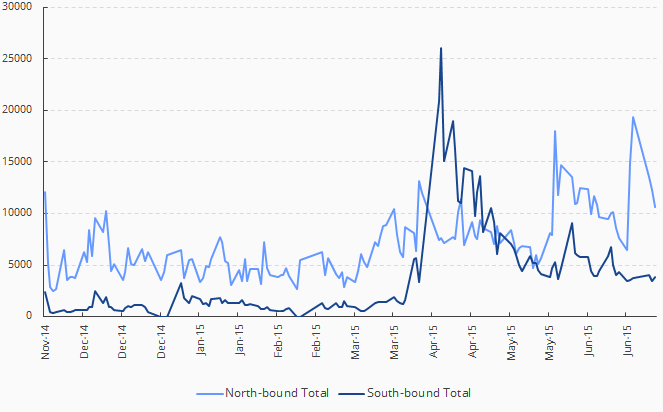

The Shanghai–Hong Kong pilot program had a relatively low start, with domestic investors originally not very interested in the Hong Kong market, in fact there were several days in the first few months with no southbound activity at all. The situation has considerably improved since then. Northbound activity (from Hong Kong to Shanghai) remains larger but there is now significant trading on the southbound side too.

So far, the turnover in the northbound is approximately 1.9 times the turnover in the southbound but the data might be skewed by the large spike in southbound trading in April. That spike disappeared after a few days and does not seem to fit the overall trend. The boom in the Chinese equity market, and the recent correction, have been factors favoring this increase of activity with foreign investors trying to profit from the unprecedented rally and domestic investors starting to diversify their holdings.

Turnover (CNY Million)

Source: Bloomberg

Get the latest news & insights from MarketVector

Get the newsletterRelated: