A Tale of Two $100Ks

The price of Bitcoin tells a remarkable story about the cyclical nature of markets and the psychology that drives them. Today, Bitcoin trades around $100,000—the same level it reached roughly a year ago. Yet, despite the identical price, the sentiment surrounding it could not be more different.

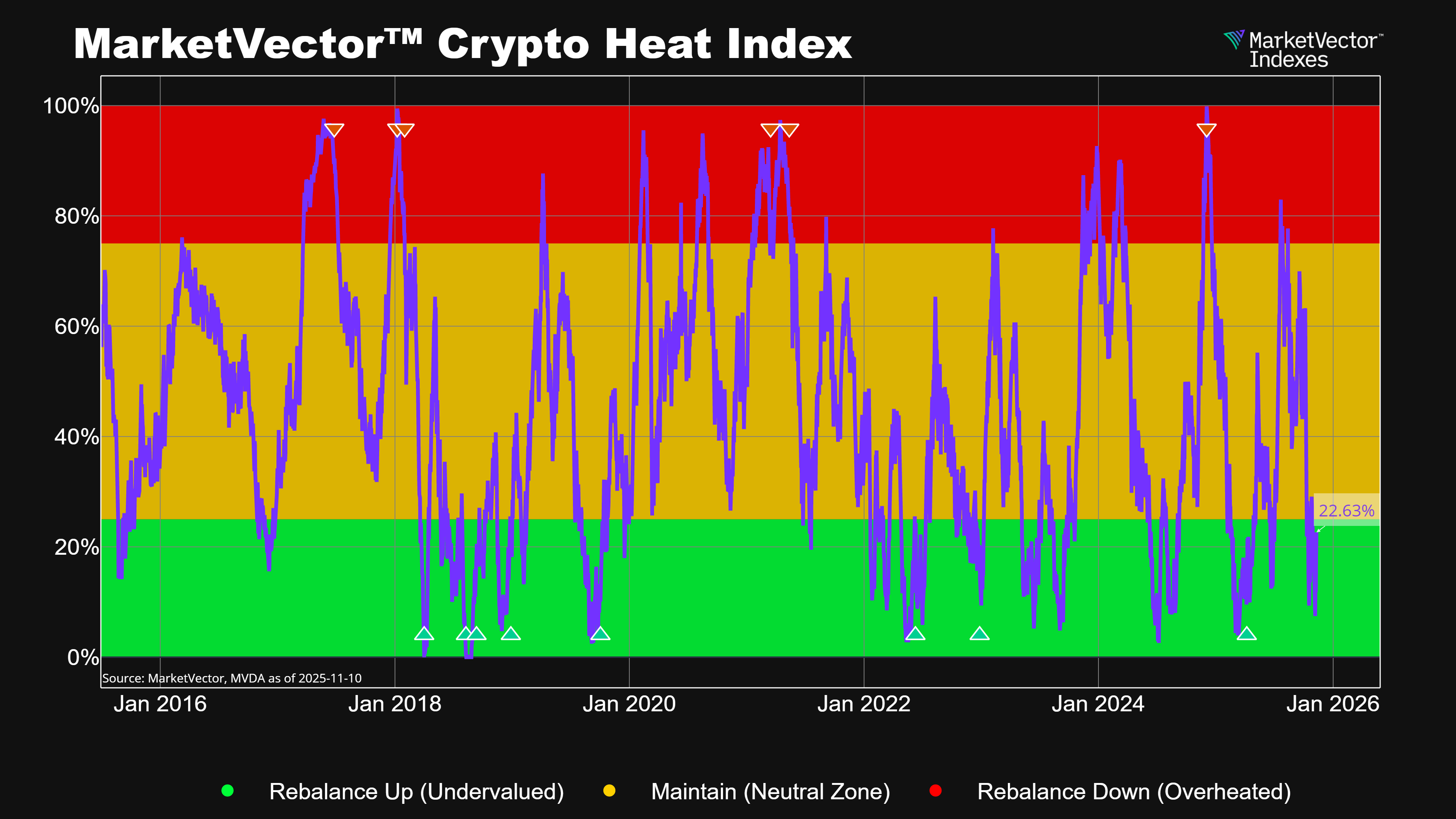

A year ago, when Bitcoin surged to $100K, the mood was euphoric. The MarketVector™ Crypto Heat Index showed a reading deep in the red zone—indicating extreme overvaluation and widespread optimism. Investors were driven by momentum and greed, certain that higher highs were inevitable.

Fast forward to today: Bitcoin is back around $100K, but this time the Heat Index sits deep in the green zone, suggesting the market is undervalued. Instead of euphoria, fear dominates. Many participants are hesitant, fatigued, or even bearish, despite the same headline price.

The MarketVector™ Crypto Heat Index

The MarketVector™ Crypto Heat Index tracks market sentiment through relative strength, market breadth and momentum metrics across the crypto landscape.

- Green Zone (Rebalance Up – Undervalued): Signals fear and attractive entry points.

- Yellow Zone (Maintain – Neutral): Reflects balanced conditions.

- Red Zone (Rebalance Down – Overheated): Marks euphoria and heightened risk of correction.

Historically, the Heat Index has captured turning points in crypto cycles—highlighting when markets become overly enthusiastic or excessively fearful. Its current position near the bottom of the range suggests conditions similar to past recovery phases, where fear laid the foundation for long-term opportunity.

Fear, Greed, and the Psychology of Price

This contrast between two identical price points illustrates a timeless truth in investing: price alone doesn’t define value—psychology does.

When markets are euphoric, prices feel “safe” because everyone agrees they should rise. When fear dominates, even a fair valuation feels risky. The Heat Index reminds us that investor emotion swings between these two extremes, shaping the narrative more powerfully than the numbers themselves.

A Lesson for Investors

The $100K story highlights a crucial lesson:

Markets don’t move because of prices—they move because of people.

Whether Bitcoin is seen as “cheap” or “expensive” depends less on its absolute level and more on collective emotion. Recognizing these shifts can help investors avoid chasing tops or capitulating at bottoms.

Conclusion

Bitcoin’s journey to $100K—twice, under opposite emotional climates—underscores how sentiment drives perception. At 100K with euphoria, investors feared missing out. At 100K with despair, they fear losing more.

The MarketVector™ Crypto Heat Index shows that today’s fear may be tomorrow’s opportunity.

About the Author:

Jonas Weber is an emerging expert in digital assets and investment strategies. As a Digital Asset Analyst at MarketVector, he excels in generating innovative index ideas, building out the quantitative research infrastructure, conducting in-depth research, and supporting client communications. Before joining MarketVector, Jonas honed his skills as a working student in Investment Consulting. At Lurse AG, a pension consultancy firm, he was instrumental in developing new investment strategies and analyzing the risk and performance of model portfolios. His collaboration with Lurse AG also extended to his master’s thesis, which he completed summa cum laude, focusing on various investment strategies and deriving optimal guarantee levels.

For informational and advertising purposes only. The views and opinions expressed are those of the authors but not necessarily those of MarketVector Indexes GmbH. Opinions are current as of the publication date and are subject to change with market conditions. Certain statements contained herein may constitute projections, forecasts, and other forward-looking statements, that do not reflect actual results. It is not possible to invest directly in an index. Exposure to an asset class represented by an index is available through investable instruments based on that index. MarketVector Indexes GmbH does not sponsor, endorse, sell, promote, or manage any investment fund or other investment vehicle that is offered by third parties and that seeks to provide an investment return based on the performance of any index. The inclusion of a security within an index is not a recommendation by MarketVector Indexes GmbH to buy, sell, or hold such security, nor is it considered to be investment advice.

About the Author(s):

Jonas Weber is an emerging expert in digital assets and investment strategies. As a Digital Asset Analyst at MarketVector, he excels in generating innovative index ideas, building out the quantitative research infrastructure, conducting in-depth research, and supporting client communications. Before joining MarketVector, Jonas honed his skills as a working student in Investment Consulting. At Lurse AG, a pension consultancy firm, he was instrumental in developing new investment strategies and analyzing the risk and performance of model portfolios. His collaboration with Lurse AG also extended to his master’s thesis, which he completed summa cum laude, focusing on various investment strategies and deriving optimal guarantee levels.

Get the latest news & insights from MarketVector

Get the newsletterRelated: