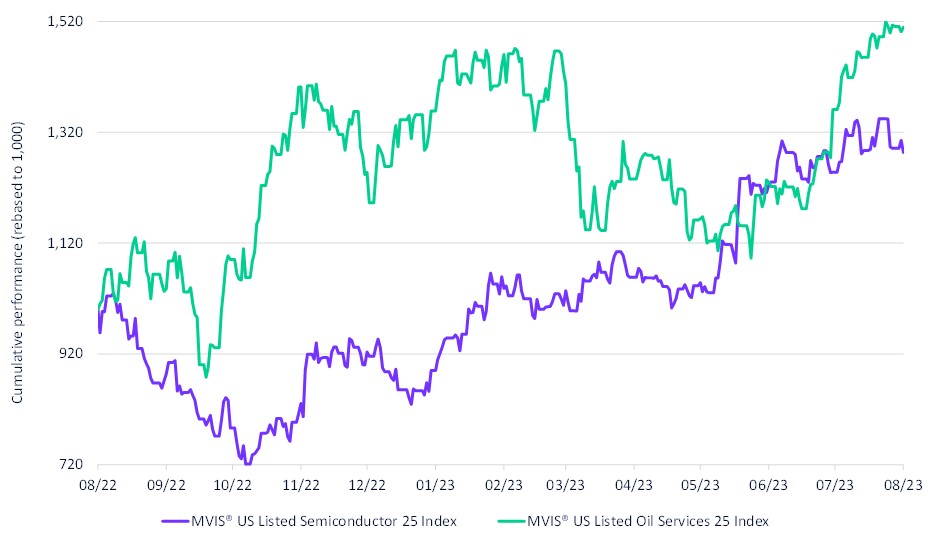

With headlines focused on the rise and disruption of artificial intelligence, semiconductors have been hailed as the “new oil” – a force that will dominate geopolitics and drive market returns. With all eyes on “new oil” outperforming the broad market delivering 32% over last 12months, don’t forget about “old oil” which has quietly surged past semiconductors with 52% over the last 12months (see Exhibit below). Oil remains a pivotal player in the global economy.

Semiconductors, as captured by MVIS® US Listed Semiconductor 25 Index (MVSMH), underlie rapidly disruptive technology themes, whereas oil, as captured by MVIS® US Listed Oil Services 25 Index (MVOIH), represents the more traditional and established cyclical sector. With policy shifts towards renewable energy, extreme weather shocks, constraining geopolitical events – oil price has become more volatile, but it remains resilient and vital to the global economy.

Semiconductors as the “new oil" serves as a compelling reminder of the industry's immense potential to reshape our world, much like oil. However, the rapid ascent of semiconductors also comes with the inherent risk of a dramatic crashes, as seen in 2022, should they fail to deliver on their transformative promise. With this in mind, the enduring significance of oil should not be overlooked. Both industries have unique roles to play as we look ahead to a world dominated by geopolitical shifts.

MVIS® US Listed Semiconductor 25 Index VS MVIS® US Listed Oil Services 25 Index

8/8/2022-8/8/2023

Source: MarketVector IndexesTM. Data as of August 8, 2023.

For more information on our family of indexes, visit www.marketvector.com.

Get the latest news & insights from MarketVector

Get the newsletterRelated: