Shifting Procurement Strategies in the Defense Industry

Government policy shifts and regulatory changes have long been known to shake up the defense industry, and recent developments prove to be no exception. New procurement strategies such as the move away from cost-plus contracts toward fixed-price agreements are forcing traditional contractors to rethink their business models and invest in innovation to remain competitive with companies like Palantir.

Cost-plus contract agreements reimburse contractors for expenses incurred with an added fee that translates to profit margin. These contracts have been infamously used for developing and selling Lockheed’s F-35 Lightning II, which was the most expensive military program in history after the government sponsored its production.

With influential politicians advocating for greater efficiency and accountability, traditional giants like Lockheed Martin and Northrop Grumman are increasingly facing pressure from agile tech firms that prioritize rapid software development and lean manufacturing practices.

The conclusion is that firms who are nimble enough to adjust their business models will win government contracts in an environment that rewards cost certainty models.

Industry-Wide Impact and Market Trends

This push for efficiency and accountability is not only altering procurement strategies but also fueling broader structural changes across the defense industry.

As governments demand more predictable budgeting and greater transparency, the sector is positioned for a surge in investments in advanced technologies that promise to be far more cost effective than the Cold War-era approach of mass-producing arms, when the US amassed over 70,000 nuclear weapons in its Enduring Stockpile.

The impact is further amplified by the Pentagon’s proposal to cut defense spending by 8% each year for the next five years. While the certainty of these budget cuts remains in question, one thing is clear: the industry is on the brink of a shift.

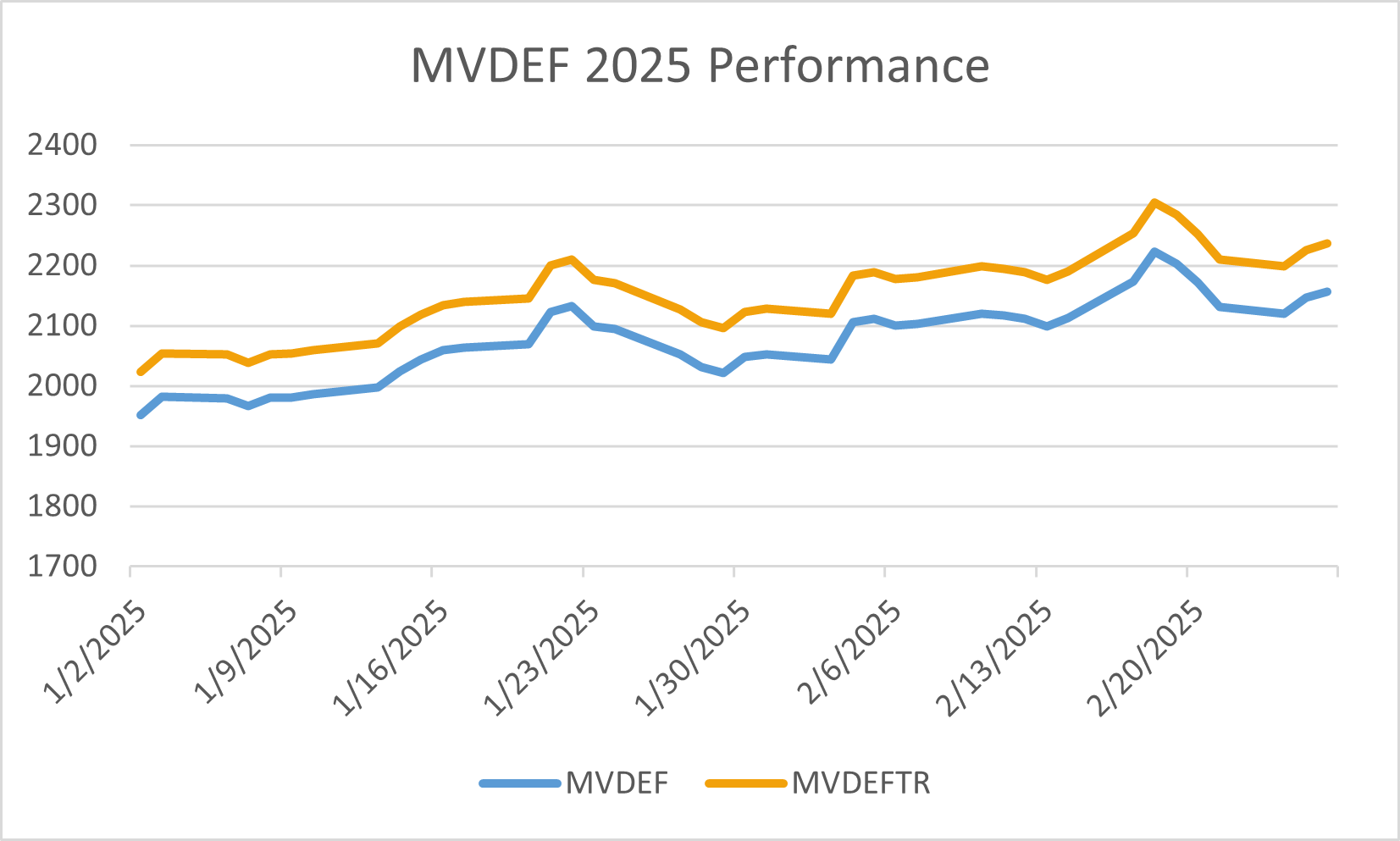

The MarketVector™Global Defense Industry Total Return Index (MVDEF) tracks the performance of companies that are involved in serving national defense industries. The index is up 37.66% year-over-year, and 121.01% over the past 5 years as of February 24th, 2025.

Source: MarketVector data as of February 26, 2025

Get the latest news & insights from MarketVector

Get the newsletterRelated: