Skyrocketing geopolitical pressures in the Middle East, sparked by Hamas’ October 7, 2023 attack on Israel, have translated to Israel experiencing a decrease in private consumption, a credit downgrade to negative1, a sharp contraction in GDP (nearly 20% in Q4 of 20232) and soaring fiscal deficits (attributable to escalated defense spending). At the same time, Israel’s economic situation is further complicated by domestic political uncertainty – initially in 2023 concerning the proposed reforms to the Israeli judicial system, and now focused on the likelihood of new elections before the end of 2024.

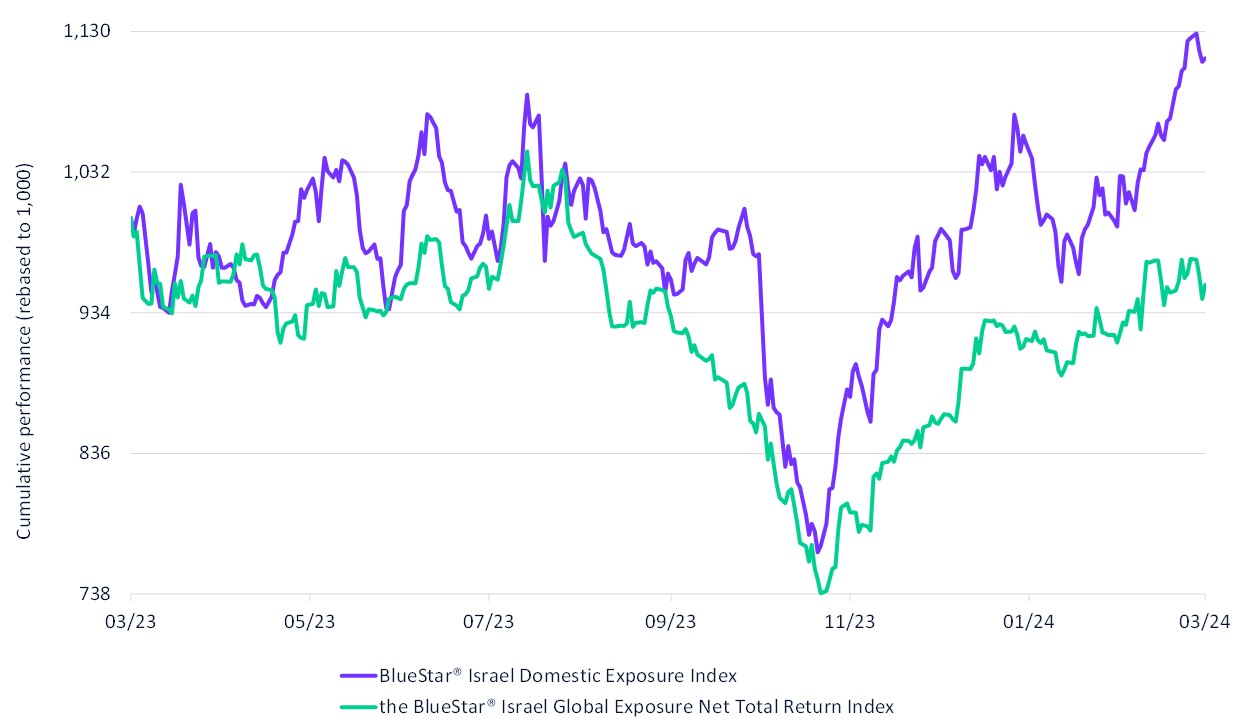

Despite all of these factors, the Israeli Shekel, bonds, and stocks have all made a substantial recovery from their lows, with domestic-oriented equities, as measured by the BlueStar® Israel Domestic Exposure Index, showing potential to emerge from a prolonged period of underperformance.

Why might this be the case? Israel’s economy has a demonstrated history of resilience over the past 40 years, and we view the current conflict as no exception, even though the extent of the fighting has been longer and fiercer. Furthermore, Israel's strong civil society has been shaped by years of adversity and threats, which have been instrumental in fostering domestic unity during crises. Finally, the longer-term emphasis on education and R&D has been pivotal in ensuring the nation's resilience and continued prosperity.

As of March 5, 2024, the BlueStar® Israel Domestic Exposure Total Return Net Index (IDEINTR) is up 6.83% year-to-date and 13.74% from one year ago. For comparison, the BlueStar® Israel Global Exposure Total Return Net Index (IGEINTR), which tracks Israeli equities that generate at least 70% of their revenue from outside Israel, is up 2.46% year-to-date, and down 5.64% from one year ago.

BlueStar® Israel Domestic Exposure Index and BlueStar® Israel Global Exposure Total Return Net Index

3/6/2023-3/6/2024

Source: MarketVector IndexesTM. All values are rebased to 1,000. Data as of March 6, 2024.

Source1: Moody’s (February 9, 2024). Moody's downgrades Israel's ratings to A2, changes outlook to negative; concludes the review. https://ratings.moodys.com/ratings-news/415081

Source2: Ziady, Hanna (February 19, 2024). Israel’s economy slumps 19.4% in the fourth quarter as war takes a toll. CNN. https://www.cnn.com/2024/02/19/economy/israel-gdp-war-economy/index.html

For more information on our family of indexes, visit www.marketvector.com.

Get the latest news & insights from MarketVector

Get the newsletterRelated: