and other forward-looking statements that do not reflect actual results. It is not possible to invest directly in an index. Exposure to an asset class represented by an index is available through investable instruments based on that index. MarketVector Indexes GmbH does not sponsor, endorse, sell, promote, or manage any investment fund or other investment vehicle that is offered by third parties and that seeks to provide an investment return based on the performance of any index. The inclusion of a security within an index is not a recommendation by MarketVector Indexes GmbH to buy, sell, or hold such security, nor is it considered to be investment advice.