Quant index strategies are investment strategies and a subset of quant strategies that use the creation of an index to replicate the quant strategy in a transparent methodology.

Quant index strategies can use various factors, such as value, growth, momentum, quality, volatility, or liquidity, to screen and rank the stocks in the index. It can also adjust the portfolio allocation periodically based on the changing market conditions and the performance of the factors.

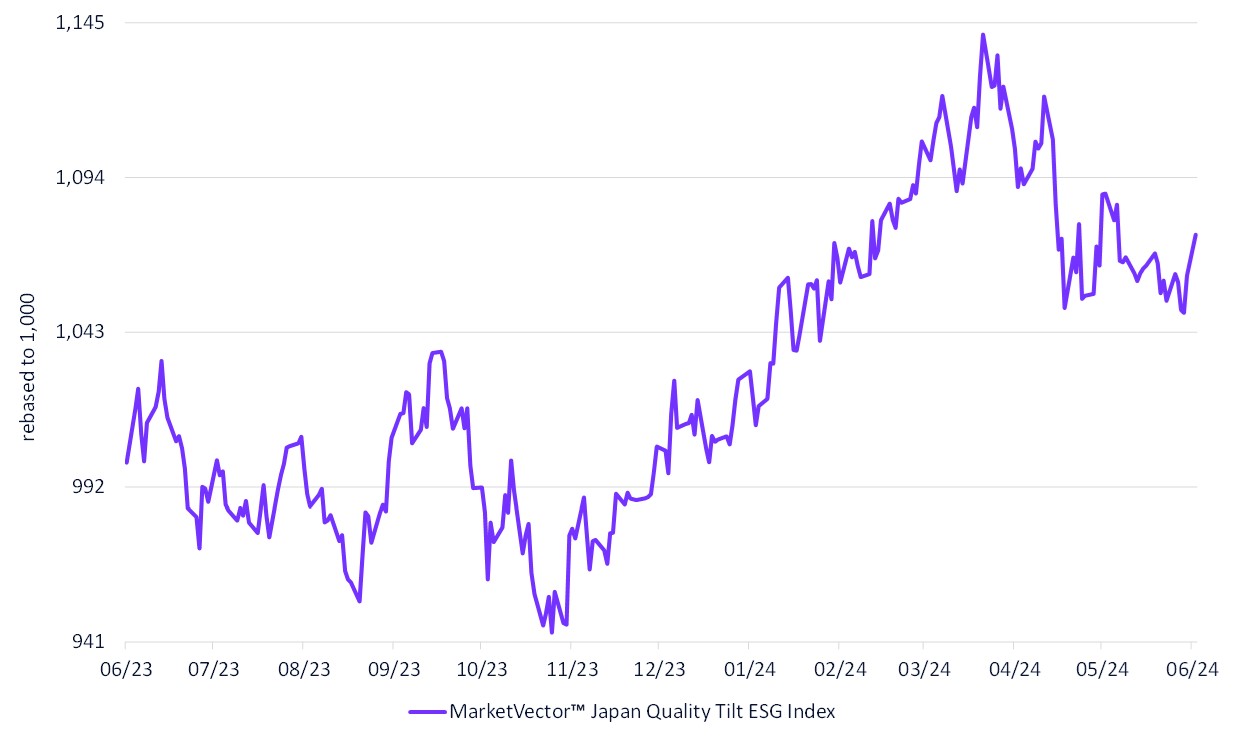

For instance, MarketVectorTM Japan Quality Tilt ESG Index which uses quality factors like Return on Equity (ROE) and Return on Assets (ROA) in the component weighting scheme was up almost 7% in the past six months.

MarketVectorTM Japan Quality Tilt ESG Index

Source: MarketVector. Data as of June 3, 2024.

Another approach to quant index strategies is to use systematic investing based on indicators, such as economic data or price data, that can signal market trends, cycles, or regimes. These indicators can help investors identify the optimal asset allocation, factor exposure, or risk management for different market conditions. For example, some indicators, such as the yield curve, inflation, or consumer confidence, can provide information about the state of the economy and the expected returns of various asset classes. Other indicators, such as moving averages, trend lines, or momentum, can capture the direction and strength of the market movements and the relative performance of different sectors or styles. By using these indicators, systematic investing can aim to enhance the returns, reduce volatility, or improve the diversification of the quant index strategies.

MarketVectorTM- GammaRoad® U.S. Equity Strategy Index rotates in its exposure between U.S. equities and US Treasury Bills using US-listed exchange-traded funds based on a methodology that was developed by GammaRoad Capital Partners, LLC was up ~22% in YoY and delivered US large cap equity performance with lower volatility.

MarketVectorTM- GammaRoad® U.S. Equity Strategy Index

Source: MarketVector. Data as of June 3, 2024.

For more information on our family of indexes, visit www.marketvector.com.

Get the latest news & insights from MarketVector

Get the newsletterRelated: