The MarketVectorTM-GammaRoad U.S. Equity Strategy Index (MVGMMA) employs a rules-based, adaptive process to allocate between U.S. equity exposure and Treasury Bills based upon its fundamental, behavioral, and trend-based measures for U.S. equity market risk.

During the second week of February, MVGMMA reduced its equity exposure for the second time this year, as its fundamental measure for economic strength turned bearish. As a result, the strategy lowered its equity weighting to 33% and increased its T-Bills exposure to 67%.

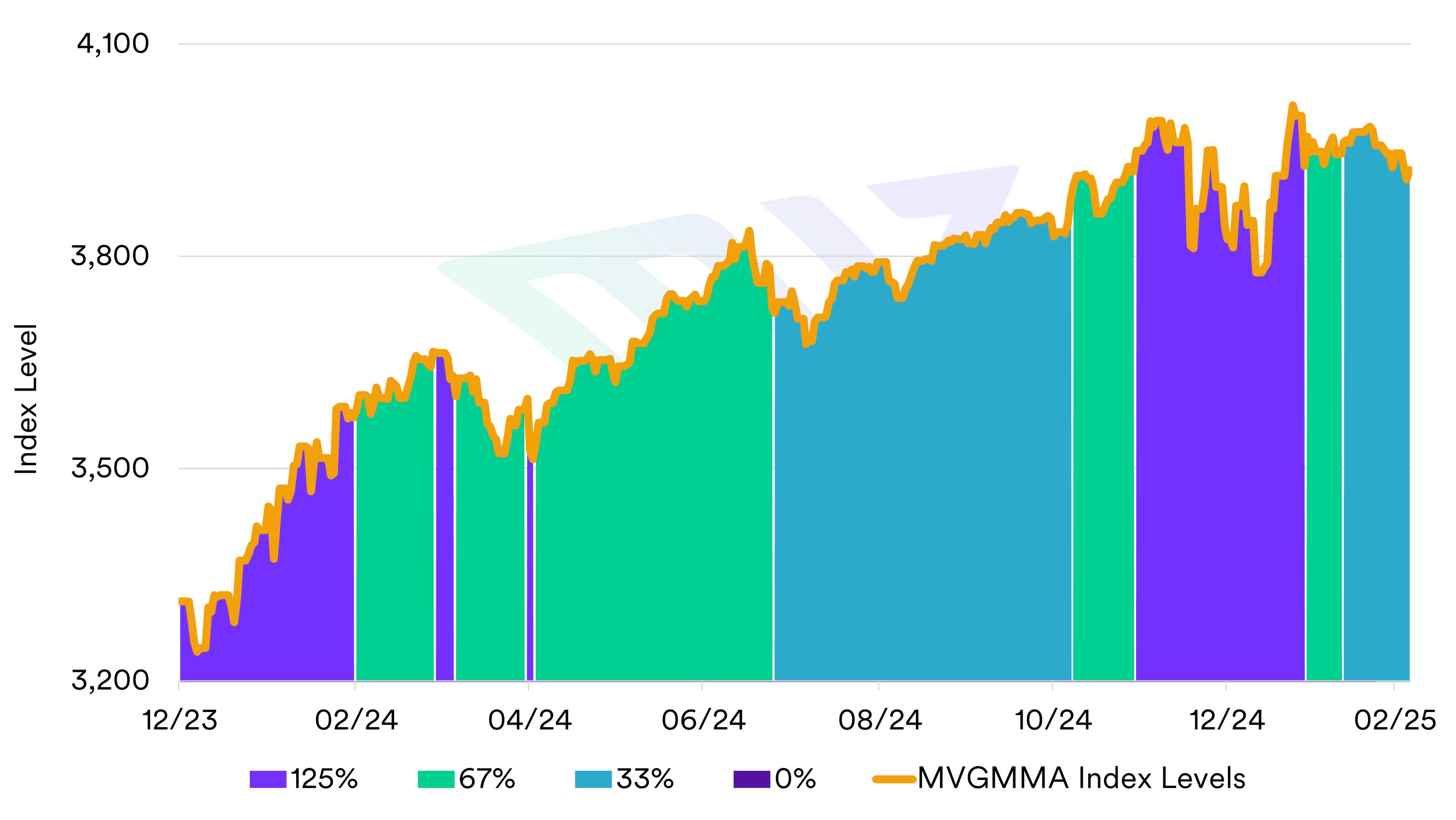

Weight of US Equity in MVGMMA at Time of Rebalancing

Source: MarketVector. Data as of March 6, 2025.

The strategy’s behavioral measure for consumer confidence had previously turned bearish in late January. The trend-based measure, which seeks to quantify the price direction of the U.S. equity market, now remains the strategy’s sole bullish driver for equity market risk entering March.

We find the strategy’s current positioning to be notable for several reasons. Specifically, our research suggests that periods where only one out of MVGMMA’s three measures is bullish:

- might be characterized by significantly higher volatility,

- might be shorter-term in nature, and

- might ultimately resolve with a significant move in either direction.

To dive deeper into the research behind these expectations and the potential implications for market volatility, please access our full strategy update here.

Get the latest news & insights from MarketVector

Get the newsletterRelated: